A) Maintaining a large inventory selection for customers.

B) Leaving extra time in order to make inventory deadlines.

C) Maintaining a small inventory supply.

D) LIFO over FIFO.

Correct Answer

verified

Correct Answer

verified

True/False

Just-in-time inventory systems cannot be used in conjunction with the LIFO cost flow assumption.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not a characteristic of the LIFO method of pricing inventory?

A) During a period of rising prices,LIFO tends to minimize the amounts of income taxes owed.

B) The cost of goods sold is measured in relatively current costs.

C) Inventory is valued at relatively current costs.

D) During a period of falling prices,LIFO tends to maximize the amounts of income taxes owed.

Correct Answer

verified

Correct Answer

verified

True/False

In a periodic inventory system,overstating the amount of ending inventory will cause an understatement of gross profit in the following year.

Correct Answer

verified

Correct Answer

verified

Essay

Inventory flow assumptions

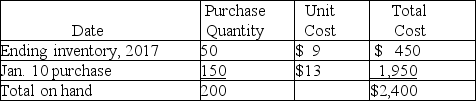

Arrow,Inc.uses a perpetual inventory system.On January 22,2018,the company had 200 units of a particular product on hand,with a total cost of $2,400.The per-unit costs were:

On January 24,2018,Arrow sold 65 units of this product.

Using the three flow assumptions listed below,compute (1)the cost of goods sold,and (2)the cost of the inventory of this product on hand after this sale.Show your computations as per below format.

On January 24,2018,Arrow sold 65 units of this product.

Using the three flow assumptions listed below,compute (1)the cost of goods sold,and (2)the cost of the inventory of this product on hand after this sale.Show your computations as per below format.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the inventory at the end of the current year is understated and the error is never caught,the effect is to:

A) Understate income this year and overstate income next year.

B) Overstate income this year and understate income next year.

C) Understate income this year with no effect on income next year.

D) Overstate the cost of goods sold,but have no effect on net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 365-day year,the average number of days required for Carlin Equipment to sell its inventory is: (Round your final answer to one decimal place)

A) 36.5 days.

B) 45.6 days.

C) 54.4 days.

D) 292.0 days.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] During the current year,Carlin Equipment Stores had net sales of $500 million,a cost of goods sold of $400 million,average accounts receivable of $60 million,and average inventory of $50 million. -Carlin Equipment 's inventory turnover rate is:

A) 6.7 times.

B) 8 times.

C) 10 times.

D) 1.25 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

Green Leaf Company had the following information available on December 31:

![[The following information applies to the questions displayed below.] Green Leaf Company had the following information available on December 31: -Management applies the LCM rule on the basis of the total inventory.What is the write-down required? A) $864. B) $556. C) $576. D) $710.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a32e_3af4_b09f_9131b7f2e428_TB1009_00_TB1009_00_TB1009_00.jpg) -Management applies the LCM rule on the basis of the total inventory.What is the write-down required?

-Management applies the LCM rule on the basis of the total inventory.What is the write-down required?

A) $864.

B) $556.

C) $576.

D) $710.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

Beech Soda,Inc.uses a perpetual inventory system.The company's beginning inventory of a particular product and its purchases during the month of January were as follows:

![[The following information applies to the questions displayed below.] Beech Soda,Inc.uses a perpetual inventory system.The company's beginning inventory of a particular product and its purchases during the month of January were as follows: On January 14,Beech Soda,Inc.sold 25 units of this product.The other 28 units remained in inventory at January 31. -Assuming that Beech Soda uses the FIFO cost flow assumption,the 28 units of this product in inventory at January 31 have a total cost of: A) $400. B) $395. C) $405. D) $410.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a32b_c9f2_b09f_a7aa5ffaf86a_TB1009_00_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg) On January 14,Beech Soda,Inc.sold 25 units of this product.The other 28 units remained in inventory at January 31.

-Assuming that Beech Soda uses the FIFO cost flow assumption,the 28 units of this product in inventory at January 31 have a total cost of:

On January 14,Beech Soda,Inc.sold 25 units of this product.The other 28 units remained in inventory at January 31.

-Assuming that Beech Soda uses the FIFO cost flow assumption,the 28 units of this product in inventory at January 31 have a total cost of:

A) $400.

B) $395.

C) $405.

D) $410.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The logic behind the lower-of-cost-or-market rule is:

A) Inventory gradually becomes obsolete.

B) Inventory that is unsalable should be written down to zero (or its scrap value) .

C) An asset is not worth more than it would cost the owner to replace it.

D) Inventory that is unsalable should be written down to its replacement cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the ending inventory is overstated in the current year:

A) Net income will be understated in the current year.

B) Next year's beginning inventory will also be overstated.

C) Next year's net income will be overstated.

D) Next year's beginning inventory will be understated.

Correct Answer

verified

Correct Answer

verified

Essay

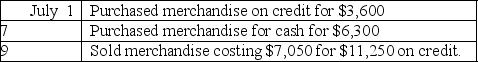

The Valley Garden Company had the following transactions:

(A)Prepare journal entries for Valley Garden assuming the company uses a perpetual inventory.

(B)Prepare journal entries for Valley Garden assuming the company uses a periodic inventory.

(A)Prepare journal entries for Valley Garden assuming the company uses a perpetual inventory.

(B)Prepare journal entries for Valley Garden assuming the company uses a periodic inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During periods of inflation,which method will yield the smallest ending inventory and the largest cost of goods sold?

A) LIFO

B) FIFO

C) Average cost

D) Specific identification

Correct Answer

verified

Correct Answer

verified

True/False

Because of the consistency principle,inventory should never be written down below cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary advantage of a just-in-time inventory system is:

A) The amount of money tied up in inventory is minimized.

B) Customers are afforded a wider selection of merchandise available for immediate delivery.

C) The company is able to use the specific identification method of inventory pricing.

D) The risks of losing sales opportunities or of having to shut down manufacturing operations because of inventory shortages are minimized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gross profit method of valuing inventory:

A) Is the most accurate of the commonly used methods.

B) Is a satisfactory substitute for taking a physical inventory for annual financial statements.

C) Assumes that the gross profit rate will remain the same for the current year as it has in the past year or so.

D) Is not an acceptable method under GAAP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross profit rate is equal to:

A) Net sales divided by gross profit.

B) Gross sales divided by gross profit.

C) Gross profit divided by net sales.

D) Gross profit divided by gross sales.

Correct Answer

verified

Correct Answer

verified

True/False

In order to obtain the maximum tax benefit,companies that use a perpetual inventory system can restate their year-end inventory at costs indicated by periodic LIFO costing procedures.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As a result of taking an annual physical inventory,it usually is necessary in a perpetual inventory system to make an entry:

A) Reducing assets and increasing the cost of goods sold.

B) Reducing assets and increasing liabilities.

C) Reducing the cost of goods sold.

D) Increasing assets and increasing the cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 147

Related Exams