A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

May Corporation, a merchandising firm, has budgeted sales as follows for the third quarter of the year:  Cost of goods sold is equal to 65% of sales. The company wants to maintain a monthly ending inventory equal to 130% of the Cost of Goods Sold for the following month. The inventory on June 30 is less than this ideal since it is only $65,000. The company is now preparing a Merchandise Purchases Budget. The desired beginning inventory for September is:

Cost of goods sold is equal to 65% of sales. The company wants to maintain a monthly ending inventory equal to 130% of the Cost of Goods Sold for the following month. The inventory on June 30 is less than this ideal since it is only $65,000. The company is now preparing a Merchandise Purchases Budget. The desired beginning inventory for September is:

A) $117,000

B) $76,050

C) $91,000

D) $59,150

Correct Answer

verified

Correct Answer

verified

True/False

The direct materials budget is typically prepared before the production budget.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

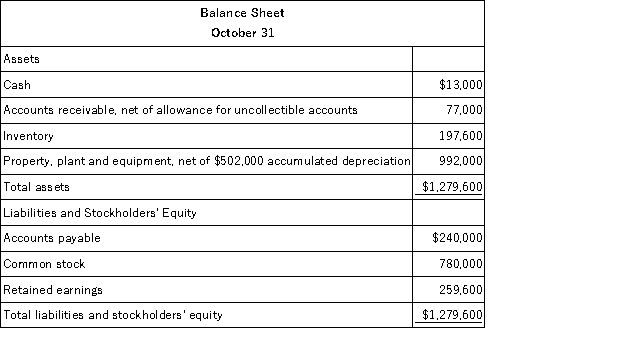

Carter Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow: o Sales are budgeted at $380,000 for November, $390,000 for December, and $400,000 for January.

O Collections are expected to be 70% in the month of sale, 27% in the month following the sale, and 3% uncollectible.

O The cost of goods sold is 65% of sales.

O The company desires to have an ending merchandise inventory equal to 80% of the following month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

O Other monthly expenses to be paid in cash are $22,000.

O Monthly depreciation is $20,000.

O Ignore taxes.  Retained earnings at the end of December would be:

Retained earnings at the end of December would be:

A) $259,600

B) $342,400

C) $422,000

D) $445,100

Correct Answer

verified

Correct Answer

verified

True/False

In companies that do not have "no lay-off" policies, the total direct labor cost for a budget period is computed by multiplying the total direct labor hours needed to make the budgeted output of completed units by the direct labor wage rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The LFG Corporation makes and sells a single product, Product T. Each unit of Product T requires 1.4 direct labor-hours at a rate of $9.80 per direct labor-hour. The direct labor workforce is fully adjusted each month to the required workload. LFG Corporation needs to prepare a Direct Labor Budget for the second quarter of next year. The budgeted direct labor cost per unit of Product T is closest to:

A) $9.80

B) $11.83

C) $7.00

D) $13.72

Correct Answer

verified

Correct Answer

verified

Multiple Choice

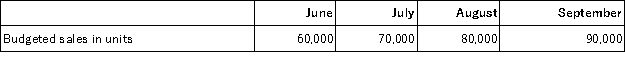

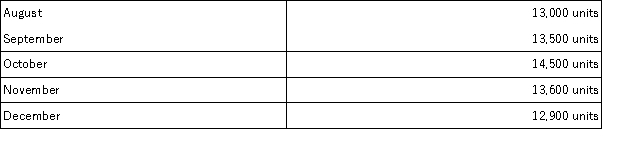

Mutskic Corporation produces and sells Product BetaC. To guard against stockouts, the company requires that 30% of the next month's sales be on hand at the end of each month. Budgeted sales of Product BetaC over the next four months are:  Budgeted production for August would be:

Budgeted production for August would be:

A) 83,000 units

B) 107,000 units

C) 77,000 units

D) 80,000 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

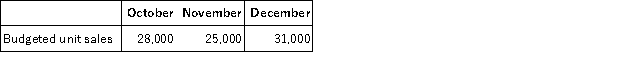

Fab Manufacturing Corporation manufactures and sells stainless steel coffee mugs. Expected mug sales at Fab (in units) for the next three months are as follows:  Fab likes to maintain a finished goods inventory equal to 30% of the next month's estimated sales. How many mugs should Fab plan on producing during the month of November?

