A) 2%.

B) 2.5%.

C) 3%.

D) 5%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A surplus of money in the money market causes

A) a decrease in the equilibrium interest rate.

B) a decrease in the money supply.

C) an increase in the demand for money.

D) a decrease in the quantity demanded of money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What will happen to the equilibrium interest rate when both money supply and nominal aggregate output decrease?

A) The equilibrium interest rate increases.

B) The equilibrium interest rate decreases.

C) The equilibrium interest rate remains constant.

D) The impact on the equilibrium interest rate is ambiguous.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

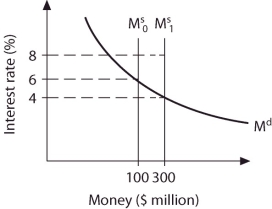

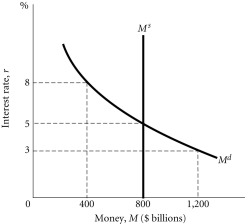

Refer to the information provided in Figure 11.5 below to answer the questions that follow.  Figure 11.5

-Refer to Figure 11.5.If the money supply decreases from

Figure 11.5

-Refer to Figure 11.5.If the money supply decreases from  to

to  ,

,

A) money demand must increase for the money market to return to equilibrium.

B) the interest rate will fall to 4%.

C) the interest rate will increase to 6%.

D) the money market will return to equilibrium only if the money supply is decreased to its original level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Related to the Economics in Practice on p.531: In Italy,checking accounts pay interest.As these interest rates increase,ceteris paribus,

A) the demand for cash increases.

B) the demand for cash decreases.

C) the demand for cash does not change.

D) the supply of cash decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

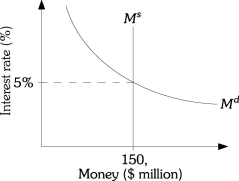

Refer to the information provided in Figure 11.3 below to answer the questions that follow.  Figure 11.3

-Refer to Figure 11.3.An increase in the money supply,ceteris paribus,will likely

Figure 11.3

-Refer to Figure 11.3.An increase in the money supply,ceteris paribus,will likely

A) increase the equilibrium interest rate and decrease equilibrium money holdings.

B) increase the equilibrium interest rate without changing equilibrium money holdings.

C) decrease the equilibrium interest rate and increase equilibrium money holdings.

D) decrease the equilibrium interest rate without changing equilibrium money holdings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average monthly balance in Yolanda's bank account is $1,800.Yolanda spends the same amount of money each day during a 30-day month,and at the end of the month her account balance is $0.Yolanda spends her money at a constant rate of ________ per day.

A) $60

B) $120

C) $180

D) $360

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following pairs of events will definitely lead to an increase in the equilibrium interest rate?

A) the sale of government securities by the Federal Reserve and an increase in nominal aggregate output

B) a decrease in the discount rate and an increase in the level of nominal aggregate output

C) the purchase of government securities by the Federal Reserve and a decrease in nominal aggregate output

D) an increase in the required reserve ratio and a decrease in the level of nominal aggregate output

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the one-year interest rate on a bond is 8% and the expected one-year rate a year from now is 12%.According to the expectations theory of the term structure of interest rates,the two-year rate will be

A) 8%.

B) 10%.

C) 12%.

D) 22%.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A shortage of money in the money market can be eliminated through

A) an increase in nominal aggregate output.

B) an increase in the price level.

C) a decrease in interest rates.

D) an increase in money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government securities that mature in less than a year are called

A) Federal funds bonds.

B) government bonds.

C) Federal Reserve bonds.

D) Treasury bills.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes the quantity demanded of money to increase?

A) an increase in income

B) a decrease in income

C) a decrease in the price level

D) a decrease in the interest rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following leads to a decrease in the interest rate?

A) an increase in the price level

B) a sale of government securities by the Fed

C) an increase in nominal aggregate output

D) a decrease in the required reserve ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

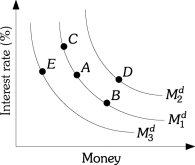

Refer to the information provided in Figure 11.1 below to answer the questions that follow.  Figure 11.1

-Refer to Figure 11.1.A movement from Point B to Point A can be caused by

Figure 11.1

-Refer to Figure 11.1.A movement from Point B to Point A can be caused by

A) a decrease in income.

B) an increase in the price level.

C) a decrease in the interest rate.

D) an increase in the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

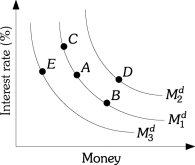

Refer to the information provided in Figure 11.1 below to answer the questions that follow.  Figure 11.1

-Refer to Figure 11.1.All of the following events can cause a movement from Point E to Point A EXCEPT

Figure 11.1

-Refer to Figure 11.1.All of the following events can cause a movement from Point E to Point A EXCEPT

A) an increase in the aggregate price level.

B) an increase in the nominal aggregate output.

C) a decrease in the interest rate.

D) an increase in real output and income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Related to the Economics in Practice on p.531: The increase in the number of ATMs in Italy has had what impact on the market for cash?

A) demand has increased

B) demand has decreased

C) supply has increased

D) supply had decreased

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a motive for holding money?

A) the transaction motive

B) the asset motive

C) the speculative motive

D) All of the above are motives for holding money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transaction demand for money depends on

A) the money supply.

B) the price level.

C) bond prices.

D) the interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Figure 11.4 below to answer the questions that follow.  Figure 11.4

-Refer to Figure 11.4.At an interest rate of 8%,firms and households

Figure 11.4

-Refer to Figure 11.4.At an interest rate of 8%,firms and households

A) will attempt to increase their holdings of money by selling bonds.

B) are satisfied with the amount of money they are holding.

C) will attempt to increase both their holdings of money and their holdings of bonds.

D) will attempt to reduce their holdings of money by buying bonds.

Correct Answer

verified

Correct Answer

verified

True/False

If the Federal Reserve wants interest rates to increase,it will sell bonds.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 129

Related Exams