Asked by

Verified

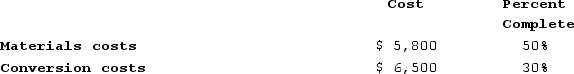

Esty Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were:  A total of 7,700 units were started and 6,600 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

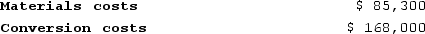

A total of 7,700 units were started and 6,600 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending inventory was 70% complete with respect to materials and 10% complete with respect to conversion costs.The total cost transferred from the first processing department to the next processing department during the month is closest to: (Round "Cost per equivalent unit" to 3 decimal places.)

The ending inventory was 70% complete with respect to materials and 10% complete with respect to conversion costs.The total cost transferred from the first processing department to the next processing department during the month is closest to: (Round "Cost per equivalent unit" to 3 decimal places.)

A) $253,300

B) $245,441

C) $316,098

D) $265,600

Weighted-Average Method

An inventory costing method in which the cost of goods available for sale is divided by the total units available for sale, resulting in a weighted average cost per unit.

Process Costing System

An accounting system used to accumulate costs in industries where production is continuous and units are indistinguishable from one another.

Conversion Costs

Costs required to convert raw material into finished goods, primarily comprising labor and overhead expenses.

- Understand the weighted-average method in process costing.

- Calculate the total cost transferred from one department to another.

Verified Answer

Learning Objectives

- Understand the weighted-average method in process costing.

- Calculate the total cost transferred from one department to another.

Related questions

In July, One of the Processing Departments at Okamura Corporation ...

Bettie Corporation Uses a Weighted-Average Process Costing System to Collect ...

Vallin Manufacturing Corporation's Beginning Work in Process Inventory Consisted of ...

In July, One of the Processing Departments at Okamura Corporation ...

Lap Corporation Uses the Weighted-Average Method in Its Process Costing ...