A) Equal to $500,000.

B) More than $500,000.

C) Less than $500,000.

D) The answer cannot be determined from the information provided.

Correct Answer

verified

Correct Answer

verified

True/False

Interest expense is calculated as the carrying value times the market rate.

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Bond X and Bond Y are both issued by the same company.Each of the bonds has a face value of $100,000 and each matures in 10 years.Bond X pays 8% interest while Bond Y pays 7% interest.The current market rate of interest is 7%.Which of the following is correct?

A) Both bonds will sell for the same amount.

B) Bond X will sell for more than Bond Y.

C) Bond Y will sell for more than Bond X.

D) Both bonds will sell at a premium.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rate quoted in the bond contract used to calculate the cash payments for interest is called the:

A) Face rate.

B) Yield rate.

C) Market rate.

D) Stated rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When bonds are issued at a premium,what happens to the carrying value and interest expense over the life of the bonds?

A) Carrying value and interest expense increase.

B) Carrying value and interest expense decrease.

C) Carrying value decreases and interest expense increases.

D) Carrying value increases and interest expense decreases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial leverage is best measured by which of the following ratios?

A) The debt to equity ratio.

B) The return on equity ratio.

C) The times interest earned ratio.

D) The return on assets ratio.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The rate quoted on the bond contract used to calculate the cash payments for interest is called the:

A) Face interest rate.

B) Interest expense rate.

C) Market interest rate.

D) Stated interest rate.

Correct Answer

verified

D

Correct Answer

verified

True/False

The stated interest rate does not change over time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Serial bonds are:

A) Bonds backed by collateral.

B) Bonds that mature in installments.

C) Bonds with greater risk.

D) Bonds issued below the face amount.

Correct Answer

verified

Correct Answer

verified

True/False

A gain or loss is recorded on bonds retired at maturity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds can be secured or unsecured.Likewise,bonds can be term or serial bonds.Which is more common?

A) Secured and term.

B) Secured and serial.

C) Unsecured and term.

D) Unsecured and serial.

Correct Answer

verified

Correct Answer

verified

True/False

As a company's level of debt increases,bankruptcy risk increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

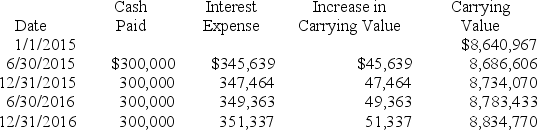

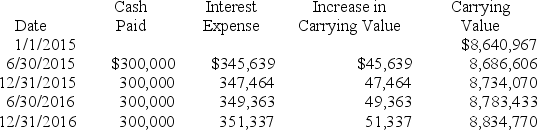

Use the following information to answer the next 4 questions:

Discount-Mart issues $10 million in bonds on January 1,2015.The bonds have a ten-year term and pay interest semiannually on June 30 and December 31 each year.Below is a partial bond amortization schedule for the bonds:

-What is the carrying value of the bonds as of December 31,2016?

-What is the carrying value of the bonds as of December 31,2016?

A) $8,834,770.

B) $8,686,606.

C) $8,734,070.

D) $8,783,433.

Correct Answer

verified

Correct Answer

verified

True/False

The times interest earned ratio compares interest expense with income available to pay interest charges.

Correct Answer

verified

Correct Answer

verified

True/False

The amount reported on the balance sheet for bonds payable is equal to the carrying value at the balance sheet date.

Correct Answer

verified

Correct Answer

verified

True/False

Companies that are believed to have high bankruptcy risk generally receive higher credit ratings and pay a lower interest rate for borrowing.

Correct Answer

verified

Correct Answer

verified

True/False

When bonds are issued at a discount (below face amount),the carrying value and the corresponding interest expense increase over time.

Correct Answer

verified

Correct Answer

verified

True/False

Return on equity is calculated as net income divided by average stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the next 4 questions:

Discount-Mart issues $10 million in bonds on January 1,2015.The bonds have a ten-year term and pay interest semiannually on June 30 and December 31 each year.Below is a partial bond amortization schedule for the bonds:

-What is the stated annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six month rate. )

-What is the stated annual rate of interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six month rate. )

A) 3%.

B) 4%.

C) 6%.

D) 8%.

Correct Answer

verified

Correct Answer

verified

True/False

A private placement is when a company chooses to sell the debt securities directly to a single investor.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 123

Related Exams