A) standards allow greater flexibility.

B) standards require less information.

C) standards never require the efficient level of output.

D) taxes encourage reducing pollution at the lowest possible cost.

Correct Answer

verified

Correct Answer

verified

True/False

Economists and environmentalists agree that pollution is undesirable and that government policy should aim to achieve a zero-pollution society.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which statement is CORRECT?

A) An emissions tax is a more efficient way to reduce pollution than is an environmental standard because an emissions tax equalizes the marginal benefit of pollution from all sources.

B) An environmental standard is a more efficient way to reduce pollution than is an emissions tax because an environmental standard can be structured to equalize the reduction in pollution from all sources.

C) If an emissions tax and environmental standards lead to the same total reduction in pollution,then they will also lead to the same reduction in pollution by individual polluters.

D) It is easy to set emissions taxes at the "correct" level since the relationship between emissions taxes and the reduction in emissions that they induce has been extensively studied and is well known.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions : -(Table: Coal Mine Pollution) Use Table: Coal Mine Pollution.The table shows the marginal social benefit and cost of various amounts of pollution from a coal mine.Suppose that the marginal cost from the production process itself (to the producer) is 0.At the market-determined quantity of pollution,the marginal social cost of pollution is:

A) $800.

B) $400.

C) $200.

D) $0.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions :

Figure: City with Two Polluters  -An external benefit is a:

-An external benefit is a:

A) negative externality.

B) benefit that accrues to domestic firms as a result of the actions of foreign (external) firms.

C) benefit that accrues to foreign (external) firms as a result of the actions of domestic firms.

D) benefit that individuals or firms confer on others without receiving compensation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which example illustrates an environmental policy based on tradable emission permits?

A) a charge to companies of $1 for every 100 units of pollutants emitted

B) paying companies $1 for each 10% reduction in emissions

C) allowing companies to buy and sell the right to a certain level of emissions

D) ignoring pollution and letting private markets operate without government interference

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Use the following to answer questions : -(Table: Externalities from Parks) Use: Table: Externalities from Parks.The table shows the marginal social benefit and the marginal social cost of preserving various amounts of land in a city for a public park.Suppose that parks result in positive benefits to the community as a whole but that the marginal private benefit that any one individual in the community gets from parks is close to 0.If 5 hectares are dedicated to the park,this outcome is _____ because _____.

A) efficient;MSB = MSC

B) efficient;MSB > MSC

C) inefficient;MSB > MSC

D) inefficient;MSB < MSC

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When individuals take external costs and benefits into account:

A) there are no external costs.

B) they internalize the externality.

C) the government should intervene in the market.

D) the market will not reach an efficient solution.

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Network externalities are often:

A) separate from positive feedback.

B) a reason for natural monopolies.

C) less likely to occur in the communications or technology industries than they are in other industries.

D) not likely to move toward market domination.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

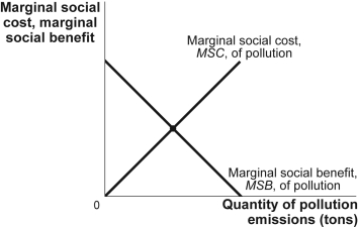

The socially optimal amount of pollution occurs where the marginal social benefit of pollution is _____ the marginal social cost of pollution.

A) equal to

B) greater than

C) less than

D) There is no socially optimal amount of pollution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions : -(Table: Externalities from Parks) Use: Table: Externalities from Parks.The table shows the marginal social benefit and the marginal social cost of preserving various amounts of land in a city for a public park.Suppose that parks result in positive benefits to the community as a whole but that the marginal private benefit that any one individual in the community gets from parks is close to 0.If the government wants to achieve the optimum amount of land for the park,it could use a Pigouvian _____ of _____ per park hectare.

A) tax;$300

B) tax;$150

C) subsidy;$150

D) subsidy;$450

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Coase theorem,the private market can achieve an efficient outcome:

A) as long as the enforcement of property rights costs less than the marginal benefit of emissions.

B) only if the property right to clean air is assigned to the polluter.

C) only if the property right to clean air is assigned to the party harmed by pollution.

D) if bargaining costs are low and property rights are well defined.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that an emissions tax is imposed on all dairy farms in Ontario.This tax would:

A) encourage the dairy farmers to lower prices.

B) increase the level of emissions.

C) reduce the supply of milk in Ontario.

