A) Income from Services

B) Rent Expense

C) Owner's Drawing

D) Owner's Capital

E) Depreciation Expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Closing entries are prepared to close the

A) temporary accounts.

B) accumulated depreciation accounts.

C) owner's Capital account.

D) Wages Payable account.

E) payables and receivables.

Correct Answer

verified

Correct Answer

verified

Essay

Explain the differences between cash and accrual accounting methods.

Correct Answer

verified

The cash basis of accounting records revenue when cash is received and expenses when cash is paid. Under the accrual method, revenues are recorded when earned, and expenses are recorded when incurred. This method is more complicated and time consuming than the cash method.

Correct Answer

verified

Multiple Choice

The _______________ requires that revenue is recorded when earned and expenses are recorded when incurred.

A) accrual basis of accounting

B) cash basis of accounting

C) hybrid basis of accounting

D) GAAP basis of accounting

Correct Answer

verified

Correct Answer

verified

True/False

If a liability was extended into the Income Statement Credit column on the work sheet, net income would be understated.

Correct Answer

verified

Correct Answer

verified

True/False

Both income statement and balance sheet accounts are closed at the end of a fiscal period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income for a company is $35,000 for the current year. The owner withdrew $3,500 per month for personal expenses. The owner's Capital account will show a net

A) decrease of $7,000.

B) increase of $7,000.

C) decrease of $42,000.

D) increase of $42,000.

E) increase of $77,000.

Correct Answer

verified

Correct Answer

verified

True/False

The owner's Capital account will always have a zero balance after the closing entries are posted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Income Summary account has a debit balance of $10,000 prior to closing. The owner's Drawing account has a balance of $7,000 before closing. The owner's Capital account will

A) decrease $10,000.

B) increase $17,000.

C) increase $10,000.

D) decrease $17,000.

E) increase $7,000.

Correct Answer

verified

Correct Answer

verified

True/False

The Income Summary account balance should always increase after the closing entries are posted at the end of the accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The post-closing trial balance will include

A) Accumulated Depreciation.

B) Depreciation Expense.

C) Drawing.

D) Rent Expense.

E) Income from Services.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

If expenses are greater than revenue, the Income Summary account will be closed by a debit to

A) Cash and a credit to Income Summary.

B) Income Summary and a credit to Cash.

C) Capital and a credit to Income Summary.

D) Income Summary and a credit to Capital.

E) Income Summary and a credit to Drawing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The second step in the closing process is to close the _____________ account(s) into the ___________ account(s) .

A) expense, income summary

B) income summary, expense

C) expense, net income

D) revenue, income summary

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The first step in the accounting cycle is to

A) analyze source documents and record business transactions in a journal.

B) prepare a post-closing trial balance.

C) complete the work sheet.

D) journalize and post the adjusting entries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The post-closing trial balance is best prepared from the

A) general ledger.

B) general journal and the general ledger.

C) general ledger and the financial statements.

D) financial statements.

E) income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sequences of documents or records describes the proper sequence in the accounting cycle?

A) Source documents, journal, ledger, work sheet, financial statements

B) Source documents, work sheet, journal, ledger, financial statements

C) Source documents, ledger, journal, work sheet, financial statements

D) Work sheet, source documents, financial statements, ledger, journal

E) Financial statements, journal, ledger, source documents, work sheet

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

When using the work sheet to prepare closing entries, which of the following statement is correct?

A) You should use all balances listed in the balance sheet columns.

B) You should use all balances listed in the balance sheet columns and the income statement columns.

C) You should use all balances listed in the income statement columns.

D) None of the answers listed

Correct Answer

verified

Correct Answer

verified

Short Answer

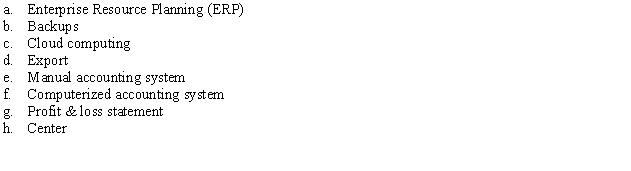

Match the terms that follow with the correct definitions.

-The ability to transfer financial reports from on program to another.

-The ability to transfer financial reports from on program to another.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true concerning the steps in the accounting cycle?

A) Preparing a trial balance should be completed before recording business transactions into a journal.

B) Journalizing and posting the closing entries should be completed after preparing financial statements.

C) Completing the work sheet should be completed after preparing the financial statements.

D) Preparing a post-closing trial balance should be completed before completing the work sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to close revenue would involve a

A) debit to capital.

B) credit to Income Summary.

C) debit to net income.

D) credit to revenue.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 112

Related Exams