A) Eliminating all employee fraud.

B) Restricting access to assets.

C) Detecting ineffectiveness.

D) Ensuring authorization of transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After documenting the client's prescribed internal control, the auditors will often perform a walk-through of each transaction cycle. An objective of a walk-through is to:

A) Verify that the controls have been implemented (placed in operation) .

B) Replace tests of controls.

C) Evaluate the major strengths and weaknesses in the client's internal control.

D) Identify weaknesses to be communicated to management in the management letter.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A situation in which the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent or detect material misstatements on a timely basis is referred to as a:

A) Control deficiency.

B) Material weakness.

C) Reportable condition.

D) Significant deficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not considered one of the five major components of internal control?

A) Risk assessment.

B) Segregation of duties.

C) Control activities.

D) Monitoring.

Correct Answer

verified

Correct Answer

verified

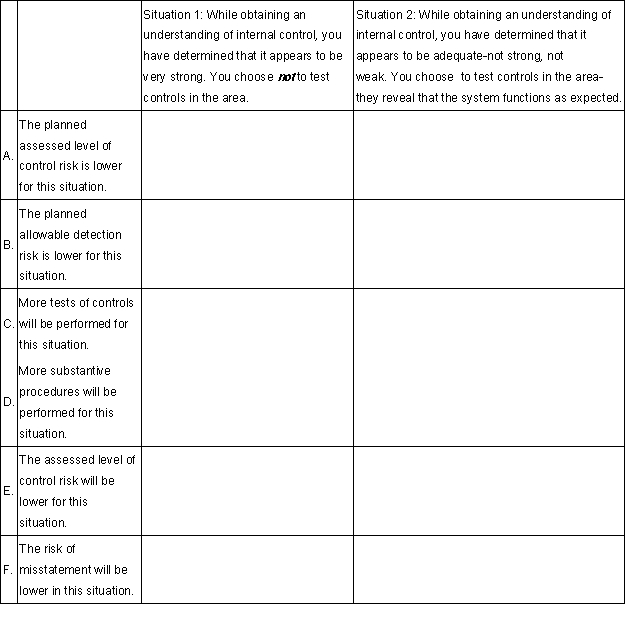

Essay

For A through F place an X in the box (for Situation 1 or Situation 2) which is most accurate for each statement below; if for any question you believe that the situations are the same relating to that question place an X in each of the two boxes.

In both situations assume inherent risk is at a high level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the auditors do not perform tests of controls for certain assertions:

A) They have performed a substandard audit.

B) They are not required to communicate significant deficiencies relating to those accounts to management and the board of directors.

C) They must issue a qualified opinion.

D) They must assess control risk at the maximum level for those assertions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is correct concerning the definition of internal control developed by the Committee of Sponsoring Organizations (COSO) ?

A) Its applicability is largely limited to internal auditing applications.

B) It is a 'process' effected by individuals.

C) It emphasizes the effectiveness and efficiency of operations over the reliability of financial reporting.

D) It suggests that it is important to view internal control as an end product as contrasted to a process or means to obtain an end.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To provide for the greatest degree of independence in performing internal auditing functions, an internal auditor most likely should report to the:

A) Financial vice-president.

B) Corporate controller.

C) Audit committee.

D) Corporate stockholders.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The program flowcharting symbol representing a decision is a:

A) Triangle.

B) Circle.

C) Rectangle.

D) Diamond.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

This organization developed a set of criteria that provide management with a basis to evaluate controls not only over financial reporting, but also over the effectiveness and efficiency of operations and compliance with laws and regulations:

A) Foreign Corrupt Practices Corporation.

B) Committee of Sponsoring Organizations.

C) Cohen Commission.

D) Financial Accounting Standards Board.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following comes closest to outlining the auditors' responsibility for considering internal control in all financial statement audits?

A) An understanding of the control environment, information and communication, risk assessment and monitoring is necessary; an understanding of control activities is only necessary for areas in which the auditor is performing tests of controls.

B) The auditor must obtain an understanding of each of the five internal control components sufficient to assess the risks of material misstatement for the audit.

C) When tests of controls have been performed, control risk must be assessed at a level less than the maximum.

D) An understanding of the control environment is necessary, but no understanding of the other components is necessary unless control risk is to be assessed at a level less than the maximum.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An integrated audit performed under Section 404b of the Sarbanes-Oxley Act addresses financial statements and:

A) Compliance with laws.

B) Internal control over asset safeguarding.

C) Internal control over financial reporting.

D) Suitable criteria.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An auditor's purpose for performing tests of controls is to provide reasonable assurance that:

A) Controls are operating effectively.

B) The risk that the auditor may unknowingly fail to modify the opinion on the financial statements is minimized.

C) Transactions are executed in accordance with management's authorization and access to assets is limited by a segregation of functions.

D) Transactions are recorded as necessary to permit the preparation of the financial statements in conformity with generally accepted accounting principles.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of fidelity bonds protects a company from embezzlement loses and also:

A) Minimizes the possibility of employing persons with dubious records in positions of trust.

B) Reduces the company's need to obtain expensive business interruption insurance.

C) Allows the company to substitute the fidelity bonds for various parts of internal control.

D) Protects employees who made unintentional errors from possible monetary damages resulting from such errors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the external auditors decide that the work performed by the internal auditors may be used, they should consider the internal auditors':

A) Competence, objectivity, and approach.

B) Efficiency and experience.

C) Independence and review skills.

D) Training and supervisory skills.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major components of internal control include all of the following, except:

A) Risk assessment.

B) The control environment.

C) Internal auditing.

D) Control activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A report on internal control performed in accordance with PCAOB Standard No. 5 includes an opinion on internal control for:

A) The entire year.

B) The prior quarter.

C) The "as-of date."

D) The end of each quarter.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be least likely to be regarded as a test of a control?

A) Tests of the additions to property by physical inspection.

B) Comparisons of the signatures on cancelled checks to the authorized check signer list.

C) Tests of signatures on purchase orders.

D) Recalculation of payroll deductions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is least likely to be considered an appropriate response relating to risks the auditors identify at the financial statement level?

A) Assign more experienced staff.

B) Incorporate additional elements of unpredictability in the selection of audit procedures.

C) Increase the scope of auditor procedures.

D) Emphasize the need to remain neutral, rather than to exercise professional skepticism.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would least likely be included in an auditor's tests of controls?

A) Inspection.

B) Observation.

C) Inquiry.

D) Analytical procedures.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 92

Related Exams