D) increase the supply of milk in Ontario.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

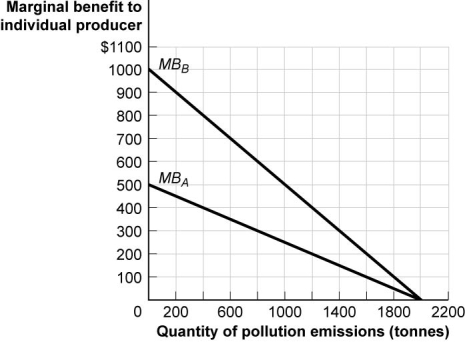

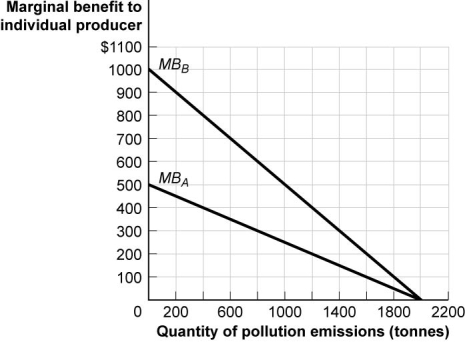

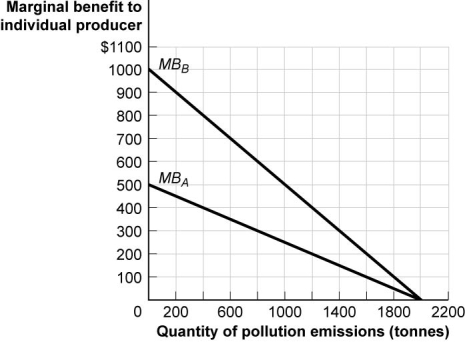

Use the following to answer questions :

Figure: City with Two Polluters  -(Figure: City with Two Polluters) Use Figure: City with Two Polluters.If the government issued licenses to emit a total of 1 600 tonnes of pollution,the market price to emit 1 tonne of pollution would equal:

-(Figure: City with Two Polluters) Use Figure: City with Two Polluters.If the government issued licenses to emit a total of 1 600 tonnes of pollution,the market price to emit 1 tonne of pollution would equal:

A) $100.

B) $200.

C) $300.

D) $400.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions :

Figure: City with Two Polluters  -Suppose that the production of roses generates a positive externality in that travellers enjoy the scenic beauty of the garden.An appropriate government policy yielding the efficient outcome would be a:

-Suppose that the production of roses generates a positive externality in that travellers enjoy the scenic beauty of the garden.An appropriate government policy yielding the efficient outcome would be a:

A) Pigouvian tax.

B) Pigouvian subsidy.

C) system of rose-production permits.

D) reduction in transaction costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Markets for the right to pollute are:

A) established by individual firms when they reduce emissions.

B) established by government when it issues tradable emission permits.

C) likely to result in fewer incentives to develop and implement technology that reduces pollution.

D) a means by which more pollution is encouraged.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions :

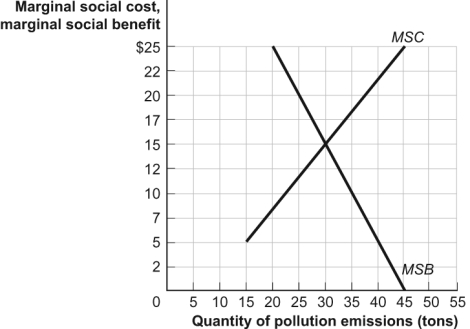

Figure: The Socially Optimal Quantity of Pollution  -(Figure: The Socially Optimal Quantity of Pollution) Use Figure: The Socially Optimal Quantity of Pollution.In the figure,firms are the only beneficiaries of pollution,and costs are borne solely by others in the society.The optimal quantity of pollution could be achieved:

-(Figure: The Socially Optimal Quantity of Pollution) Use Figure: The Socially Optimal Quantity of Pollution.In the figure,firms are the only beneficiaries of pollution,and costs are borne solely by others in the society.The optimal quantity of pollution could be achieved:

A) with a Pigouvian subsidy.

B) through a free market solution.

C) with a Pigouvian tax.

D) by subsidizing consumers of the products produced by the firms.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions :

Figure: Efficiency and Pollution  -(Figure: Efficiency and Pollution) Use Figure: Efficiency and Pollution.Assume that firms are the only beneficiaries of pollution and that costs are borne solely by others in the society.If the government imposed an environmental standard that did not allow the quantity of pollution to exceed 20 tonnes,there would be:

-(Figure: Efficiency and Pollution) Use Figure: Efficiency and Pollution.Assume that firms are the only beneficiaries of pollution and that costs are borne solely by others in the society.If the government imposed an environmental standard that did not allow the quantity of pollution to exceed 20 tonnes,there would be:

A) a socially optimal quantity of pollution.

B) too little pollution because its marginal social benefit would exceed its marginal social cost.

C) too much pollution because its marginal social cost would exceed its marginal social benefit.

D) too much pollution because any pollution is too much from an economist's perspective.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A plastics manufacturing plant dumps pollution into the Big River.This pollution leads to higher costs and disruption for fishermen on the river,for which they are not compensated.In this situation:

A) too few of society's resources are being used to produce plastic.

B) too many of society's resources are being used to produce plastic.

C) the ideal amount of society's resources are being used to produce plastic.

D) there is an external benefit to society from plastic production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the same amount of pollution emitted,an emissions tax is said to be more efficient than is an environmental standard because all polluters:

A) emit pollution up to the point at which the marginal benefit of polluting is equal to the emissions tax.

B) emit the same amount of pollution,regardless of the marginal benefit of polluting.

C) pay the same total tax bill for their pollution.

D) reduce pollution emissions to zero.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 194

Related Exams