Asked by

Verified

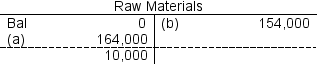

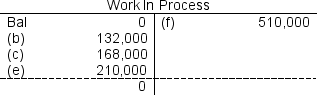

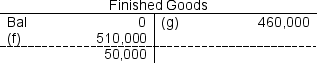

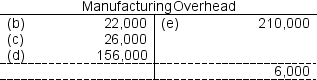

The following accounts are from last year's books at Sharp Manufacturing:

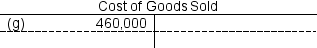

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the amount of cost of goods manufactured for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs.What is the amount of cost of goods manufactured for the year?

A) $252,000

B) $454,000

C) $510,000

D) $460,000

Job-Order Costing

An accounting method that assigns costs to specific production jobs or batches, making it possible to track the cost of each job individually.

Direct Labor Costs

Wages paid to workers directly involved in manufacturing a product or providing a service.

Cost of Goods Manufactured

The total cost incurred by a company to produce goods in a specific period, including labor, materials, and overhead.

- Calculate the financial outlay for goods manufactured and goods sold in the context of a job-order costing system.

Verified Answer

Learning Objectives

- Calculate the financial outlay for goods manufactured and goods sold in the context of a job-order costing system.

Related questions

Solt Corporation Uses a Job-Order Costing System and Has Provided ...

Maysonet Corporation Uses a Job-Order Costing System and Has Provided ...

The Cost of Goods Manufactured for February Was

Under Lamprey Company's Job-Order Costing System, Manufacturing Overhead Is Applied ...

Cai Corporation Uses a Job-Order Costing System and Has Provided ...