A) Goodwill impairments may not be reversed.

B) Goodwill impairments may be reversed.

C) No impairment losses may be reversed.

D) A distinction is made between impairment procedures for intangibles with finite and indefinite lives.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Capital stock of a foreign subsidiary is translated at the historical rate,that is,the rate prevailing on the date the subsidiary was acquired.

B) Dividends are translated at the average exchange rate for the year.

C) Retained earnings are translated at the average exchange rate for the year.

D) Assets and liabilities are translated at the historical rate prevailing when the subsidiary was acquired.

Correct Answer

verified

Correct Answer

verified

Essay

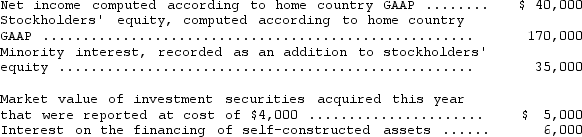

The following financial information is for Milo Company,a non-U.S.firm with shares listed on a U.S.stock exchange:

If Milo Company were following U.S.GAAP,the minority interest would have been classified as a liability instead of as part of stockholders' equity.In addition,minority interest income of $4,000 for the year would have been excluded from the computation of net income.Under U.S.GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Milo's reported stockholders' equity and net income to U.S.GAAP.

If Milo Company were following U.S.GAAP,the minority interest would have been classified as a liability instead of as part of stockholders' equity.In addition,minority interest income of $4,000 for the year would have been excluded from the computation of net income.Under U.S.GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Milo's reported stockholders' equity and net income to U.S.GAAP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements most accurately reflects the approach the FASB and IASB have identified for reaching convergence of U.S.and international accounting standards?

A) Convergence will be achieved primarily by modifying FASB standards to conform with IASB standards.

B) Convergence will be achieved primarily by modifying IASB standards to conform with FASB standards.

C) FASB and IASB will create new standards rather than trying to eliminate differences between standards that are in need of significant improvement.

D) FASB and IASB will try to eliminate differences between standards by eliminating differences between existing standards of the two standard-setting bodies that can be easily resolved and will then work jointly on more complex issues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under international accounting standards,which of the following methods of inventory costing is not acceptable?

A) Weighted-average

B) Moving-average

C) FIFO

D) LIFO

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true regarding the application of lower-of-cost-or-market method under international accounting standards?

A) No lower-of-cost-or-market rule for inventory exists under international accounting standards.

B) Inventory is recorded at the lower-of-cost-or-market value (defined as replacement cost of the inventory) .

C) Inventory is recorded at the lower-of-cost-or-market value defined as net-realizable value.

D) Inventory is recorded at the lower-of-cost-or-market value defined as net-realizable value,minus the normal profit margin.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

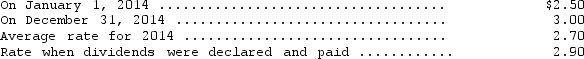

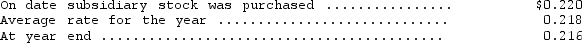

Finnish Company converts its foreign subsidiary financial statements using the translation process.The company's subsidiary in Denmark reported the following for 2014: revenues and expenses of 95,000 and 63,000 kroner,respectively,earned or incurred evenly throughout the year,dividends of 43,000 kroner were paid during the year.The following exchange rates are available:  Translated net income for 2014 is

Translated net income for 2014 is

A) $86,400.

B) $96,000.

C) $(29,700) .

D) $(28,500) .

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a short-term convergence topic that the FASB must address in order to eliminate the reconciliation of accounts prepared under different sets of standards of different countries?

A) Segment reporting

B) Accounting for income taxes

C) Accounting for research and development costs

D) Accounting for the impairment of assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under international accounting standards,revenue is recognized

A) only when a sale and delivery have occurred.

B) upon the increase in the fair value of biological assets (e.g. ,cattle) without waiting for the assets to be sold.

C) upon the increase in the fair value of agricultural produce (e.g. ,harvested wheat) without waiting for the assets to be sold

D) upon the increase in the fair value of both biological assets (e.g. ,cattle) and agricultural produce (e.g. ,harvested wheat) without waiting for the assets to be sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

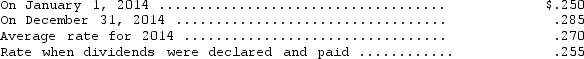

Hosgood Distributing Inc.converts its foreign subsidiary financial statements using the translation process.Their German subsidiary reported the following for 2014: revenues and expenses of 9,050,000 and 6,400,000 marks,respectively,earned or incurred evenly throughout the year,dividends of 2,000,000 marks were paid during the year.The following exchange rates are available:  Translated net income for 2014 is

Translated net income for 2014 is

A) $755,250.

B) $715,500.

C) $662,500.

D) $675,750.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under international accounting standards,deferred tax assets and liabilities are classified as

A) neither current or noncurrent but are disclosed in a separate section of the balance sheet.

B) current and noncurrent.

C) only current.

D) only noncurrent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true regarding the accounting for research and development costs under international accounting standards?

A) All research and development costs of any type are expensed.

B) All ordinary research and development costs are expensed,but development costs related to computer software are capitalized.

C) All ordinary research and development costs are expensed,but both research and development costs related to computer software are capitalized.

D) All development costs of any nature are capitalized.

Correct Answer

verified

Correct Answer

verified

Essay

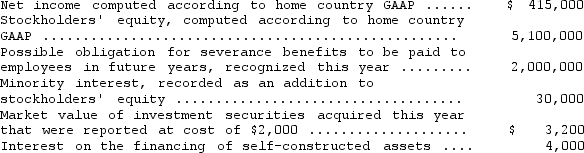

The following financial information is for Pasha Company,a non-U.S.firm with shares listed on a U.S.stock exchange:

If Pasha Company were following U.S.GAAP,the minority interest would have been classified as a liability instead of as part of stockholders' equity.In addition,minority interest income of $5,000 for the year would have been excluded from the computation of net income.Under U.S.GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Pasha's reported stockholders' equity and net income to U.S.GAAP.

If Pasha Company were following U.S.GAAP,the minority interest would have been classified as a liability instead of as part of stockholders' equity.In addition,minority interest income of $5,000 for the year would have been excluded from the computation of net income.Under U.S.GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Pasha's reported stockholders' equity and net income to U.S.GAAP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under international accounting standards regarding depreciation,an entity

A) must depreciate separately the components of a composite asset (e.g. ,land and building) separately.

B) is not allowed to depreciate the components of a composite asset (e.g. ,land and building) separately.

C) may depreciate separately the components of a composite asset (e.g. ,land and building)

D) must use fair value accounting for property,plant,and equipment,thus eliminating the need for depreciation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

DeGaulle Enterprises,a subsidiary of Clinton Company based in New York,reported the following information at the end of its first year of operations (all in French francs) : assets--4,790,000;expenses--6,500,000;liabilities--2,950,000;capital stock--1,200,000,revenues--7,140,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

A) $1,287 debit adjustment

B) $1,287 credit adjustment

C) $6,080 debit adjustment

D) $6,080 credit adjustment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under international accounting standards,cash received from interest (associated with interest revenue) can be shown on the statement of cash flows as an

A) operating activity only.

B) operating or financing activity.

C) operating or investing activity.

D) investing or financing activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the primary factor in determining the functional currency of a foreign subsidiary?

A) How the costs for the foreign entity's product are determined

B) The denomination of the foreign entity's financing

C) The location of the primary sales market that influences the price of the foreign entity's product

D) Management's assessment of all relevant factors

Correct Answer

verified

Correct Answer

verified

Showing 41 - 57 of 57

Related Exams