A) rise, keep constant, lowering

B) rise, raise, lowering

C) rise, lower, raising

D) fall, keep constant, raising

E) fall, raise, lowering

Correct Answer

verified

Correct Answer

verified

Multiple Choice

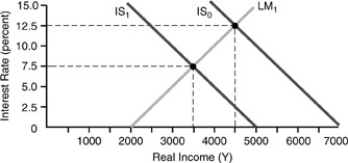

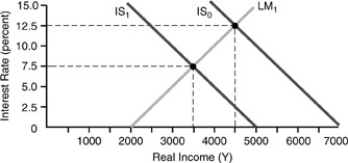

Figure 4-8  -Given the level of real GDP, the equilibrium level of the interest rate depends on the

-Given the level of real GDP, the equilibrium level of the interest rate depends on the

A) demand for money.

B) monetary-fiscal policy mix.

C) size of the multiplier.

D) extent of crowding out.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

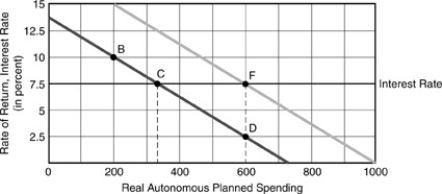

Figure 4-4  -In figure above, if the interest rate falls from 10% to 7.5% and this causes businesses to become more optimistic about future investment conditions, we would observe that planned investment would

-In figure above, if the interest rate falls from 10% to 7.5% and this causes businesses to become more optimistic about future investment conditions, we would observe that planned investment would

A) decrease from B to C to D.

B) increase from B to C to D.

C) increase from B to C to F.

D) decrease from B to C to F.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monetary policy will have a large income effect provided the

A) IS curve is flat.

B) LM curve is steep.

C) IS curve is steep.

D) LM curve is flat.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The September 11 attacks had the effect of shifting the

A) IS curve to the right.

B) IS curve to the left.

C) LM curve to the right.

D) LM curve to the left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the IS curve is negatively sloped and the LM curve is positively sloped

A) an increase in government expenditures will raise real GDP and lower interest rates.

B) a fall in the real money supply will raise real GDP and lower the interest rate.

C) an increase in taxes and an increase in money supply will lower the interest rate and give little or no change in real GDP.

D) an increase in taxes and a fall in the money supply will raise the interest rate and give little or no change in real GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 4-8  -The fiscal-policy multiplier will be greater

-The fiscal-policy multiplier will be greater

A) the greater is the interest responsiveness of the demand for money.

B) the smaller is the interest responsiveness of autonomous expenditures.

C) the smaller is the income responsiveness of the demand for money.

D) All of the above tend to make the fiscal-policy multiplier greater.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Complete "crowding-out" describes the situation in the economy when

A) fiscal policy is effective in changing output.

B) the shift in the LM curve by monetary policy is "impotent."

C) the shift in the IS curve by fiscal policy is "impotent."

D) fiscal policy crowds out monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government increases its expenditures by $100 billion and simultaneously reduces the money supply by $100 billion. We definitely know that

A) equilibrium GDP will fall.

B) equilibrium GDP will rise.

C) the interest rate will rise.

D) the interest rate will fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a diagram with "calories consumed per day" on the horizontal axis and "exercise per day" on the vertical axis, we can draw a line along which your body weight at this moment will remain constant. This line is analogous to how ________ for changing values of the variables on the two axes.

A) the IS curve holds income constant

B) the IS curve holds the demand for money constant

C) the LM curve holds the demand for money constant

D) the LM curve holds income constant

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three functions of money are

A) store of value, medium of exchange, payment specie.

B) store of value, unit of account, bank settlement.

C) store of value, unit of account, to regulate the economy.

D) store of value, unit of account, medium of exchange.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To "accommodate" an expansionary fiscal policy, the Fed ________ the money supply in order to hold ________ constant.

A) expands, the interest rate

B) expands, real income

C) contracts, the interest rate

D) contracts, real income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 4-1  -If there is unplanned inventory decumulation there is excess

-If there is unplanned inventory decumulation there is excess

A) demand for bonds.

B) supply of bonds.

C) demand for commodities.

D) supply of commodities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed's goal is to hold income constant, an expansionary fiscal policy must be accompanied by ________ monetary policy, and the Fed must allow the interest rate to ________ significantly.

A) an expansionary, rise

B) an expansionary, fall

C) a contractionary, rise

D) a contractionary, fall

Correct Answer

verified

Correct Answer

verified

Multiple Choice

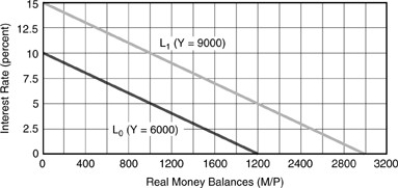

On a money demand diagram with the interest rate on the vertical axis, the real money balance demand schedule would be a vertical line under the assumption that

A) a lower interest rate raises the demand for real money.

B) a lower interest rate lowers the demand for real money balances.

C) the interest rate has no effect on the demand for real money balances.

D) balances.

E) a higher real GDP raises the demand for real money balances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With normally-sloped IS and LM curves, an increase in government spending ________ the interest rate, which ________ autonomous planned expenditure, resulting in a final increase in income ________ than what the government spending increase would have produced in the Chapter 3 model.

A) lowers, raises, greater

B) lowers, lowers, greater

C) raises, lowers, less

D) raises, raises, less

E) raises, raises, greater

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As income and production rise, the demand for real money balances will ________ and interest rates will ________.

A) fall; fall

B) rise; rise

C) rise; fall

D) fall; rise

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A change in interest rates ________, while a change in income ________ the real money demand schedule.

A) decreases; increases

B) has a large effect on; has no effect on

C) moves the economy along; shifts

D) shifts; moves along

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the demand for money depends only on real income, the resulting ________ LM curve causes fiscal policy to have a ________ effect on income.

A) vertical, very strong

B) vertical, zero

C) horizontal, very strong

D) horizontal, zero

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a given level of equilibrium GDP, a tight-money/easy-fiscal policy mix compared with easy-money/tight-fiscal policy mix implies a

A) lower interest rate.

B) lower level of investment.

C) higher level of taxation.

D) lower level of government expenditures.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 147

Related Exams