Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct method of preparing a statement of cash flows

A) is the overwhelming choice of most companies.

B) begins with net income in the operating activities section.

C) will produce the same net figure as the indirect method.

D) All of these choices.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the direct method is used to compute net cash flows from operating activities.For this item extracted from the financial statements-Decrease in Inventory-indicate the effect on cash payments for purchases by choosing one of the following:

A) Add to Cost of Goods Sold to compute cash payments for purchases.

B) Subtract from Cost of Goods Sold to compute cash payments for purchases.

C) Not used to adjust Cost of Goods Sold to compute cash payments for purchases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct method of preparing a statement of cash flows

A) eliminates the need for a schedule of noncash investing and financing transactions.

B) provides a different result than the indirect method.

C) adjusts net income for changes in current accounts.

D) shows cash receipts from sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a statement of cash flows is prepared using the direct method,

A) net income is the starting point in determining cash flows from operations.

B) cash paid for dividends is not included.

C) the increase in cash is different than when the indirect method is used.

D) the amount of cash collected from customers is calculated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the balance of accounts payable does not change during a period.When preparing a statement of cash flows,an increase in ending inventory over beginning inventory will result in an adjustment to cost of goods sold under the direct approach because

A) the amount of cost of goods sold is equal to the amount of cash paid for purchases.

B) consumed inventory is an expense but not a use of funds.

C) the amount of cost of goods sold on an accrual basis is less than the amount of cash paid for purchases of inventory.

D) the amount of cash paid for purchases of inventory is less than the amount of cost of goods sold on an accrual basis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the direct method is used to compute net cash flows from operating activities.For this item extracted from the financial statements-Increase in Prepaid Expenses-indicate the effect on cash payments for operating expenses by choosing one of the following:

A) Add to operating expenses to arrive at cash payments for operating expenses.

B) Subtract from operating expenses to arrive at cash payments for operating expenses.

C) Not used to adjust operating expenses to arrive ay cash payments for operating expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the direct method is used to compute net cash flows from operating activities.For this item extracted from the financial statements-Increase in Income Taxes Payable-indicate the effect on cash payments for income taxes by choosing one of the following:

A) Add to Income Taxes to arrive at cash payments for income taxes.

B) Subtract from Income Taxes to arrive at cash payments for income taxes.

C) Not used to adjust Income Taxes to arrive at cash payments for income taxes.

Correct Answer

verified

Correct Answer

verified

True/False

On a statement of cash flows prepared using the direct method,if Income Taxes Payable decreased during the accounting period,cash payments for taxes will be less than the expense shown on the income statement.

Correct Answer

verified

Correct Answer

verified

True/False

On a statement of cash flows prepared using the direct method,the FASB requires that cash payments for interest be classified as operating activities.

Correct Answer

verified

Correct Answer

verified

Essay

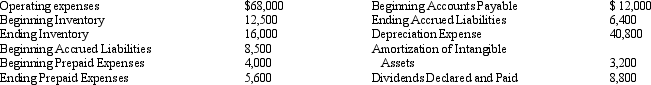

Using the direct method,calculate the amount of cash payments for operating expenses.Show your work

Correct Answer

verified

Correct Answer

verified

True/False

The direct method converts each item on the income statement to its cash equivalent.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 32 of 32

Related Exams