Asked by

peyton schumann

on Nov 19, 2024

Verified

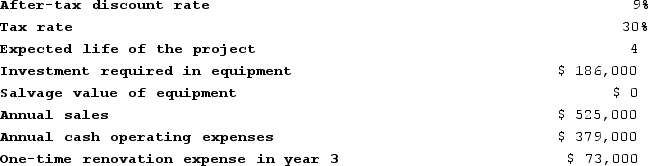

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 3 is:

A) $11,925

B) $1,988

C) $5,962

D) $7,950

Capital Budgeting

A procedure for examining and picking long-term investment opportunities that match the goal of wealth maximization for the firm.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts, resulting in a constant annual charge.

- Assess the financial impact of income tax in capital budgeting plans.

Verified Answer

MD

Learning Objectives

- Assess the financial impact of income tax in capital budgeting plans.

Related questions

Mulford Corporation Has Provided the Following Information Concerning a Capital ...

Boynes Corporation Is Considering a Capital Budgeting Project That Would ...

Decelle Corporation Is Considering a Capital Budgeting Project That Would ...

Correll Corporation Is Considering a Capital Budgeting Project That Would ...

Correll Corporation Is Considering a Capital Budgeting Project That Would ...