Asked by

Verified

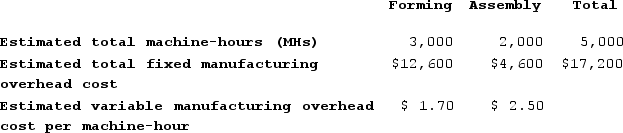

Camm Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Assembly Department is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. The departmental predetermined overhead rate in the Assembly Department is closest to:

A) $2.50

B) $2.30

C) $4.80

D) $5.46

Departmental Predetermined Rates

These are rates used to allocate indirect costs to various departments based on estimated overhead and expected activity.

Machine-Hours

A measure of the amount of time machinery is in operation, used in manufacturing to allocate costs based on machine usage.

Overhead Rate

The rate at which overhead costs are allocated to products or services, typically based on direct labor hours, machine hours, or another allocation base.

- Ascertain predetermined overhead rates for manufacturing sectors based on distinct benchmarks like machine-hours and direct labor-hours.

- Comprehend the distinctions between departmental and plantwide overhead rates.

Verified Answer

Learning Objectives

- Ascertain predetermined overhead rates for manufacturing sectors based on distinct benchmarks like machine-hours and direct labor-hours.

- Comprehend the distinctions between departmental and plantwide overhead rates.

Related questions

The Predetermined Overhead Rate for the Finishing Department Is Closest ...

The Predetermined Overhead Rate for the Customizing Department Is Closest ...

The Predetermined Overhead Rate for the Casting Department Is Closest ...

Assume That the Company Uses Departmental Predetermined Overhead Rates with ...

The Predetermined Overhead Rate for the Machining Department Is Closest ...