A) A decrease in wealth

B) A decrease in real interest rates

C) Consumer expectations of rising prices of products

D) Increased optimism about future incomes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two basic determinants of investment spending are:

A) Consumer spending and government spending

B) Expected returns and real interest rates

C) General price level and the level of output

D) Domestic trade and international trade

Correct Answer

verified

Correct Answer

verified

Multiple Choice

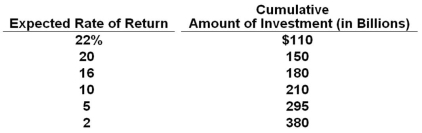

According to the cumulative investment table above, if the real interest rate falls from 20% to 16%, then:

According to the cumulative investment table above, if the real interest rate falls from 20% to 16%, then:

A) $180 billion of additional investments will be undertaken

B) $330 billion of total investments will be undertaken

C) $30 billion of additional investments will be undertaken

D) $440 billion of total investments will be undertaken

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lower real interest rate typically induces consumers to:

A) Save more

B) Buy fewer imported goods

C) Purchase more goods that are bought using credit

D) Purchase fewer goods that are bought without using credit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Matt's disposable income increases from $4,000 to $4,500 and his level of saving increases from $200 to $325, it may be concluded that his marginal propensity to:

A) Consume is .80

B) Consume is .75

C) Consume is .60

D) Save is .30

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally speaking, the greater the MPS, the:

A) Smaller would be the increase in income which results from an increase in consumption spending

B) Larger would be the increase in income which results from an increase in consumption spending

C) Larger would be the increase in income which results from a decrease in consumption spending

D) Smaller would be the increase in income which results from a decrease in consumption spending

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One factor that shifts the consumption schedule is household wealth. Households build wealth by:

A) Spending their current incomes

B) Spending out of their future incomes

C) Spending their incomes as they earn them

D) Not spending all their current incomes

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Paradox of Thrift highlights the idea that:

A) Saving more is good for the economy in the short run

B) Saving more can be bad for the economy during a recession

C) In spending more, households will end up saving less

D) In spending more, workers may end up losing their jobs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

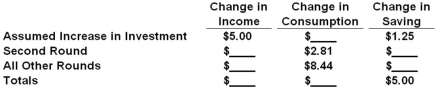

Answer the following question based on the table below which illustrates the multiplier process resulting from an autonomous increase in investment by $5.  Refer to the above table. The multiplier in this economy is:

Refer to the above table. The multiplier in this economy is:

A) 2

B) 3

C) 4

D) 5

Correct Answer

verified

Correct Answer

verified

Multiple Choice

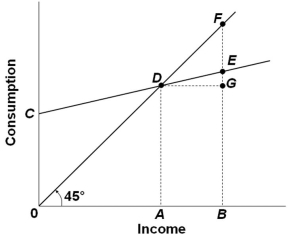

Refer to the consumption schedule above. The average propensity to save at income level B is represented by:

Refer to the consumption schedule above. The average propensity to save at income level B is represented by:

A) 0C/0B

B) EF/BE

C) EF/BF

D) DE/AB

Correct Answer

verified

Correct Answer

verified

True/False

The marginal propensity to consume shows the fraction of any level of total income that is consumed.

Correct Answer

verified

Correct Answer

verified

True/False

There are only two things that people could do with their disposable income - spend it or save it.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As disposable income decreases, the:

A) Average propensity to consume increases

B) Average propensity to consume decreases

C) Level of consumption increases

D) Level of saving increases

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An $18 billion increase in spending creates $18 billion of new income in the first round of the multiplier process and $13.5 billion in the second round. The multiplier in the economy is:

A) 2

B) 3

C) 4

D) 5

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The MPC can be defined as the:

A) Change in consumption divided by the change in income

B) Change in income divided by the change in consumption

C) Ratio of income to saving

D) Ratio of saving to consumption

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fraction, or percentage, of total income which is saved is called the:

A) Average propensity to save

B) Marginal propensity to save

C) Disposable income schedule

D) Saving schedule

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In an economy, for every $1600 decrease in income, spending falls by $1200. It can be concluded that the:

A) Slope of the saving schedule is 1.33

B) Slope of the saving schedule is 0.75

C) Marginal propensity to consume is 1.33

D) Marginal propensity to save is .25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that new computer software for accounting and analysis at a business has a useful life of only one year and costs $200,000 before it needs to be upgraded to a new version. The revenue generated by this software is expected to be $250,000. The expected rate of return from this new computer software is:

A) 11 percent

B) 20 percent

C) 25 percent

D) 80 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

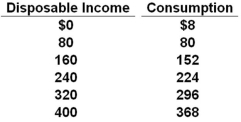

The disposable income (DI) and consumption (C) schedules are for a private, closed economy. All figures are in billions of dollars.  Refer to the data above. At the $320 billion level of disposable income, the average propensity to save is:

Refer to the data above. At the $320 billion level of disposable income, the average propensity to save is:

A) .015

B) .075

C) .335

D) .925

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When consumers decide to increase household debt, this action will:

A) Shift the consumption schedule upward

B) Shift the consumption schedule downward

C) Increase the amount consumed along a stable consumption schedule

D) Decrease the amount consumed along a stable consumption schedule

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 142

Related Exams