A) part of the M2+ definition of the money supply.

B) part of the M2 definition of the money supply.

C) part of the M1 definition of the money supply.

D) not part of the definitions of the money supply.

Correct Answer

verified

Correct Answer

verified

True/False

When a borrower repays a loan of $4000, either in cash or by cheque, the supply of money is reduced by $4000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we let P equal the price level expressed as an index number and D equal the value of the dollar, then we can say that:

A) P = D - 1.

B) D = 1/P.

C) 1 = D/P.

D) D = P - 1.![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What function is money serving when you deposit money in a savings account?

A) a store of value

B) a unit of account

C) a chequable deposit

D) a medium of exchange

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Near-monies" are important:

A) because they are likely to affect the level of consumer spending.

B) because they can be converted into chequable deposits and thereby affect macroeconomic stability.

C) because they complicate defining money and therefore complicate the formulation of monetary policy.

D) for all of the above reasons.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Demand deposits are also called:

A) chequing accounts.

B) high-powered money.

C) savings balances.

D) Bank of Canada notes.

Correct Answer

verified

Correct Answer

verified

True/False

The basic source of money in our economy is the Department of Finance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Coins held in chartered banks are:

A) included in M1, but not in M2.

B) included both in M1 and in M2.

C) included in M2, but not in M1.

D) not part of the nation's money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Individual chartered banks are limited in their ability to create money by lending because:

A) lending is likely to result in the loss of reserves to other banks.

B) only the Department of Finance is authorized to create new money.

C) the Bank of Canada prohibits bank lending when the result is an expansion of the money supply.

D) banking is a highly competitive industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

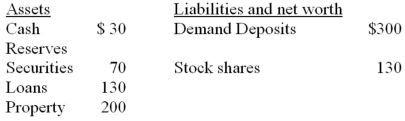

Consolidated balance sheet for the chartered banking system. Assume the desired reserve ratio is 10 percent. All figures are in billions.

-Refer to the above information. The chartered banking system has excess reserves of:

-Refer to the above information. The chartered banking system has excess reserves of:

A) $0 billion.

B) $30 billion.

C) $60 billion.

D) $70 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the relationship between the real value or purchasing power of the monetary unit and the price level? The purchasing power of money:

A) and the price level varies inversely.

B) and the price level vary directly during recessions, but inversely during inflations.

C) and the price level vary directly, but not proportionately.

D) and the price level vary directly and proportionately.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Demand deposits are classified as money because:

A) they can be readily used in the making of purchases and payment of debts.

B) banks hold currency equal to the value of their outstanding deposits.

C) they are ultimately the obligations of the government.

D) they earn interest income for the depositor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Securatization is:

A) the process of slicing up and bundling groups of loans, mortgages, corporate bonds and other financial debts into distinct new securities.

B) the securing of loans, mortgages, corporate bonds and other financial debts by governments.

C) a guarantee that loans, mortgages, corporate bonds and other financial debts were secure.

D) the process of securing loans, mortgages, corporate bonds and other financial debts by insurance companies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The paper money used in Canada is:

A) National Bank notes.

B) Treasury notes of 1890.

C) Canada notes.

D) Bank of Canada notes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of money reported as M2:

A) is smaller than the amount reported as M1.

B) is larger than the amount reported as M1.

C) excludes coins and currency.

D) includes nonpersonal fixed-term deposits of residents booked in Canada.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that Johnson deposits $350 of his currency in his account in the XYZ bank. Later the same day Swanson negotiates a loan for $2,000 at the same bank. In what direction and by what amount has this single transaction changed the supply of money?

A) increased by $2,350

B) increased by $2,000

C) decreased by $350

D) decreased by $1,650

Correct Answer

verified

Correct Answer

verified

True/False

Chartered banks monetize claims when they sell securities to the Bank of Canada. Subtopic: True-false

Correct Answer

verified

Correct Answer

verified

Multiple Choice

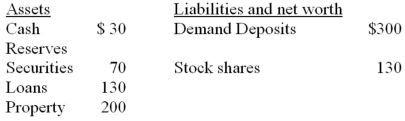

Consolidated balance sheet for the chartered banking system. Assume the desired reserve ratio is 10 percent. All figures are in billions.

-Refer to the above information. After a deposit of $10 billion of new currency into a chequing account in the banking system, excess reserves will increase by:

-Refer to the above information. After a deposit of $10 billion of new currency into a chequing account in the banking system, excess reserves will increase by:

A) $0 billion.

B) $7 billion.

C) $9 billion.

D) $10 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A chartered bank's desired reserve can be calculated by:

A) dividing its excess reserves by its desired reserve.

B) dividing its desired reserve by its excess reserves.

C) multiplying its demand-deposit liabilities by the reserve ratio.

D) multiplying its demand-deposit liabilities by its excess reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following is information about a banking system: new currency deposited in the system = $40 billion; desired reserve ratio = 20%; excess reserves prior to the currency deposit = $0. -Refer to the above information. The $40 billion deposit of currency into chequing accounts will initially create:

A) $8 billion of new demand deposits.

B) $10 billion of new demand deposits.

C) $40 billion of new demand deposits.

D) $160 billion of new demand deposits.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 286

Related Exams