A) Taxes,government spending,and saving.

B) Planned investment,net exports,and government spending.

C) Planned consumption and planned saving.

D) Planned saving only.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would cause a leftward shift in the investment function?

A) Technological progress

B) A reduction in the rate of interest

C) Optimistic expectations about business conditions

D) An increase in business taxes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the marginal propensity to consume (MPC) is 0.75 and government purchases increase by $200 billion,then

A) equilibrium real Gross Domestic Product (GDP) will increase by $800 billion.

B) equilibrium real Gross Domestic Product (GDP) will increase by $200 billion.

C) equilibrium real Gross Domestic Product (GDP) will increase by $50 billion.

D) the effect on equilibrium real Gross Domestic Product (GDP) cannot be determined from the given information.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your real disposable income is your real income after you have paid

A) rent and food expenses.

B) net taxes.

C) medical expenses.

D) consumption expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

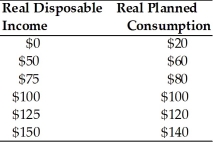

-Use the above table.The MPC is

-Use the above table.The MPC is

A) 0.91.

B) 0.80.

C) 0.20.

D) 0.09.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal propensity to save is

A) real consumption/real disposable income.

B) real saving/real disposable income.

C) change in real consumption/change in real disposable income.

D) change in real saving/change in real disposable income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things being constant,if the marginal propensity to save (MPS) is 0.1,and private investment spending falls by $100 million,then real Gross Domestic Product (GDP)

A) decreases by $10 million.

B) increases by $90 million.

C) decreases by $1 billion.

D) increases by $1 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

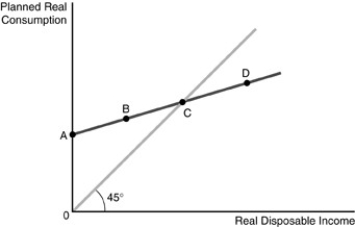

-Refer to the above figure.The figure represents the consumption function for a consumer.Point D represents

-Refer to the above figure.The figure represents the consumption function for a consumer.Point D represents

A) autonomous consumption.

B) saving.

C) dissaving.

D) zero saving.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Along the 45-degree reference line,

A) total planned real expenditures = real GDP.

B) total planned real expenditures = planned nominal expenditures.

C) total planned nominal expenditures = consumption.

D) total planned investment spending = planned real expenditures.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does a reduction in the price level affect the position of the C + I + G + X curve and in turn the equilibrium level of real GDP?

A) The C + I + G + X curve shifts down,thereby reducing the equilibrium level of real GDP.

B) The C + I + G + X curve shifts down,thereby increasing the equilibrium level of real GDP.

C) The C + I + G + X curve shifts up,thereby reducing the equilibrium level of real GDP.

D) The C + I + G + X curve shifts up,thereby increasing the equilibrium level of real GDP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The consumption function shifts upward when

A) real income increases.

B) saving increases.

C) the real wealth of the average household increases.

D) population decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The multiplier effect tends to

A) generate instability.

B) promote stability of the general price level.

C) magnify small changes in spending into much larger changes in real Gross Domestic Product (GDP) .

D) increase the MPC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lump-sum tax,such as a $1000 tax that every family must pay one time,is

A) a type of income tax.

B) an autonomous tax.

C) negatively related to real GDP.

D) a regressive tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement relative to retained earnings and investment?

A) Lower interest rates stimulate borrowing for investment,but have no effect on the use of retained earnings for investment spending.

B) Lower interest rates stimulate borrowing for investment,but discourage the use of retained earnings for investment.

C) Lower interest rates reduce the opportunity cost of retained earnings,stimulating the use of these funds in investment.

D) Lower interest rates have no effect on investment spending at all because investment spending is autonomous.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

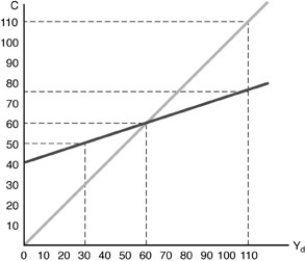

-Consider the above figure.At an income of $60 we would expect saving to be equal to

-Consider the above figure.At an income of $60 we would expect saving to be equal to

A) $60.

B) $40.

C) $10.

D) $0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thinking as an economist would,which is true of investment?

A) It is the portion of disposable income that is not used for consumption or saving.

B) Investment represents spending on capital goods.

C) Investment is putting money into stocks and bonds.

D) Investment is a stock concept.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whenever total planned expenditures differ from real GDP,

A) unplanned inventories will remain unchanged.

B) unplanned inventories will change.

C) government spending will adjust.

D) tax revenues will move the economy back to equilibrium.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is negative for the "typical" consumer at some level of real disposable income?

A) Marginal propensity to save.

B) Marginal propensity to consume.

C) Average propensity to save.

D) Average propensity to consume.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The saving function shows the relationship between planned real saving and

A) real wealth.

B) real disposable income.

C) the average propensity to save.

D) the marginal propensity to save.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The investment function will shift when there is a change in

A) the interest rate.

B) firms' profit expectations.

C) the cost of borrowing.

D) the opportunity cost of retained earnings.

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 445

Related Exams