Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit entry:

A) Increases asset and expense accounts.

B) Decreases liability and equity accounts.

C) Increases the owner's withdrawals account.

D) Decreases revenue accounts.

E) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the month of November,Cornish Company had cash receipts of $3,500 and paid out $1,000 for expenses.The November 30th cash balance was $4,300.What was the cash balance on November 1?

A) $1,800.

B) $2,800.

C) $4,300.

D) $5,800.

E) $7,300.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A book of original entry is:

A) A book in which amounts are posted from a journal.

B) Another name for the cash account.

C) Another name for the general journal.

D) Also called a ledger.

E) Sometimes called a book of final entry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The right side of a T-account is a(n) :

A) Debit.

B) Increase.

C) Credit.

D) Decrease.

E) Account balance.

Correct Answer

verified

Correct Answer

verified

True/False

Credits to accounts are always increases.

Correct Answer

verified

Correct Answer

verified

Short Answer

Increases in assets are _______________ to asset accounts,and increases in liabilities are _______________ to liability accounts.

Correct Answer

verified

Correct Answer

verified

True/False

A trial balance that is in balance is proof that no errors were made in journalizing the transactions,posting to the ledger,and preparing the trial balance.

Correct Answer

verified

Correct Answer

verified

Essay

The Shreddy Company receives a $3,200 bill from a supplier for delivery services rendered.Set up two or more T-accounts below and show how this transaction would be recorded directly in those accounts.

Correct Answer

verified

Correct Answer

verified

Essay

On June 20,2015,Lucie Majeau invested the following assets in a new sole proprietorship: cash,$12,000; office equipment,$6,000; land,$100,000; building,$115,000.Majeau owes the bank a $25,000 note payable that is secured by the land and building.Prepare the general journal entry to record Majeau's investments in the new business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following accounts,the one that normally has a credit balance is:

A) Cash.

B) Office Equipment.

C) Sales Salaries Payable.

D) Ted Neal,Withdrawals.

E) Sales Salaries Expense.

Correct Answer

verified

Correct Answer

verified

Essay

A business paid $2,500 to satisfy a previously recorded account payable.Set up two or more T-accounts below and show how this transaction would be recorded directly in those accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

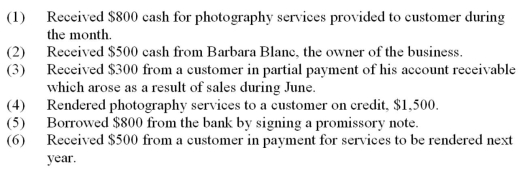

The following transactions occurred during July for Hurley Services:  How much revenue was earned in July?

How much revenue was earned in July?

A) $1,200.

B) $2,300.

C) $2,800.

D) $5,500.

E) $7,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most flexible type of journal that can be used to record any kind of transaction is called a:

A) Ledger.

B) Trial balance.

C) Chart of accounts.

D) General Journal.

E) Balance column account.

Correct Answer

verified

Correct Answer

verified

True/False

Since all figures are eventually posted to the ledger,the posting reference column in a journal is not necessary.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A credit is used to record:

A) A decrease in an expense account.

B) A decrease in an asset account.

C) An increase in an unearned revenue account.

D) An increase in a revenue account.

E) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following accounts,the one that normally has a debit balance is:

A) Accounts Payable.

B) Accounts Receivable.

C) Ted Neal,Capital.

D) Sales Revenue.

E) Unearned Revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of copying journal information to the ledger is called:

A) Double-entering.

B) Posting.

C) An internal business transaction.

D) Journalizing.

E) An external business transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A simple account form widely used in accounting education to illustrate how debits and credits work is called a:

A) Withdrawals account.

B) Capital account.

C) Ledger.

D) T-account.

E) Balance column account.

Correct Answer

verified

Correct Answer

verified

True/False

Asset accounts normally have credit balances and expense accounts normally have debit balances.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 131

Related Exams