Asked by

Verified

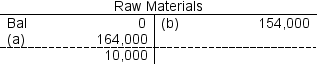

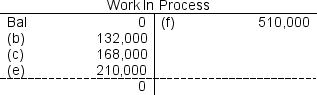

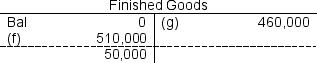

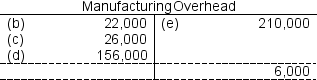

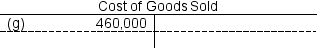

The following accounts are from last year's books of Sharp Manufacturing:

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the amount of direct materials used for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the amount of direct materials used for the year?

A) $164,000

B) $154,000

C) $132,000

D) $168,000

Job-Order Costing

An accounting method that assigns costs to specific batches or job orders, making it suitable for companies producing unique products or jobs.

Direct Materials

Direct Materials are raw materials that are directly traceable to the manufacturing of a product and are an integral part of the finished product.

Manufacturing Overhead

All indirect costs associated with the production of goods, such as utilities, maintenance, and supplies not directly traceable to a product.

- Discern between direct and indirect expenditures and their ramifications in the context of job-order costing procedures.

Verified Answer

Learning Objectives

- Discern between direct and indirect expenditures and their ramifications in the context of job-order costing procedures.

Related questions

During September at Renfro Corporation, $65,000 of Raw Materials Were ...

Dipaola Corporation Has Provided the Following Data Concerning Last Month's ...

Fisher Corporation Uses a Predetermined Overhead Rate Based on Direct ...

Bottum Corporation, a Manufacturing Corporation, Has Provided Data Concerning Its ...

Juarez Builders Incurred $285,000 of Labor Costs for Construction Jobs ...