Correct Answer

verified

Correct Answer

verified

True/False

The time value of money is considered when calculating the payback period of an investment.

Correct Answer

verified

Correct Answer

verified

True/False

A special order of goods or services should always be accepted when the incremental revenue exceeds the incremental costs.

Correct Answer

verified

Correct Answer

verified

Not Answered

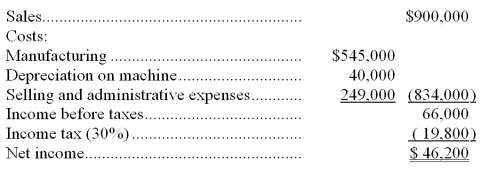

Casco Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $280,000 with a 7-year life, no salvage value, and will be depreciated using straight-line depreciation. The expected annual income related to this equipment follows. Compute the (a) payback period and (b) accounting rate of return for this equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An opportunity cost:

A) Is an unavoidable cost.

B) Requires a current outlay of cash.

C) Results from past managerial decisions.

D) Is the lost benefit of choosing an alternative course of action.

E) Is irrelevant in decision making.

Correct Answer

verified

Correct Answer

verified

True/False

The accounting rate of return uses cash flows in its calculation.

Correct Answer

verified

Correct Answer

verified

Short Answer

The _______________________________ is computed by discounting the future net cash flows from the investment at the project's required rate of return and then subtracting the initial amount invested.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

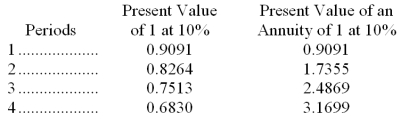

Edgar Company is considering the purchase of new equipment costing $80,000. The projected net cash flows are $35,000 for the first two years and $30,000 for years three and four. The revenue is to be received at the end of each year. The machine has a useful life of 4 years and no salvage value. Edgar requires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity for different periods is presented below. Compute the net present value of the machine.

A) $(15,731) .

B) $(4,896) .

C) $15,731.

D) $4,896.

E) $23,775.

Correct Answer

verified

E

Correct Answer

verified

Not Answered

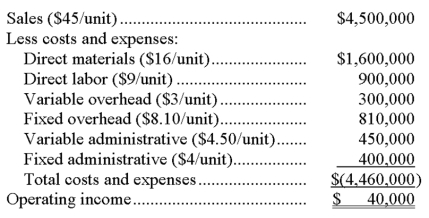

Peters, Inc. sells a single product and reports the following results from sales of 100,000 units:  A foreign company wants to purchase 15,000 units. However, they are willing to pay only $36 per unit for this one-time order. They also agree to pay all freight costs. To fill the order, Peters will incur normal production costs. Total fixed overhead will have to be increased by $60,000 to pay for equipment rentals and insurance. No additional administrative costs (variable or fixed) will be incurred in association with this special order.

Required:

(1) Should Peters accept the order if it does not affect regular sales? Explain.

(2) Assume that Peters can accept the special order only by giving up 5,000 units of its normal sales. Should Peters accept the special order under these circumstances?

A foreign company wants to purchase 15,000 units. However, they are willing to pay only $36 per unit for this one-time order. They also agree to pay all freight costs. To fill the order, Peters will incur normal production costs. Total fixed overhead will have to be increased by $60,000 to pay for equipment rentals and insurance. No additional administrative costs (variable or fixed) will be incurred in association with this special order.

Required:

(1) Should Peters accept the order if it does not affect regular sales? Explain.

(2) Assume that Peters can accept the special order only by giving up 5,000 units of its normal sales. Should Peters accept the special order under these circumstances?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

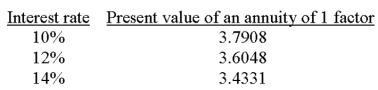

A company is considering a 5-year project. The company plans to invest $60,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

A) The project should be accepted.

B) The project should be rejected because it earns more than 10%.

C) The project earns more than 10% but less than 12%. If the hurdle rate is 12%, the project should be rejected.

D) Only 9% is acceptable.

E) Only 10% is acceptablE.Investment/Annual net cash flows = $60,000/$16,200 = 3.704

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Parker Plumbing has received a special one-time order for 1,500 faucets (units) at $5 per unit. Parker currently produces and sells 7,500 units at $6.00 each. This level represents 75% of its capacity. Production costs for these units are $4.50 per unit, which includes $3.00 variable cost and $1.50 fixed cost. To produce the special order, a new machine needs to be purchased at a cost of $1,000 with a zero salvage value. Management expects no other changes in costs as a result of the additional production. If Parker wishes to earn $1,250 on the special order, the size of the order would need to be:

A) 4,500 units.

B) 2,250 units.

C) 1,125 units.

D) 625 units.

E) 300 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company paid $200,000 ten years ago for a specialized machine that has no salvage value and is being depreciated at the rate of $10,000 per year. The company is considering using the machine in a new project that will have incremental revenues of $28,000 per year and annual cash expenses of $20,000. In analyzing the new project, the $10,000 depreciation on the machine is an example of a(n) :

A) Incremental cost.

B) Opportunity cost.

C) Variable cost.

D) Sunk cost.

E) Out-of-pocket cost.

Correct Answer

verified

D

Correct Answer

verified

True/False

The internal rate of return equals the rate that yields a net present value of zero for an investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company can buy a machine that is expected to have a three-year life and a $30,000 salvage value. The machine will cost $1,800,000 and is expected to produce a $200,000 after-tax net income to be received at the end of each year. If a table of present values of 1 at 12% shows values of 0.8929 for one year, 0.7972 for two years, and 0.7118 for three years, what is the net present value of the cash flows from the investment, discounted at 12%?

A) $118,855

B) $583,676

C) $629,788

D) $705,391

E) $1,918,855

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A minimum acceptable rate of return for an investment decision is called the:

A) Internal rate of return.

B) Average rate of return.

C) Hurdle rate.

D) Maximum rate.

E) Payback rate.

Correct Answer

verified

Correct Answer

verified

Not Answered

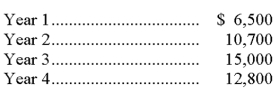

A company is considering a proposal to invest $30,000 in a project that would provide the following net cash flows:  Compute the project's payback period.

Compute the project's payback period.

Correct Answer

verified

Correct Answer

verified

True/False

When computing payback period, the year in which a capital investment is made is year 1.

Correct Answer

verified

Correct Answer

verified

Not Answered

Fields Company currently manufactures one of its parts at a cost of $3.25 per unit. This cost is based on a normal production rate of 50,000 units. Variable costs are $2.10 per unit, fixed costs related to making this part are $40,000 per year, and allocated fixed costs are $45,000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Fields is considering buying the part from a supplier for a quoted price of $2.80 per unit guaranteed for a three-year period. Should the company continue to manufacture the part, or should it buy the part from the outside supplier? Support your answer with analyses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An additional cost incurred only if a particular action is taken is a(n) :

A) Period cost.

B) Pocket cost.

C) Discount cost.

D) Incremental cost.

E) Sunk cost.

Correct Answer

verified

Correct Answer

verified

True/False

Capital budgeting decisions are risky because the outcome is uncertain, large amounts are usually involved, the investment involves a long-term commitment, and the decision could be difficult or impossible to reverse.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 150

Related Exams