Asked by

DIANAROSE LISBOS

on Nov 19, 2024

Verified

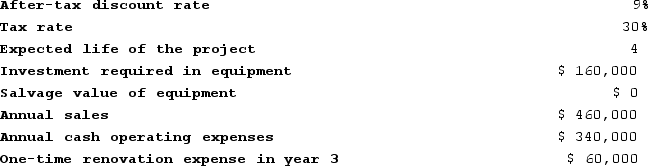

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

A) $6,000

B) $36,000

C) $24,000

D) $19,500

Capital Budgeting

The approach of examining and picking out long-term investments congruent with the aim of enhancing shareholder wealth.

Straight-Line Depreciation

A technique for determining the depreciation of an asset that evenly spreads its cost over its lifespan.

- Evaluate the income tax costs pertinent to capital budgeting endeavors.

Verified Answer

DG

Learning Objectives

- Evaluate the income tax costs pertinent to capital budgeting endeavors.

Related questions

Marbry Corporation Has Provided the Following Information Concerning a Capital ...

Boynes Corporation Is Considering a Capital Budgeting Project That Would ...

Decelle Corporation Is Considering a Capital Budgeting Project That Would ...

Correll Corporation Is Considering a Capital Budgeting Project That Would ...

Correll Corporation Is Considering a Capital Budgeting Project That Would ...