A) Core; headline

B) Headline; core

C) Core; nominal

D) Nominal; core

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To measure core inflation, the BLS excludes ______________ from the basket of goods used to calculate the CPI.

A) food and gasoline

B) food, clothing, and housing

C) food and housing

D) housing and gasoline

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real rate of return is 3 percent, and the inflation rate is 4 percent, then the nominal interest rate must be:

A) −1 percent.

B) 1 percent.

C) 7 percent.

D) −7 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

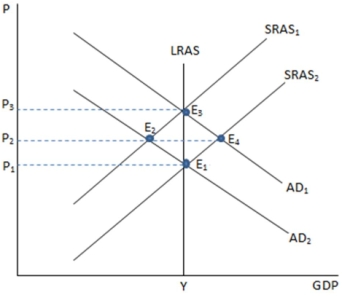

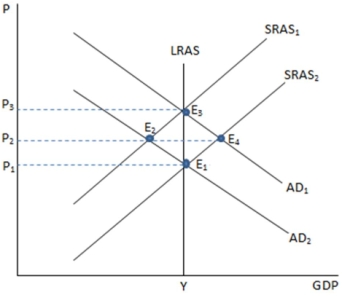

If the economy is experiencing an economic boom, which point in the graph shown would likely represent this?

If the economy is experiencing an economic boom, which point in the graph shown would likely represent this?

A) E1

B) E2

C) E3

D) E4

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Core inflation is all of the following but:

A) a measure of inflation that excludes goods with historically volatile price changes.

B) the BLS's official measure of changes in prices.

C) Both an overall rise in prices in the economy.

D) a measure of inflation that excludes gasoline and food price changes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Phillips Curve depicts that, in general:

A) high amounts of unemployment in an economy will coincide with low inflation.

B) low amounts of unemployment in an economy will coincide with low inflation.

C) high amounts of unemployment in an economy will coincide with high inflation.

D) high amounts of output in an economy will coincide with low inflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most economists agree that the best rate of inflation for a stable economy would be around:

A) zero.

B) two to three percent.

C) five to six percent.

D) seven percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the economy is represented in the graph shown and is currently at point E3, then the economy must be in:

If the economy is represented in the graph shown and is currently at point E3, then the economy must be in:

A) long-run equilibrium.

B) a recession.

C) an economic boom.

D) an economic recovery.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Demand pull inflation occurs when the:

A) price of a key input increases suddenly.

B) price level changes in response to changes in the business cycle.

C) price of necessity goods increases suddenly.

D) business cycle becomes sporadic and unpredictable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The real interest rate is:

A) the everyday notion of the interest rate.

B) adjusted for inflation.

C) the amount of interest the bank pays you for saving or charges you for borrowing.

D) the actual average interest rate in the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the purchasing power of your savings is increasing over time, we know that:

A) the real rate of interest is positive.

B) if the nominal interest rate is zero, inflation must be negative.

C) the inflation rate must be less than the nominal rate of interest.

D) All of these statements are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deflation is an overall:

A) rise in prices in the economy.

B) decline in prices in the economy.

C) rise in prices in the economy, excluding those with historically volatile price changes.

D) decline in prices in the economy, excluding those with historically volatile price changes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price indexes:

A) allow us to convert nominal measures of output into real measures of output.

B) let us measure how much real stuff we get for our money.

C) like the CPI or GDP price deflator are used to measure the aggregate price level.

D) All of these statements are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an economy produces 2,000 units of output with a price level of $1 and the money supply (M) is $1,000, velocity is:

A) 2.

B) 500.

C) 50.

D) 5.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The neutrality of money is the idea that:

A) aggregate price levels do not affect real outcomes in the economy.

B) hard money has a neutral effect in the economy.

C) in real terms, it makes no difference who is spending each dollar.

D) virtual money has a neutral effect in the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity theory of money, changes in the price level are primarily the result of changes in the:

A) quantity of money.

B) unemployment rate.

C) rate of spending.

D) total output.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an economy's actual output differs from its potential at some point in time, we say that it is experiencing:

A) an output gap.

B) a recession.

C) a boom.

D) an inflationary gap.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the economy is represented in the graph shown and is currently at point E1, then the economy must be in:

A) long-run equilibrium.

B) a recession.

C) an economic boom.

D) an economic recovery.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Conducting expansionary monetary policy when the economy is at its long-run equilibrium causes the Phillips Curve to:

A) shift straight up.

B) shift straight down.

C) become less steep.

D) become more steep.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity theory of money, a decrease in prices would be due to:

A) a decrease in the money supply.

B) an increase in the money supply.

C) a decrease in the production of output.

D) an increase in the production of output.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 162

Related Exams