Filters

Question type

Correct Answer

verified

Correct Answer

verified

Question 52

True/False

Price floors are typically imposed to benefit sellers.

Correct Answer

verified

Correct Answer

verified

Question 53

True/False

A tax on golf clubs will cause buyers of golf clubs to pay a higher price,sellers of golf clubs to receive a lower price,and fewer golf clubs to be sold.

Correct Answer

verified

Correct Answer

verified

Question 54

True/False

When a free market for a good reaches equilibrium,anyone who is willing and able to pay the market price can buy the good.

Correct Answer

verified

Correct Answer

verified

Question 55

True/False

A tax on buyers usually causes buyers to pay more for the good and sellers to receive less for the good than they did before the tax was levied.

Correct Answer

verified

Correct Answer

verified

Question 56

True/False

A binding minimum wage may not help all workers,but it does not hurt any workers.

Correct Answer

verified

Correct Answer

verified

Question 57

True/False

At the equilibrium price,the quantity that buyers want to buy exactly equals the quantity that sellers want to sell.

Correct Answer

verified

Correct Answer

verified

Question 58

True/False

Since half of the FICA tax is paid by firms and the other half is paid by workers,the burden of the tax must fall equally on firms and workers.

Correct Answer

verified

Correct Answer

verified

Question 59

True/False

Binding price ceilings benefit consumers because they allow consumers to buy all the goods they demand at a lower price.

Correct Answer

verified

Correct Answer

verified

Question 60

True/False

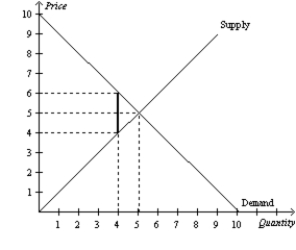

Figure 6-36  -Refer to Figure 6-36.If the government places a $2 tax in the market,the buyer bears $2 of the tax burden.

-Refer to Figure 6-36.If the government places a $2 tax in the market,the buyer bears $2 of the tax burden.

Correct Answer

verified

Correct Answer

verified

Question 61

True/False

Whether a tax is levied on sellers or buyers,buyers and sellers usually share the burden of taxes.

Correct Answer

verified

Correct Answer

verified

Question 62

True/False

If a good or service is sold in a competitive market free of government regulation,then the price of the good or service adjusts to balance supply and demand.

Correct Answer

verified

Correct Answer

verified

Question 63

True/False

The effects of rent control in the long run include lower rents and lower-quality housing.

Correct Answer

verified

Correct Answer

verified

Question 64

True/False

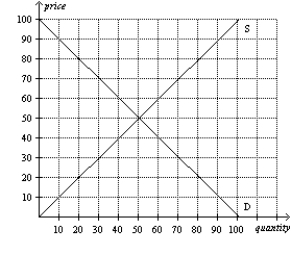

Figure 6-35  -Refer to Figure 6-35.A price floor set at $60 would create a surplus of 20 units.

-Refer to Figure 6-35.A price floor set at $60 would create a surplus of 20 units.

Correct Answer

verified

Correct Answer

verified

Question 65

True/False

The term tax incidence refers to how the burden of a tax is distributed among the various people who make up the economy.

Correct Answer

verified

Correct Answer

verified

Question 66

True/False

When the government imposes a binding price ceiling on a competitive market,a surplus of the good arises,and sellers must ration the scarce goods among the large number of potential buyers.

Correct Answer

verified

Correct Answer

verified

Question 67

True/False

Workers,rather than firms,bear most of the burden of the payroll tax.

Correct Answer

verified

Correct Answer

verified

Question 68

True/False

Long lines and discrimination are examples of rationing methods that may naturally develop in response to a binding price ceiling.

Correct Answer

verified

Correct Answer

verified

Question 69

True/False

A large majority of economists favor eliminating the minimum wage.

Correct Answer

verified

Correct Answer

verified

Question 70

True/False

Most of the burden of a luxury tax falls on the middle class workers who produce luxury goods rather than on the rich who buy them.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 166

Related Exams