Asked by

Verified

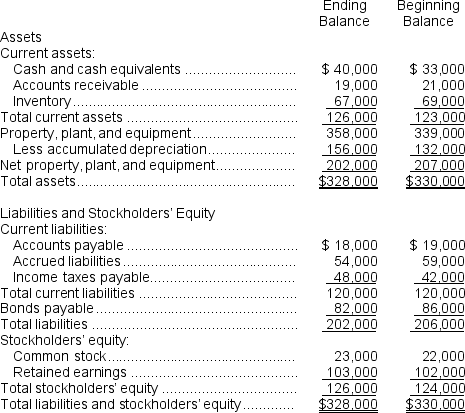

Illies Corporation's comparative balance sheet appears below:  The company did not dispose of any property, plant, and equipment during the year.Its net income for the year was $5,000 and its cash dividends were $4,000.The company did not issue any bonds payable or purchase any of its own common stock during the year.Its net cash provided by (used in) operating activities and net cash provided by (used in) financing activities are:

The company did not dispose of any property, plant, and equipment during the year.Its net income for the year was $5,000 and its cash dividends were $4,000.The company did not issue any bonds payable or purchase any of its own common stock during the year.Its net cash provided by (used in) operating activities and net cash provided by (used in) financing activities are:

A) net cash provided by (used in) operating activities, $33,000; net cash provided by (used in) financing activities, $(1,000)

B) net cash provided by (used in) operating activities, $35,000; net cash provided by (used in) financing activities, $(7,000)

C) net cash provided by (used in) operating activities, $33,000; net cash provided by (used in) financing activities, $(7,000)

D) net cash provided by (used in) operating activities, $35,000; net cash provided by (used in) financing activities, $(1,000)

Bonds Payable

A financial liability representing the amount a company owes to holders of its issued bonds, typically repayable at a future date.

Cash Dividends

A distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders in the form of cash.

Net Income

The total profit of a company after all expenses and taxes have been deducted from revenue.

- Calculate net cash provided by (used in) operating activities.

- Identify the components of net cash provided by (used in) financing activities.

Verified Answer

Learning Objectives

- Calculate net cash provided by (used in) operating activities.

- Identify the components of net cash provided by (used in) financing activities.

Related questions

Klutz Dance Studio Had Net Income of $167,000 for the ...

The Following Transactions Occurred Last Year at Jogger Corporation ...

Morbeck Corporation's Net Income Last Year Was $56,000 ...

Carriveau Corporation's Most Recent Balance Sheet Appears Below: Net ...

Based Solely on the Information Above, the Net Cash Provided ...