A) Government interagency borrowing must have increased during the period.

B) Government interagency borrowing must have decreased during the period.

C) Foreign ownership of U.S.Treasury securities must have risen during the period.

D) Foreign ownership of U.S.Treasury securities must have fallen during the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When government spending exceeds government revenues during a given period of time,

A) a budget deficit exists.

B) a budget surplus exists.

C) the national debt must be decreasing.

D) Congress is obliged to raise taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which decade did the United States begin experiencing large trade deficits?

A) 1960s

B) 1970s

C) 1980s

D) 1990s

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy is initially experiencing a recessionary gap.A reduction in the size of the budget deficit will cause which of the following in the short run?

A) a reduction in the size of the recessionary gap and increase in real GDP.

B) an increase in the size of the recessionary gap and decrease in real GDP.

C) an increase in inflation and increase in aggregate supply.

D) an inflationary gap.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Since the late 1980s,the share of the net public debt owed to foreign interests has

A) remained constant.

B) decreased.

C) increased.

D) gone up and then down,finally settling at around 10 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which is the fastest growing component of the federal government budget?

A) Spending on the military and the war on terrorism

B) Spending to improve the nation's schools

C) Spending to improve and expand the nation's infrastructure

D) Spending on entitlements

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net public debt is equal to

A) the gross public debt minus current year tax revenue collection.

B) the gross public debt minus taxes paid by foreign corporations on their profits made in the United States.

C) the gross public debt plus all governmental interagency borrowing.

D) the gross public debt minus all governmental interagency borrowing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run,what effect does a government's deficit spending have on equilibrium real Gross Domestic Product (GDP) ?

A) The government's deficit spending will increase equilibrium real Gross Domestic Product (GDP) .

B) Deficit spending will decrease the nation's equilibrium real Gross Domestic Product (GDP) .

C) Higher government deficits will not raise equilibrium Gross Domestic Product (GDP) above the full-employment level.

D) Equilibrium real Gross Domestic Product (GDP) will increase beyond the full-employment level and there will also be an inflationary effect.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT an entitlement?

A) Medicaid

B) Social Security

C) Federal government salaries

D) Medicare

Correct Answer

verified

Correct Answer

verified

Multiple Choice

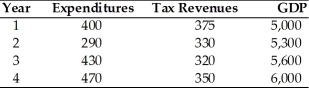

-Suppose that initially there is no public debt.Using the above table,what is the public debt as a percentage of GDP in Year 3?

-Suppose that initially there is no public debt.Using the above table,what is the public debt as a percentage of GDP in Year 3?

A) 1.7 percent

B) 2.0 percent

C) 7.7 percent

D) 5.9 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest component of U.S.federal spending that contributes to the U.S.government budget deficit is

A) entitlements.

B) military spending.

C) interest expenses.

D) salaries of government employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks change ________ whereas flows relate to ________.

A) within a given period of time;changes between points in time

B) only at the end of each year;amounts at a given point in time

C) between points in time;changes within a given time period

D) and that causes flows to change;changes that have no impact on stocks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the current year,a nation's government spending equals $1.5 trillion and its revenues are $1.9 trillion.Which of the following is true?

A) The nation's national debt equals $0.4 trillion.

B) This nation has a current year budget surplus of $0.4 trillion.

C) This nation is currently running a budget deficit of $0.4 trillion.

D) The nation has a current year trade surplus of $0.4 trillion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy is initially operating at full employment.A reduction in the size of the budget deficit will cause which of the following in the long run?

A) a recessionary gap.

B) a reduction in real GDP.

C) an inflationary gap.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the public debt is true?

A) It is a stock variable.

B) It is equal to the budget deficit.

C) It decreases when the government runs a budget deficit..

D) All of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the difference between the short run and the long run when there is full employment and the government engages in deficit spending?

A) Real GDP will increase in both the short run and the long run.

B) Real GDP will increase in the long run but not the short run.

C) Real GDP will increase in the short run but not the long run.

D) Real GDP will not increase in either the long run or the short run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public debt is held as

A) corporate bonds and common stocks of the largest companies.

B) Federal Reserve Notes.

C) U.S.Notes.

D) Treasury Bills,Treasury Notes,Treasury Bonds,and U.S.Savings Bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net public debt is

A) all federal public debt irrespective of who owns it.

B) gross public debt minus all government interagency borrowing.

C) all public debt minus all money owed on the federal income tax.

D) all public debt plus all government interagency borrowing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does a government budget deficit occur?

A) A government's tax revenues exceed its spending.

B) A government's spending exceeds its tax revenues.

C) If a nation carries a public debt,it must be running a deficit every year.

D) A nation earns more on exports than it spends on imports.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the budget deficit is true?

A) It is a stock variable.

B) It is a flow variable.

C) It is equal to the public debt.

D) None of the above.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 145

Related Exams