Asked by

Blake Bryant

on Oct 15, 2024

Verified

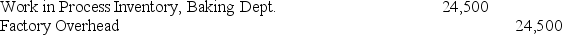

If the predetermined overhead allocation rate is 245% of direct labor cost,and the Baking Department's direct labor cost for the reporting period is $10,000,the following entry would be made to record the allocation of overhead to the products processed in this department:

Direct Labor Cost

The total cost of work performed by employees directly involved in the manufacturing process.

- Acquire an understanding of how overhead allocation is computed and its role in process costing.

Verified Answer

HB

Learning Objectives

- Acquire an understanding of how overhead allocation is computed and its role in process costing.

Related questions

Yamada Company Applies Factory Overhead to Its Production Departments on ...

If the Predetermined Overhead Allocation Rate Is 250% of Direct ...

Price Company Assigns Overhead Based on Machine Hours ...

Process Costing Systems Consider Overhead Costs to Include Those Costs ...

Mundes Corporation Uses the Weighted-Average Method in Its Process Costing ...