A) 2.50 years

B) 1.90 years

C) 2.63 years

D) 1.93 years

E) 2.40 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects S and L are equally risky,mutually exclusive,and have normal cash flows.Project S has an IRR of 15%,while Project L's IRR is 12%.The two projects have the same NPV when the WACC is 7%.Which of the following statements is CORRECT?

A) If the WACC is 10%,both projects will have positive NPVs.

B) If the WACC is 6%,Project S will have the higher NPV.

C) If the WACC is 13%,Project S will have the lower NPV.

D) If the WACC is 10%,both projects will have a negative NPV.

E) Project S's NPV is more sensitive to changes in WACC than Project L's.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

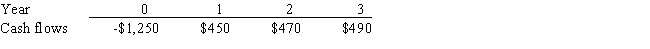

Datta Computer Systems is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 5.01%

B) 5.50%

C) 5.99%

D) 6.67%

E) 6.18%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that all projects being considered have normal cash flows and are equally risky.

A) If a project's IRR is equal to its WACC,then,under all reasonable conditions,the project's NPV must be negative.

B) If a project's IRR is equal to its WACC,then under all reasonable conditions,the project's IRR must be negative.

C) If a project's IRR is equal to its WACC,then under all reasonable conditions the project's NPV must be zero.

D) There is no necessary relationship between a project's IRR,its WACC,and its NPV.

E) When evaluating mutually exclusive projects,those projects with relatively long lives will tend to have relatively high NPVs when the cost of capital is relatively high.

Correct Answer

verified

Correct Answer

verified

True/False

Normal Projects S and L have the same NPV when the discount rate is zero.However,Project S's cash flows come in faster than those of L.Therefore,we know that at any discount rate greater than zero,L will have the higher NPV.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a project with normal cash flows has an IRR greater than the WACC,the project must also have a positive NPV.

B) If Project A's IRR exceeds Project B's,then A must have the higher NPV.

C) A project's MIRR can never exceed its IRR.

D) If a project with normal cash flows has an IRR less than the WACC,the project must have a positive NPV.

E) If the NPV is negative,the IRR must also be negative.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

McCall Manufacturing has a WACC of 10%.The firm is considering two normal,equally risky,mutually exclusive,but not repeatable projects.The two projects have the same investment costs,but Project A has an IRR of 15%,while Project B has an IRR of 20%.Assuming the projects' NPV profiles cross in the upper right quadrant,which of the following statements is CORRECT?

A) Each project must have a negative NPV.

B) Since the projects are mutually exclusive,the firm should always select Project B.

C) If the crossover rate is 8%,Project B will have the higher NPV.

D) Only one project has a positive NPV.

E) If the crossover rate is 8%,Project A will have the higher NPV.

Correct Answer

verified

Correct Answer

verified

True/False

If you were evaluating two mutually exclusive projects for a firm with a zero cost of capital,the payback method and NPV method would always lead to the same decision on which project to undertake.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One advantage of the NPV over the IRR is that NPV takes account of cash flows over a project's full life whereas IRR does not.

B) One advantage of the NPV over the IRR is that NPV assumes that cash flows will be reinvested at the WACC,whereas IRR assumes that cash flows are reinvested at the IRR.The NPV assumption is generally more appropriate.

C) One advantage of the NPV over the MIRR method is that NPV takes account of cash flows over a project's full life whereas MIRR does not.

D) One advantage of the NPV over the MIRR method is that NPV discounts cash flows whereas the MIRR is based on undiscounted cash flows.

E) Since cash flows under the IRR and MIRR are both discounted at the same rate (the WACC) ,these two methods always rank mutually exclusive projects in the same order.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

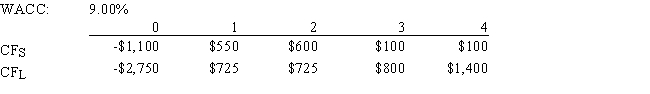

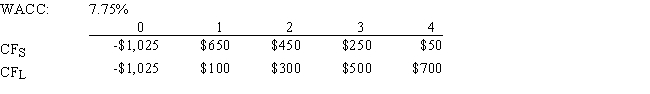

Noe Drilling Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone,i.e. ,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

A) $92.69

B) $62.57

C) $0.00

D) $95.01

E) $78.79

Correct Answer

verified

Correct Answer

verified

Multiple Choice

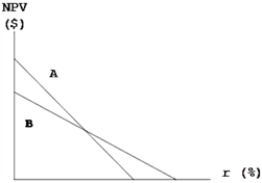

Projects A and B have identical expected lives and identical initial cash outflows (costs) .However,most of one project's cash flows come in the early years,while most of the other project's cash flows occur in the later years.The two NPV profiles are given below:

Which of the following statements is CORRECT?

