A) Reported as a current liability on the balance sheet.

B) Reported as a long-term liability on the balance sheet.

C) Combined with the rest of the long-term debt on the balance sheet.

D) Paid immediately.

Correct Answer

verified

Correct Answer

verified

True/False

The journal entry to record a contingent liability requires a debit to a loss (or expense) account and a credit to a liability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Strikers, Inc. sells soccer goals to customers over the Internet. History has shown that 2% of Strikers' goals are faulty and will need repair under the warranty program. For the year, Strikers has sold 4,000 goals and 45 have been repaired. If the estimated cost to repair a goal is $200, what would be the Warranty Liability at the end of the year?

A) $0.

B) $16,000.

C) $7,000.

D) $6,750.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amplify, Inc. was sued by Sound City for $50,000. Sound City feels very confident that it will win the case and will be awarded the full amount. Amplify, Inc. feels it is probable that it will lose the case and pay Sound City the full amount. Which of the following is correct?

A) Amplify, Inc. would record a loss and contingent liability for $50,000.

B) Sound City would record a gain and lawsuit receivable for $50,000.

C) Sound City would record nothing.

D) Both a. and c. are correct.

Correct Answer

verified

Correct Answer

verified

True/False

Differences between financial accounting and tax accounting result in a company being permitted to defer paying some of its income tax expense, in which case it will report a deferred tax liability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gain contingencies usually are recognized in a company's income statement when:

A) The gain is certain.

B) The amount can be reasonably estimated.

C) The gain is reasonably possible and the amount can be reasonable estimated.

D) The gain is probable and the amount can be reasonably estimated.

Correct Answer

verified

Correct Answer

verified

Essay

During January, Deluxe Printing pays employee salaries of $1 million. Withholdings in January are $76,500 for the employee portion of FICA, $210,000 for federal and state income tax, and $40,000 for the employee portion of health insurance (payable to Blue Cross/Blue Shield). The company incurs an additional $38,000 for federal and state unemployment tax and $30,000 for the employer portion of health insurance. 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reeves Co. filed suit against Higgins, Inc., seeking damages for copyright violations. Higgins' legal counsel believes it is probable that Higgins will settle the lawsuit for an estimated amount in the range of $100,000 to $200,000, with all amounts in the range considered equally likely. How should Higgins report this litigation?

A) As a liability for $100,000 with disclosure of the range.

B) As a liability for $150,000 with disclosure of the range.

C) As a liability for $200,000 with disclosure of the range.

D) As a disclosure only. No liability is reporteD.When no amount within a range of potential losses appears more likely than others, the liability is recorded at the minimum amount in the range.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Pita Pit borrowed $100,000 on November 1, 2012, and signed a six-month note bearing interest at 12%. Principal and interest are payable in full at maturity on May 1, 2013. In connection with this note, The Pita Pit should report interest expense at December 31, 2012, in the amount of:

A) $0.

B) $1,000.

C) $2,000.

D) $6,000.

Correct Answer

verified

Correct Answer

verified

True/False

Commonly, current liabilities are payable within one year, and long-term liabilities are payable more than one year from now.

Correct Answer

verified

Correct Answer

verified

True/False

Quick assets include only cash, short-term investments, and accounts receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's liquidity refers to its:

A) Ability to collect accounts receivable.

B) Ability to sell inventory efficiently.

C) Ability to generate profits from operations.

D) Ability to pay currently maturing debts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given a choice, most companies would prefer to report a liability as long-term rather than current because:

A) It may cause the firm to appear less risky to investors and creditors.

B) It may reduce interest rates on borrowing.

C) It may cause the company to appear more stable commanding a higher stock price for new stock listings.

D) All of the other answers are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding liquidity ratios is false?

A) A high current ratio generally indicates the ability to pay current liabilities on a timely basis.

B) A high acid-test ratio generally indicates the ability to pay current liabilities on a timely basis.

C) All current assets are due within one year and therefore have essentially equal liquidity.

D) As a rule of thumb, a current ratio of 1 or higher often reflects an acceptable level of liquidity.

Correct Answer

verified

Correct Answer

verified

True/False

A gain contingency is an existing uncertain situation that might result in a gain, which often is the flip side of loss contingencies.

Correct Answer

verified

Correct Answer

verified

True/False

In a classified balance sheet, we categorize all liabilities as current.

Correct Answer

verified

Correct Answer

verified

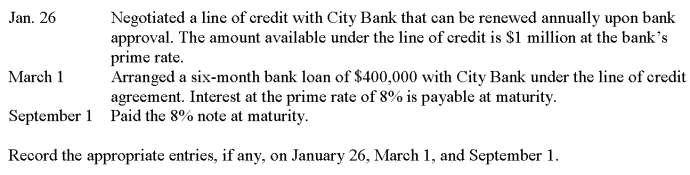

Essay

The following selected transactions relate to liabilities of Deco Emporium whose fiscal year ends on December 31.

Correct Answer

verified

Correct Answer

verified

True/False

If the likelihood of loss is remote, disclosure usually is not required.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bears Inc. sells football helmets to local schools and warrants all of its products for one year. While no helmets sold in 2012 have been returned to them yet, based upon previous years, Bears Inc. estimates that 3% of its products will need repairs or be replaced within the next year. What effect would this warranty have on assets, liabilities, and stockholders' equity in 2012?

A) A decrease in assets and decrease in stockholders' equity.

B) No journal entry is necessary until products under warranty are returned.

C) An increase in stockholders' equity and a decrease in liabilities.

D) A decrease in stockholders' equity and an increase in liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Working capital is

A) Current assets divided by current liabilities.

B) Current assets minus current liabilities.

C) Cash, short-term investments, and accounts receivable divided by current liabilities.

D) Cash, short-term investments, and accounts receivable minus current liabilities.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 142

Related Exams