A) the total quantity of financial assets that people want to hold.

B) how much income people want to earn per year.

C) how much wealth people want to hold in liquid form.

D) how much currency the Federal Reserve decides to print.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If P = 2 and Y = 1000, then which of the following pairs of values are possible?

A) M = 500, V = 4

B) M = 1500, V = 3

C) M = 2000, V = 2

D) M = 500, V = 1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The idea that nominal variables are heavily influenced by the quantity of money and that money is largely irrelevant for understanding the determinants of real variables is called the

A) velocity concept.

B) Fisher effect.

C) classical dichotomy.

D) Mankiw effect.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wealth is redistributed from creditors to debtors when inflation was expected to be

A) high and it turns out to be high.

B) low and it turns out to be low.

C) low and it turns out to be high.

D) high and it turns out to be low.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs of inflation can be significant even if actual inflation and expected inflation are the same?

A) menu costs

B) inflation tax

C) shoeleather costs

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The country of Lessidinia has a tax system identical to that of the United States. Suppose someone in Lessidinia bought a parcel of land for 20,000 foci (the local currency) in 1960 when the price index equaled 100. In 2002, the person sold the land for 100,000 foci, and the price index equaled 600. The tax rate on nominal gains was 20 percent. Compute the taxes on the nominal gain and the change in the real value of the land in terms of 2002 prices to find the after-tax real rate of capital gain.

A) -60 percent

B) -30 percent

C) 30 percent

D) 60 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relative-price variability

A) rises with inflation, leading to an improved allocation of resources.

B) rises with inflation, leading to a misallocation of resources.

C) falls with inflation, leading to an improved allocation of resources.

D) falls with inflation, leading to a misallocation of resources.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, as the price level increases the quantity of money

A) demanded increases.

B) demanded decreases.

C) supplied increases.

D) supplied decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

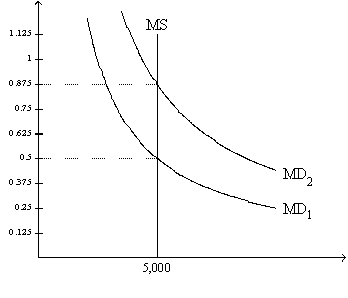

Figure 12-2. On the graph, MS represents the money supply and MD represents money demand. The usual quantities are measured along the axes.

-Refer to Figure 12-2. If the relevant money-demand curve is the one labeled MD1, then

-Refer to Figure 12-2. If the relevant money-demand curve is the one labeled MD1, then

A) when the money market is in equilibrium, one dollar purchases one-half of a basket of goods and services.

B) when the money market is in equilibrium, one unit of goods and services sells for 2 dollars.

C) there is an excess demand for money if the value of money in terms of goods and services is 0.375.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which case below does a person's purchasing power from saving increase the least?

A) the nominal interest rate = 10% and inflation = 8%

B) the nominal interest rate = 9% and inflation = 6%

C) the nominal interest rate = 8% and inflation = 4%

D) the nominal interest rate = 7% and inflation = 2%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Governments may prefer an inflation tax to some other type of tax because the inflation tax

A) is easier to impose.

B) reduces inflation.

C) falls mainly on high-income individuals.

D) reduces the real cost of government expenditure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the last tax year you lent money at a nominal rate of 6 percent. Actual inflation was 1 percent, but people had been expecting 1.5 percent . This difference between actual and expected inflation

A) transferred wealth from the borrower to you and caused your after-tax real interest rate to be 0.5 percentage points higher than what you had expected.

B) transferred wealth from the borrower to you and caused your after-tax real interest rate to be more than 0.5 percentage points higher than what you had expected.

C) transferred wealth from you to the borrower and caused your after-tax real interest rate to be 0.5 percentage points lower than what you had expected.

D) transferred wealth from you to the borrower and caused your after-tax real interest rate to be more than 0.5 percentage points lower than what you had expected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, if the price level is above the equilibrium level, there is an

A) excess demand for money, so the price level will rise.

B) excess demand for money, so the price level will fall.

C) excess supply of money, so the price level will rise.

D) excess supply of money, so the price level will fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that monetary neutrality and the Fisher effect both hold and the money supply growth rate has been the same for a long time. Other things the same a higher money supply growth would be associated with

A) both higher inflation and higher nominal interest rates.

B) a higher inflation rate, but not higher nominal interest rates.

C) a higher nominal interest rate, but not higher inflation.

D) neither a higher inflation rate nor a higher nominal interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the assumptions of the quantity theory of money, if the money supply increases by 5 percent, then

A) nominal and real GDP would rise by 5 percent.

B) nominal GDP would rise by 5 percent; real GDP would be unchanged.

C) nominal GDP would be unchanged; real GDP would rise by 5 percent.

D) neither nominal GDP nor real GDP would change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the money market is drawn with the value of money on the vertical axis, as the price level decreases the quantity of money

A) demanded increases.

B) demanded decreases.

C) supplied increases.

D) supplied decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If P = 4 and Y = 450, then which of the following pairs of values are possible?

A) M = 800, V = 4

B) M = 600, V =3

C) M = 400, V =2

D) M = 200, V =1

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Katarina puts money into an account. One year later she sees that she has 6 percent more dollars and that her money will buy 2 percent more goods.

A) The nominal interest rate was 8 percent and the inflation rate was 6 percent.

B) The nominal interest rate was 6 percent and the inflation rate was 4 percent.

C) The nominal interest rate was 4 percent and the inflation rate was 2 percent.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If when the money supply changes, real output and velocity do not change, then a 2 percent increase in the money supply

A) decreases the price level by 2 percent.

B) decreases the price level by less than 2 percent.

C) increases the price level by less than 2 percent.

D) increases the price level by 2 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inflation tax

A) transfers wealth from the government to households.

B) is the increase in real income taxes due to lack of indexation in income tax rules.

C) is a tax on everyone who holds money.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 384

Related Exams