A) $82,000

B) $340,000

C) $389,000

D) $307,000

Correct Answer

verified

Correct Answer

verified

True/False

Manufacturing salaries and wages incurred in the factory are period costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Werner Brothers,Inc. ,used the high-low method to derive its cost formula for electrical power cost.According to the cost formula,the variable cost per unit of activity is $2 per machine-hour.Total electrical power cost at the high level of activity was $9,400 and at the low level of activity was $9,000.If the high level of activity was 2,200 machine hours,then the low level of activity was:

A) 1,800 machine hours

B) 1,900 machine hours

C) 2,000 machine hours

D) 1,700 machine hours

Correct Answer

verified

Correct Answer

verified

True/False

Thread that is used in the production of mattresses is an indirect material that is therefore classified as manufacturing overhead.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gabat Inc.is a merchandising company.Last month the company's merchandise purchases totaled $67,000.The company's beginning merchandise inventory was $19,000 and its ending merchandise inventory was $22,000.What was the company's cost of goods sold for the month?

A) $108,000

B) $67,000

C) $64,000

D) $70,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

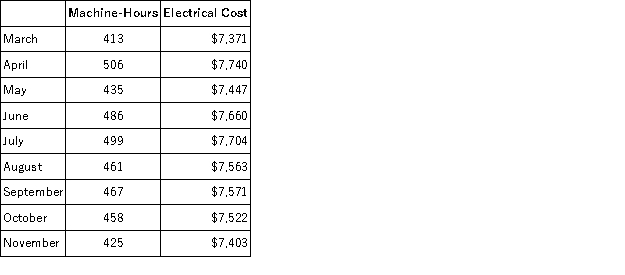

Electrical costs at one of Reifel Corporation's factories are listed below:  Management believes that electrical cost is a mixed cost that depends on machine-hours. Using the high-low method,the estimate of the variable component of electrical cost per machine-hour is closest to:

Management believes that electrical cost is a mixed cost that depends on machine-hours. Using the high-low method,the estimate of the variable component of electrical cost per machine-hour is closest to:

A) $0.12

B) $20.38

C) $7.98

D) $3.97

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

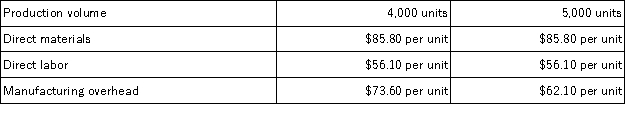

Cardiv Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total cost to manufacture 4,300 units is closest to:

The best estimate of the total cost to manufacture 4,300 units is closest to:

A) $877,200

B) $909,400

C) $901,925

D) $926,650

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following companies would have the highest proportion of variable costs in its cost structure?

A) Public utility.

B) Airline.

C) Fast food outlet.

D) Architectural firm.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

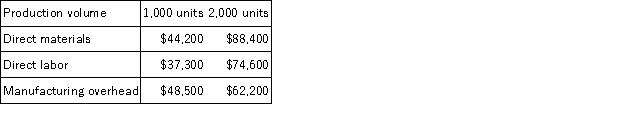

Davis Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:

A) $130,000

B) $177,600

C) $34,800

D) $225,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

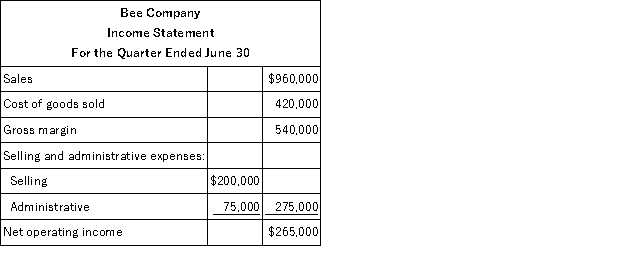

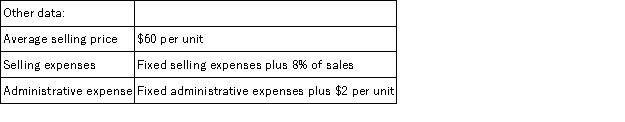

Bee Company is a honey wholesaler.An income statement and other data for the second quarter of the year are given below:

Bee Company's net operating income for the second quarter using the contribution approach is:

Bee Company's net operating income for the second quarter using the contribution approach is:

A) $156,200

B) $685,000

C) $431,200

D) $265,000

Correct Answer

verified

Correct Answer

verified

True/False

The contribution margin is the amount remaining from sales revenues after variable expenses have been deducted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following costs would be found in a company's accounting records except:

A) sunk cost.

B) opportunity cost.

C) indirect costs.

D) direct costs.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

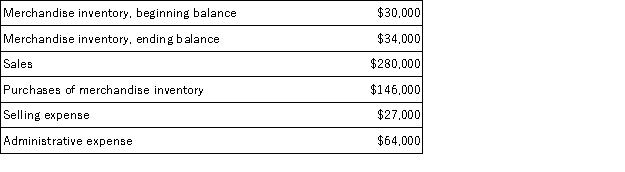

Nieman Inc. ,a local retailer,has provided the following data for the month of March:  The cost of goods sold for March was:

The cost of goods sold for March was:

A) $146,000

B) $150,000

C) $142,000

D) $237,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of direct materials cost is classified as a:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

At an activity level of 8,300 machine-hours in a month,Baudry Corporation's total variable maintenance cost is $220,448 and its total fixed maintenance cost is $556,764. What would be the average fixed maintenance cost per unit at an activity level of 8,600 machine-hours in a month? Assume that this level of activity is within the relevant range.

A) $93.64

B) $67.08

C) $64.74

D) $75.15

Correct Answer

verified

Correct Answer

verified

True/False

The engineering approach to the analysis of mixed costs involves a detailed analysis of what cost behavior should be,based on an industrial engineer's evaluation of the production methods to be used,the materials specifications,labor requirements,equipment usage,production efficiency,power consumption,and so on.

Correct Answer

verified

Correct Answer

verified

True/False

The traditional format income statement provides managers with an income statement that clearly distinguishes between fixed and variable costs and therefore aids planning,control,and decision making.

Correct Answer

verified

Correct Answer

verified

True/False

A cost that differs from one month to another is known as a differential cost.

Correct Answer

verified

Correct Answer

verified

True/False

Commissions paid to salespersons are a variable selling expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manufacturing company prepays its insurance coverage for a three-year period.The premium for the three years is $2,400 and is paid at the beginning of the first year.Seventy percent of the premium applies to manufacturing operations and thirty percent applies to selling and administrative activities.What amounts should be considered product and period costs respectively for the first year of coverage?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 186

Related Exams