Filters

Question type

A) $405,000

B) $283,500

C) $240,000

D) $168,000

Correct Answer

verified

Correct Answer

verified

Question 82

Multiple Choice

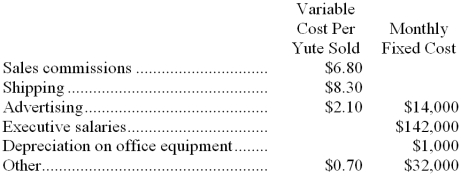

Porus Corporation makes and sells a single product called a Yute. The company is in the process of preparing its Selling and Administrative Expense Budget for the last quarter of the year. The following budget data are available:  All of these expenses (except depreciation) are paid in cash in the month they are incurred.

-If the total budget for selling and administrative expense for October is $493,300, then how many Yutes does the company plan to sell in October?

All of these expenses (except depreciation) are paid in cash in the month they are incurred.

-If the total budget for selling and administrative expense for October is $493,300, then how many Yutes does the company plan to sell in October?

A) 17,500 units

B) 17,000 units

C) 17,200 units

D) 16,700 units

Correct Answer

verified

Correct Answer

verified

Question 83

Multiple Choice

The Charade Company is preparing its Manufacturing Overhead budget for the fourth quarter of the year. The budgeted variable factory overhead is $5.00 per direct labor-hour; the budgeted fixed factory overhead is $75,000 per month, of which $15,000 is factory depreciation. -If the budgeted direct labor time for December is 8,000 hours, then total budgeted factory overhead per direct labor-hour is (rounded) :

A) $14.38

B) $9.38

C) $12.50

D) $16.25

Correct Answer

verified

Correct Answer

verified

Question 84

Multiple Choice

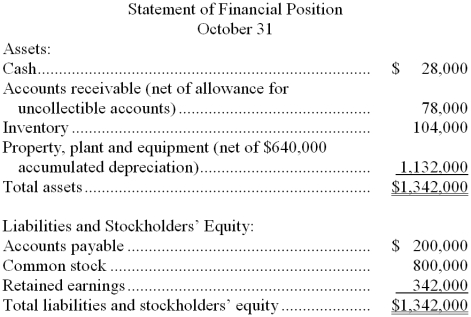

Dilom Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow:

Sales are budgeted at $260,000 for November, $230,000 for December, and $210,000 for January.

Collections are expected to be 55% in the month of sale, 40% in the month following the sale, and 5% uncollectible.

The cost of goods sold is 80% of sales.

The company purchases 50% of its merchandise in the month prior to the month of sale and 50% in the month of sale. Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $21,700.

Monthly depreciation is $17,000.

Ignore taxes.  -The cash balance at the end of December would be:

-The cash balance at the end of December would be:

A) $40,100

B) $28,000

C) $12,100

D) $40,800

Correct Answer

verified

Correct Answer

verified

Showing 141 - 144 of 144

Related Exams