A) $400 000;$600 000;$480 000

B) $296 000;$740 000;$444 000

C) $200 000;$300 000;$240 000

D) $800 000;$1 200 000;$960 000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a firm that would break even at $200 000 sales and earn a profit of $30 000 at sales of $250 000,which of the following statements is always true?

A) Fixed costs are $80 000.

B) The selling price is $2 per unit.

C) Profit at sales of $300 000 would be $80 000.

D) The contribution margin is 60 per cent of sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's fixed costs are $60 000,variable cost per unit is $15 and selling price per unit is $20.The contribution margin per unit is:

A) $5

B) $15

C) $20

D) $35

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under activity-based costing systems,break-even point in units treats which costs as included in the numerator? i.Batch costs ii.Product costs iii.Faculty level costs

A) i and ii

B) i and iii

C) ii and iii

D) All of the given answers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

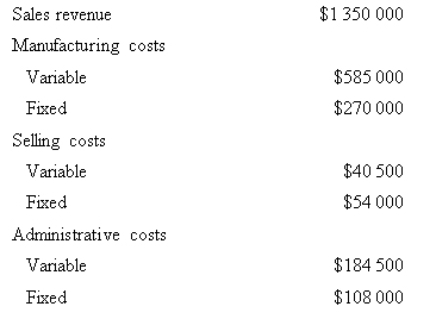

Econ Pty Ltd produced and sold 45 000 units of a single product last year.Data concerning the year's profit and loss statement is as follows:

Assuming all cost relationships will remain constant for the coming year,how many units must be sold for the company to earn an after-tax profit of $180 000 if the income tax rate is 40 per cent?

A) 45 000

B) 47 500

C) 61 000

D) 70 000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

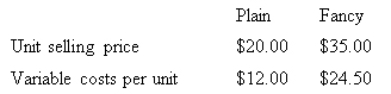

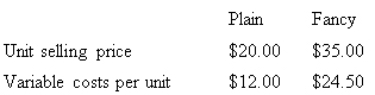

Maxie Pty Ltd makes and sells two types of shoes,Plain and Fancy.Product data is as follows:

Sixty per cent of the sales in units are Plain and annual fixed expenses are $45 000 and the sales mix remains constant.Assume an income tax rate of 20 per cent.The break-even point for this data is 5000 units in total.How will the calculation of the break-even point change (if at all) if the relative percentages of the products in the mix change from 60 per cent Plain shoes to 40 per cent Fancy shoes?

A) The break-even point in total will not change.The only change will be the relative number of each of the units.

B) Neither the break-even point in total nor the relative number of each of the units to produce at break-even will change.

C) The break-even point will change because the calculation above assumes a constant mix,namely 60 per cent to 40 per cent.

D) The break-even point will be higher.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

'Goal seek' analysis provides for which of the following? i.An output for a given set of inputs ii.Required inputs for a given output iii.A range of outputs for a range of inputs

A) i

B) ii

C) iii

D) None of the given answers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are advantages of an activity-based costing approach to cost volume profit (CVP) analysis as compared to a CVP analysis based on traditional product costing?

A) Unit variable costs are recognised more clearly.

B) Fixed costs are viewed as fixed only with respect to changes in sales and production volume,but not as fixed with respect to changes in other cost drivers such as number of set-ups and number of material moves.

C) The assumption in traditional CVP analysis that sales and production volumes are equal can be relaxed.

D) Unit variable costs are recognised more clearly AND fixed costs are viewed as fixed only with respect to changes in sales and production volume,but not with respect to changes in other cost drivers such as number of set-ups and number of material moves.

Correct Answer

verified

Correct Answer

verified

True/False

'What-if' analysis allows financial models to be manipulated in terms of changes to assumptions and data,to determine the changes in outputs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will increase a company's break-even point?

A) Increasing the contribution margin per unit

B) Increasing the variable cost per unit

C) Reducing the company's total fixed costs

D) Increasing the selling price per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Would you expect the following to be high or low in an automated firm: (1) level of fixed costs, (2) level of risk and (3) break-even point?

A) high,high,high

B) low,high low

C) high,high,low

D) low,low,high

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maxie Pty Ltd makes and sells two types of shoes,Plain and Fancy.Product data is as follows:

Sixty per cent of the sales in units are Plain and annual fixed expenses are $45 000 and the sales mix remains constant.Assume an income tax rate of 20 per cent.How many units of Plain must Maxie Pty Ltd sell to earn an after tax profit of $18 000?

A) 4500

B) 7875

C) 3960

D) 8437

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are assumptions of cost volume profit analysis? i.Sales mix is constant ii.External factors do not change. iii.Fixed costs change with sales volume.iv.Variable costs are constant per unit of sales.

A) i,ii and iii

B) ii,iii and iv

C) i,ii and iv

D) All of the given answers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the cost-volume-profit graph is false?

A) It can be used to identify both profit areas and loss areas.

B) It shows the relevant range of total revenue.

C) It cannot be used to make managerial decisions involving step-wise costs.

D) It can be used to identify break-even points.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's fixed costs are $60 000,variable cost per unit is $15 and selling price per unit is $20.The contribution margin percentage is:

A) 2.5%

B) 25%

C) 33%

D) 400%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's fixed costs are $60 000,variable cost per unit is $15 and selling price per unit is $20.The break-even point in units is:

A) 1715

B) 3000

C) 4000

D) 12 000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

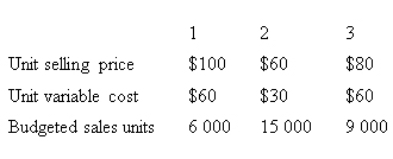

A firm makes and sells three standard products in a specific product mix.All three products are made using the same production facilities.The following budgeted data for the coming year is available.Total annual fixed costs $348 000

Tax rate 40%

The break-even sales units for products 1,2 and 3 are:

A) 1200;3000;1800

B) 3600;9000;5400

C) 2400;6000;3600

D) Can only determine the total break-even point,not the units of each product

Correct Answer

verified

Correct Answer

verified

Showing 81 - 97 of 97

Related Exams