Which of the following statements is CORRECT?

A) More of Project A's cash flows occur in the later years.

B) More of Project B's cash flows occur in the later years.

C) We must have information on the cost of capital in order to determine which project has the larger early cash flows.

D) The NPV profile graph is inconsistent with the statement made in the problem.

E) The crossover rate,i.e. ,the rate at which Projects A and B have the same NPV,is greater than either project's IRR.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows,with one outflow followed by a series of inflows.

A) A project's regular IRR is found by compounding the cash inflows at the WACC to find the terminal value (TV) ,then discounting this TV at the WACC.

B) A project's regular IRR is found by discounting the cash inflows at the WACC to find the present value (PV) ,then compounding this PV to find the IRR.

C) If a project's IRR is greater than the WACC,then its NPV must be negative.

D) To find a project's IRR,we must solve for the discount rate that causes the PV of the inflows to equal the PV of the project's costs.

E) To find a project's IRR,we must find a discount rate that is equal to the WACC.

Correct Answer

verified

Correct Answer

verified

True/False

Conflicts between two mutually exclusive projects occasionally occur,where the NPV method ranks one project higher but the IRR method puts the other one first.In theory,such conflicts should be resolved in favor of the project with the higher IRR.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the economy is in a mild recession,and as a result interest rates and money costs generally are relatively low.The WACC for two mutually exclusive projects that are being considered is 8%.Project S has an IRR of 20% while Project L's IRR is 15%.The projects have the same NPV at the 8% current WACC.However,you believe that the economy is about to recover,and money costs and thus your WACC will also increase.You also think that the projects will not be funded until the WACC has increased,and their cash flows will not be affected by the change in economic conditions.Under these conditions,which of the following statements is CORRECT?

A) You should reject both projects because they will both have negative NPVs under the new conditions.

B) You should delay a decision until you have more information on the projects,even if this means that a competitor might come in and capture this market.

C) You should recommend Project L,because at the new WACC it will have the higher NPV.

D) You should recommend Project S,because at the new WACC it will have the higher NPV.

E) You should recommend Project L because it will have the higher IRR at the new WACC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The NPV,IRR,MIRR,and discounted payback (using a payback requirement of 3 years or less) methods always lead to the same accept/reject decisions for independent projects.

B) For mutually exclusive projects with normal cash flows,the NPV and MIRR methods can never conflict,but their results could conflict with the discounted payback and the regular IRR methods.

C) Multiple IRRs can exist,but not multiple MIRRs.This is one reason some people favor the MIRR over the regular IRR.

D) If a firm uses the discounted payback method with a required payback of 4 years,then it will accept more projects than if it used a regular payback of 4 years.

E) The percentage difference between the MIRR and the IRR is equal to the project's WACC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

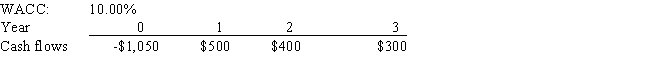

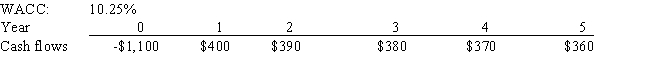

Warnock Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's projected NPV can be negative,in which case it will be rejected.

A) -$42.25

B) -$30.01

C) -$34.35

D) -$48.96

E) -$39.48

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Barry Company is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's projected NPV can be negative,in which case it will be rejected.

A) $338.67

B) $399.63

C) $301.41

D) $274.32

E) $413.17

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Moerdyk & Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,i.e. ,no conflict will exist.

A) $35.63

B) $42.42

C) $40.30

D) $50.06

E) $52.18

Correct Answer

verified

B

Correct Answer

verified

True/False

The IRR of normal Project X is greater than the IRR of normal Project Y,and both IRRs are greater than zero.Also,the NPV of X is greater than the NPV of Y at the cost of capital.If the two projects are mutually exclusive,Project X should definitely be selected,and the investment made,provided we have confidence in the data.Put another way,it is impossible to draw NPV profiles that would suggest not accepting Project X.

Correct Answer

verified

Correct Answer

verified

True/False

If the IRR of normal Project X is greater than the IRR of mutually exclusive (and also normal)Project Y,we can conclude that the firm should always select X rather than Y if X has NPV > 0.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 107

Related Exams