Fab likes to maintain a finished goods inventory equal to 30% of the next month's estimated sales. How many mugs should Fab plan on producing during the month of November?

A) 23,200 mugs

B) 26,800 mugs

C) 25,900 mugs

D) 34,300 mugs

Correct Answer

verified

Correct Answer

verified

Multiple Choice

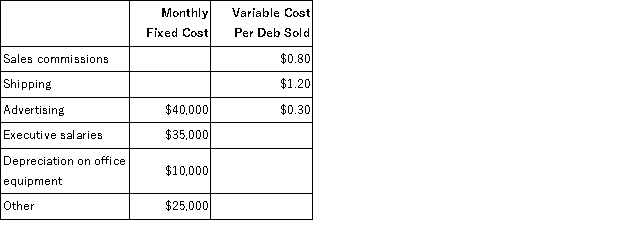

The Prattle Corporation makes and sells only one product called a Deb. The company is in the process of preparing its Selling and Administrative Expense Budget for next year. The following budget data are available:  All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the company has budgeted to sell 16,000 Debs in February, then the total budgeted fixed selling and administrative expenses for February is:

All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the company has budgeted to sell 16,000 Debs in February, then the total budgeted fixed selling and administrative expenses for February is:

A) $75,000

B) $70,000

C) $110,000

D) $100,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All the following are considered to be benefits of participative budgeting, except for:

A) Individuals at all organizational levels are recognized as being part of a team; this results in greater support for the organization.

B) The budget estimates are prepared by those in directly involved in activities.

C) When managers set their own targets for the budget, top management need not be concerned with the overall profitability of operations.

D) Managers are held responsible for reaching their goals and cannot easily shift responsibility by blaming unrealistic goals set by others.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Noel Enterprises has budgeted sales in units for the next five months as follows:  Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year. The desired ending inventory for August is:

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year. The desired ending inventory for August is:

A) 720 units

B) 460 units

C) 540 units

D) 380 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paradise Corporation budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels (in units) are planned for next year.  *Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be:

*Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be:

A) 440,000 units

B) 480,000 units

C) 510,000 units

D) 450,000 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Gerald Corporation makes and sells a single product called a Clop. Each Clop requires 1.1 direct labor-hours at $8.20 per direct labor-hour. The direct labor workforce is fully adjusted each month to the required workload. The company is preparing a Direct Labor Budget for the first quarter of the year. The budgeted direct labor cost per Clop is closest to:

A) $7.45

B) $8.20

C) $9.02

D) $9.76

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cowles Corporation Inc., makes and sells a single product, Product R. Three yards of Material K are needed to make one unit of Product R. Budgeted production of Product R for the next five months is as follows:  The company wants to maintain monthly ending inventories of Material K equal to 30% of the following month's production needs. On July 31, this requirement was not met because only 3,500 yards of Material K were on hand. The cost of Material K is $0.80 per yard. The company wants to prepare a Direct Materials Purchase Budget for the rest of the year. The desired ending inventory of Material K for September is:

The company wants to maintain monthly ending inventories of Material K equal to 30% of the following month's production needs. On July 31, this requirement was not met because only 3,500 yards of Material K were on hand. The cost of Material K is $0.80 per yard. The company wants to prepare a Direct Materials Purchase Budget for the rest of the year. The desired ending inventory of Material K for September is:

A) 12,750 yards

B) 12,500 yards

C) 13,050 yards

D) 12,150 yards

Correct Answer

verified

Correct Answer

verified

True/False

In business, a budget is a method for putting a limit on spending.

