A) either money demand or money supply shifts right.

B) either money demand or money supply shifts left.

C) money demand shifts right or money supply shifts left.

D) money demand shifts left or money supply shifts right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, if the Federal Reserve sells bonds, then the money supply curve

A) shifts right, causing the price level to rise.

B) shifts right, causing the price level to fall.

C) shifts left, causing the price level to rise.

D) shifts left, causing the price level to fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the classical dichotomy, which of the following is not influenced by monetary factors?

A) unemployment

B) the price level

C) nominal interest rates

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If monetary neutrality holds, then an increase in the money supply

A) increases real but not nominal variables. Most economists think that monetary neutrality is a good description of the short run.

B) increases real but not nominal variables. Most economists think that monetary neutrality is a good description of the long run.

C) increases nominal but not real variables. Most economists think that monetary neutrality is a good description of the short run.

D) increases nominal but not real variables. Most economists think that monetary neutrality is a good description of the long run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that inflation by itself reduces people's purchasing power is called

A) the inflation tax.

B) menu costs.

C) the inflation fallacy.

D) shoeleather costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sam deposits money into an account with a nominal interest rate of 4 percent. He expects inflation to be 1.5 percent. His tax rate is 32 percent. Sam's aftertax real rate of interest

A) will be 1.2 percent if inflation turns out to be 1.5 percent; it will be higher if inflation turns out to be lower than 1.5 percent.

B) will be 1.2 percent if inflation turns out to be 1.5 percent; it will be lower if inflation turns out to be lower than 1.5 percent.

C) will be 1.7 percent if inflation turns out to be 1.5 percent; it will be higher if inflation turns out to be lower than 1.5 percent.

D) will be 1.7 percent if inflation turns out to be 1.5 percent; it will be lower if inflation turns out to be lower than 1.5 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fisher effect is crucial for understanding changes over time in

A) the nominal interest rate.

B) the real interest rate.

C) the inflation rate.

D) the unemployment rate.

Correct Answer

verified

Correct Answer

verified

Short Answer

According to the quantity theory of money, an increase in the money supply causes the price level to _____ and the value of money to _____.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the United States unexpectedly decided to pay off its debt by printing new money. Which of the following would happen?

A) People who held money would feel poorer.

B) Prices would rise.

C) People who had lent money at a fixed interest rate would feel poorer.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

True/False

An excess supply of money is eliminated by a decrease in the value of money.

Correct Answer

verified

Correct Answer

verified

True/False

If the Fed were to unexpectedly increase the money supply, creditors would gain at the expense of debtors.

Correct Answer

verified

Correct Answer

verified

Short Answer

An increase in the price level causes the value of money to _____. Therefore, people will want to hold ____ money, because the cost of their purchases has increased.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the history of U.S. inflation is not correct?

A) Prices rose at an average annual rate of about 3.6 percent over the last 80 years.

B) There was about a 17-fold increase in the price level over the last 80 years.

C) Inflation in the 1970s was below the average over the last 80 years.

D) The United States has experienced periods of deflation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

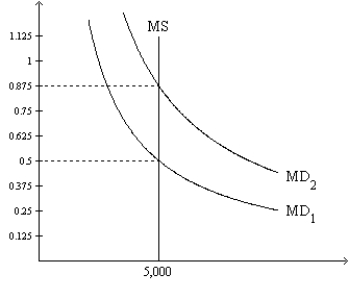

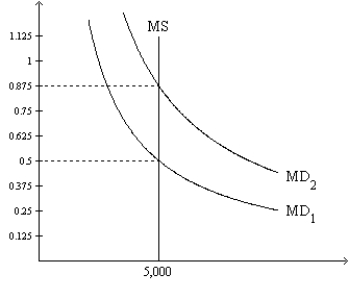

Figure 30-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.  -Refer to Figure 30-2. Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

-Refer to Figure 30-2. Which of the following events could explain a shift of the money-demand curve from MD1 to MD2?

A) an increase in the value of money

B) a decrease in the price level

C) an open-market purchase of bonds by the Federal Reserve

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that monetary neutrality and the Fisher effect both hold. An increase in the money supply growth rate increases

A) the inflation rate and real interest rates.

B) the inflation rate, but not real interest rates.

C) real interest rates, but not the inflation rate.

D) neither the inflation rate nor real interest rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inflation rises, people will desire to hold

A) less money and will go to the bank less frequently.

B) less money and will go to the bank more frequently.

C) more money and will go to the bank less frequently.

D) more money and will go to the bank more frequently.

Correct Answer

verified

Correct Answer

verified

True/False

Nominal GDP measures output of final goods and services in physical terms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payments you make on your automobile loan are given in terms of dollars. As prices rise you notice you give up fewer goods to make your payments.

A) The dollar amount you pay is a nominal value. The number of goods you give up is a real value.

B) The dollar amount you pay is a real value. The number of goods you give up is a nominal value.

C) Both the dollar amount you pay and the goods you give up are nominal values.

D) Both the dollar amount you pay and the goods you give up are real values.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 30-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.  -Refer to Figure 30-2. At the end of 2009 the relevant money-demand curve was the one labeled MD2. At the end of 2010 the relevant money-demand curve was the one labeled MD1. Assuming the economy is always in equilibrium, what was the economy's approximate inflation rate for 2010?

-Refer to Figure 30-2. At the end of 2009 the relevant money-demand curve was the one labeled MD2. At the end of 2010 the relevant money-demand curve was the one labeled MD1. Assuming the economy is always in equilibrium, what was the economy's approximate inflation rate for 2010?

A) -43 percent

B) -57 percent

C) 57 percent

D) 75 percent

Correct Answer

verified

Correct Answer

verified

True/False

U.S. prices rose at an average annual rate of about 3.6 percent over the last 80 years.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 484

Related Exams