Filters

Question type

A) prepare a trial balance.

B) prepare a post-closing trial balance.

C) complete the work sheet.

D) journalize and post the adjusting entries.

Correct Answer

verified

Correct Answer

verified

Question 62

Multiple Choice

Baker Co. uses the accrual basis of accounting. Baker Co. prepays cash in May for insurance that covers only the month of June. Which of the following statements is true?

A) Baker Co. should record the insurance expense in May.

B) Baker Co. should record the insurance expense in June.

C) Baker Co. should record the payment of cash in June.

D) Baker Co. should neither record the payment of cash nor the insurance expense in May.

Correct Answer

verified

Correct Answer

verified

Question 63

Multiple Choice

The post-closing trial balance is best prepared from the

A) general ledger.

B) general journal and the general ledger.

C) general ledger and the financial statements.

D) financial statements.

E) income statement.

Correct Answer

verified

Correct Answer

verified

Question 64

Matching

Match the correct definitions below with the terms .

Premises

List of the final balances of the general ledger after end-of-year procedures

Process in which preparing the post-closing trial balance is the last step

Accounts that belong to only one fiscal year and are closed out at the end of each fiscal year

The account used to record amounts taken out of the business by the owner

Account classifications that are closed into the Income Summary account

The debit to Income Summary represents the total

Accounts that are not closed out at the end of each fiscal year

Financial statements prepared during the fiscal year for a period of less than twelve months

Clearing the accounts or bringing to zero balance

Account that is used to assist in closing temporary-equity accounts

Responses

Interim statements

Closing entries

Expenses

Real or permanent accounts

Drawing account

Income Summary

Post-closing trial balance

Accounting cycle

Expense and revenue

Temporary-equity accounts

Correct Answer

Premises

Responses

List of the final balances of the general ledger after end-of-year procedures

Process in which preparing the post-closing trial balance is the last step

Accounts that belong to only one fiscal year and are closed out at the end of each fiscal year

The account used to record amounts taken out of the business by the owner

Account classifications that are closed into the Income Summary account

The debit to Income Summary represents the total

Accounts that are not closed out at the end of each fiscal year

Financial statements prepared during the fiscal year for a period of less than twelve months

Clearing the accounts or bringing to zero balance

Account that is used to assist in closing temporary-equity accounts

Premises

List of the final balances of the general ledger after end-of-year procedures

Process in which preparing the post-closing trial balance is the last step

Accounts that belong to only one fiscal year and are closed out at the end of each fiscal year

The account used to record amounts taken out of the business by the owner

Account classifications that are closed into the Income Summary account

The debit to Income Summary represents the total

Accounts that are not closed out at the end of each fiscal year

Financial statements prepared during the fiscal year for a period of less than twelve months

Clearing the accounts or bringing to zero balance

Account that is used to assist in closing temporary-equity accounts

Responses

Question 65

Essay

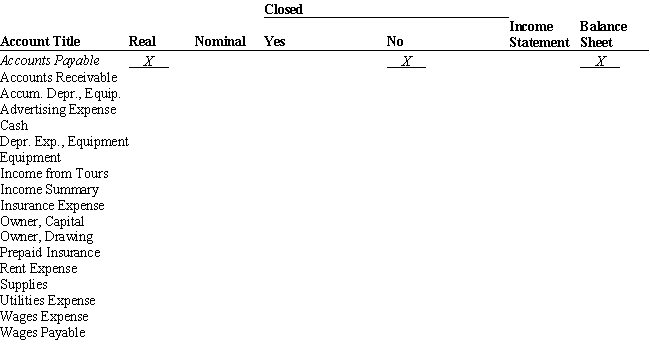

Classify the following accounts as real (permanent) or nominal (temporary), and indicate with an X whether the account is closed. Also, indicate the financial statement in which each account will appear. The Accounts Payable account is given as an example.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 105 of 105

Related Exams