Correct Answer

verified

Correct Answer

verified

Essay

Freet Inc. is preparing its cash budget for November. The budgeted beginning cash balance is $11,000. Budgeted cash receipts total $126,000 and budgeted cash disbursements total $130,000. The desired ending cash balance is $20,000. The company can borrow up to $170,000 at any time from a local bank, with interest not due until the following month. Required: Prepare the company's cash budget for November in good form. Make sure to indicate what borrowing, if any, would be needed to attain the desired ending cash balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Davey Corporation is preparing its Manufacturing Overhead Budget for the fourth quarter of the year. The budgeted variable manufacturing overhead rate is $3.00 per direct labor-hour; the budgeted fixed manufacturing overhead is $66,000 per month, of which $10,000 is factory depreciation. If the budgeted direct labor time for October is 6,000 hours, then the total budgeted manufacturing overhead for October is:

A) $28,000

B) $56,000

C) $74,000

D) $84,000

Correct Answer

verified

Correct Answer

verified

Essay

The following information is budgeted for McCracken Plumbing Supply Corporation for next quarter:  All sales at McCracken are on credit. Forty percent are collected in the month of sale, 58% in the month following the sale, and the remaining 2% are uncollectible. Merchandise purchases are paid in full the month following the month of purchase. The selling and administrative expenses above include $8,000 of depreciation on display fixtures and warehouse equipment. All other selling and administrative expenses are paid as incurred. McCracken wants to maintain a cash balance of $15,000. Any amount below this can be borrowed from a local bank as needed in increments of $1,000. All borrowings are made at month end.

Required:

Prepare McCracken's cash budget for May. McCracken expects to have $24,000 of cash on hand at the beginning of May.

All sales at McCracken are on credit. Forty percent are collected in the month of sale, 58% in the month following the sale, and the remaining 2% are uncollectible. Merchandise purchases are paid in full the month following the month of purchase. The selling and administrative expenses above include $8,000 of depreciation on display fixtures and warehouse equipment. All other selling and administrative expenses are paid as incurred. McCracken wants to maintain a cash balance of $15,000. Any amount below this can be borrowed from a local bank as needed in increments of $1,000. All borrowings are made at month end.

Required:

Prepare McCracken's cash budget for May. McCracken expects to have $24,000 of cash on hand at the beginning of May.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

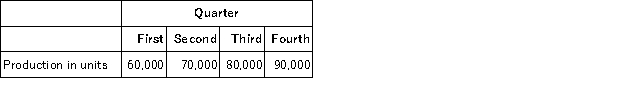

Prester Corporation has budgeted production for next year as follows:  Two pounds of material A are required for each unit produced. The company has a policy of maintaining a stock of material A on hand at the end of each quarter equal to 25% of the next quarter's production needs for materialA. A total of 30,000 pounds of material A are on hand to start the year. Budgeted purchases of material A for the second quarter would be:

Two pounds of material A are required for each unit produced. The company has a policy of maintaining a stock of material A on hand at the end of each quarter equal to 25% of the next quarter's production needs for materialA. A total of 30,000 pounds of material A are on hand to start the year. Budgeted purchases of material A for the second quarter would be:

A) 145,000 pounds

B) 140,000 pounds

C) 135,000 pounds

Correct Answer

verified

Correct Answer

verified

Multiple Choice

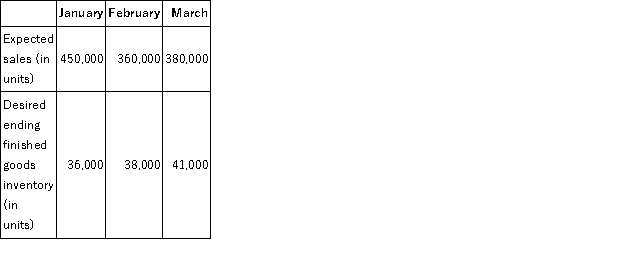

The following information relates to Marter Manufacturing Corporation for next quarter:  How many units should the company plan on producing for the month of February?

How many units should the company plan on producing for the month of February?

A) 360,000 units

B) 362,000 units

C) 358,000 units

D) 398,000 units

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 173

Related Exams