A) It should be included in the work in progress.

B) It should be expensed in the period the cost is incurred.

C) It should be ignored in the work in progress account and reported only in the internal production reports.

D) It should be expensed immediately under the FIFO method, but included in the work in progress in the weighted average method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a firm, which produces its product through two processes, the costs transferred into Process 2 from Process 1 can be described as

A) prior process costs.

B) transferred in costs.

C) prior period costs.

D) prior process costs AND transferred in costs.

Correct Answer

verified

Correct Answer

verified

True/False

Conversion costs are generally added at specific points throughout a process.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard costs are based on estimates of cost of materials, labour and overheads. Standard costs are also known as

A) actual costs.

B) forecasted costs.

C) expected costs.

D) budgeted costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement/s is/are true?

A) Weighted average costs provide a better basis for cost control than FIFO costs.

B) Weighted average costs provide a better basis for performance evaluation than standard costs.

C) Cost per equivalent unit provides a measure of production efficiency.

D) Weighted average costs provide a better basis for cost control than FIFO costs AND cost per equivalent unit provides a measure of production efficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rex Company Ltd had 4000 units in work in process at 1 April. During April, 11 000 units were completed. At 30 April, 5000 units remained in work in process. How many units were started during April?

A) 11 000

B) 5000

C) 12 000

D) 16 000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under Australian accounting standards, which methods can be used to prepare the departmental production report?

A) Weighted average, first in first out and standard costing

B) Last in first out, first in first out and standard costing

C) Last in first out, standard costing, weighted average

D) First in first out, last in first out, weighted average and standard costing

Correct Answer

verified

Correct Answer

verified

Multiple Choice

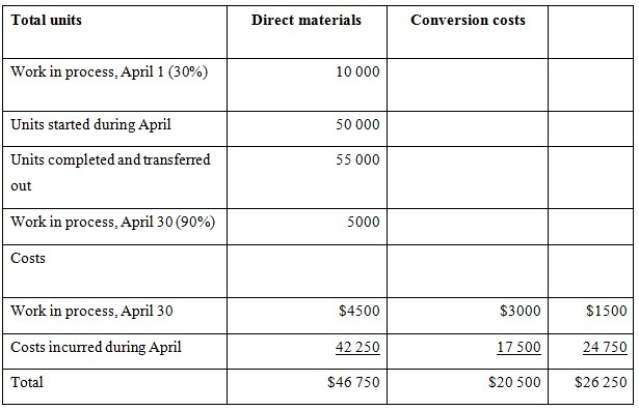

Healthy Flavour is a food processing company that makes a product called Health Nut soup in two processes-blending and condensing. The output of the blending department is transferred to the condensing department. All materials are added at the beginning of the blending process, and conversion activity occurs uniformly throughout both processes. The following data pertain to the month of April in the blending department.  Using the FIFO method of process costing, calculate the cost per equivalent unit of conversion activity for the month of April.

Using the FIFO method of process costing, calculate the cost per equivalent unit of conversion activity for the month of April.

A) $0.5048

B) $0.4169

C) $0.4381

D) None of the given answers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about operation costing is true? i. Conversion costs are accumulated by department. ii. Direct material costs are accumulated by batch. iii. It is a hybrid product costing system.

A) i, ii and iii

B) ii and iii

C) i and iii

D) i and ii

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The FIFO method is a more accurate method than weighted average because:

A) it does not require the calculation of equivalent units.

B) the costs of current period are not combined with the costs of the prior period.

C) it considers prior period costs during the current period.

D) it must be computerised in order to obtain accurate calculations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following ways is normal spoilage accounted for?

A) Expensed in the period in which it occurred

B) Included as part of the unit cost of output

C) Written off to cost of goods sold

D) Included in inventory valuation until year-end and then written off

Correct Answer

verified

Correct Answer

verified

True/False

To calculate equivalent units, multiply the partially completed physical units in the process by the percentage of completion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Banana Shirts produces t-shirts in large batches. Most of its t-shirts are made of regular cotton, although some are made from ethically produced cotton. The manufacturing process is relatively simple; most t-shirts go through similar processes; the main difference is whether the t-shirt requires embroidery or printing. The most appropriate costing system for Banana Shirts is

A) process costing system.

B) job costing system.

C) operation costing systems.

D) both job costing system and operation costing system are appropriate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At Hilltop Dairy Producers Pty Ltd, an employee ignored the standard sterilising procedures before beginning the new batch of low fat milk causing the batch to curdle. This would be regarded as

A) spoilage.

B) normal spoilage.

C) expected spoilage.

D) abnormal spoilage.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not required when calculating the equivalent units for conversion? I Percentage of conversion for ending work in progress Ii Percentage of conversion for physical units that have been completed and transferred out of the department Iii) Cost of direct materials

A) i only

B) i and ii

C) i, ii and iii

D) i and iii

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wages paid to a supervisor in a factory are a part of:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Softcloth Textile Pty Ltd manufactures a variety of fabrics. The Weaving Department had 1000 units in work in process on April 1, which were 20 per cent complete as to conversion costs. During April, 8000 units were completed and transferred. On April 30, 4000 units remained in work in process 50 per cent complete as to conversion costs. Using the weighted average method process costing, calculate the equivalent units of conversion for the month of April.

A) 12 000

B) 9000

C) 9800

D) 10 000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company starts work on 1000 physical units and completes 75 per cent of conversion activity. The costs are $1500 for conversion and $5000 for direct material. What is the cost per equivalent unit for direct material?

A) $10.00 per unit

B) $5.00 per unit

C) $6.00 per unit

D) $6.67 per unit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Owl's Hours produces herbal tea and prides itself in having one of the largest ranges of herbal teas in Australia. It sells more than 50 varieties of tea leaves with a wide range of prices (depending on where the tea leaves are grown) . The production processes of its products is simple, but vary depending on whether the tea is sold as loose leaves (which requires packing tea leaves in various sized boxes) or tea bags (which requires additional process in packaging tea in specially designed tea bags) . Owl's Hours decides to use an operation costing system. This decision is

A) correct, because the company uses a large variety of tea leaves as direct materials and yet has simple production processes.

B) correct, because the company uses a large variety of tea leaves as direct materials and the different products require different sequences of processes.

C) incorrect, because the different production lines require the tea leaves to be packaged in very distinctive methods.

D) incorrect, because the company has a very homogenous product - it produces and sells only tea.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume material is added at the beginning of a process, and the beginning WIP inventory is 30 per cent complete as to conversion costs. Using the FIFO method of costing, the total equivalent units for material for this process during this period is equal to

A) units started this period in this process.

B) units started this period in this process plus 70 per cent of beginning inventory.

C) beginning inventory this period for the process.

D) units started this period in this process plus the beginning inventory.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 87

Related Exams