A) LIFO.

B) FIFO.

C) Average.

D) Specific identification.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an error in valuing inventory occurs in one year:

A) It has no effect upon income in the following year.

B) It has no effect upon the income statement, only on the balance sheet.

C) It is self-correcting after two years.

D) Retained earnings will be adversely affected until corrected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross profit rate is equal to.

A) Net sales divided by gross profit.

B) Gross sales divided by gross profit.

C) Gross profit divided by net sales.

D) Gross profit divided by gross sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies with periodic inventory systems often use techniques such as the gross profit method and the retail method to:

A) Prepare interim financial statements without taking a complete physical inventory.

B) Increase gross profit.

C) Value inventory at its sales price instead of its cost.

D) Reduce taxable income during a period of rising prices.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose for using an inventory flow assumption is to:

A) Parallel the physical flow of units of merchandise.

B) Offset against revenue an appropriate cost of goods sold.

C) Minimize income taxes.

D) Maximize the reported amount of net income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trent Department Store uses a perpetual inventory system but adjusts its inventory records at year-end to reflect the results of a complete physical inventory. In the physical inventory taken at the ends of 2010 and 2011, Trent's employees failed to count the merchandise in the store's window display. The cost of this merchandise amounted to $13,000 at the end of 2010, and $19,000 at the end of 2011. As a result of these errors, the cost of goods sold for 2005 will be:

A) Understated by $19,000.

B) Overstated by $6,000.

C) Understated by $6,000.

D) None of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The logic behind the lower-of-cost-or-market rule is:

A) Inventory gradually becomes obsolete.

B) Inventory that is unsalable should be written down to zero (or its scrap value) .

C) An asset is not worth more than it would cost the owner to replace it.

D) Inventory that is unsalable should be written down to its replacement cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many companies state in their annual reports that inventory is shown at the lower of its cost or market value. This means that the inventory:

A) Is obsolete.

B) Has been written down to a carrying value below cost.

C) Is shown at the lesser of cost or sales value.

D) Is valued at current replacement cost or historical cost, whichever is less.

Correct Answer

verified

Correct Answer

verified

True/False

Just-in-time inventory systems cannot be used in conjunction with LIFO.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A store that sells expensive custom-made jewelry is most likely to determine its cost of goods sold using:

A) Specific identification.

B) Average cost.

C) First-in, first-out.

D) Last-in, last-out.

Correct Answer

verified

Correct Answer

verified

True/False

When goods for sale are not homogeneous in nature, it is not necessary to use the specific identification method of accounting for inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If all things are equal, except one company uses LIFO during inflation and the other uses FIFO, then:

A) The LIFO company will have a higher inventory turnover.

B) The FIFO company will have a higher inventory turnover.

C) The two companies will have the same inventory turnover.

D) Inventory valuation methods do not effect inventory turnover calculations.

Correct Answer

verified

Correct Answer

verified

Essay

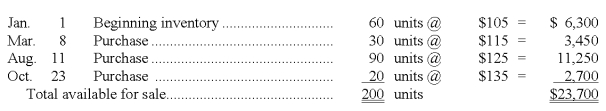

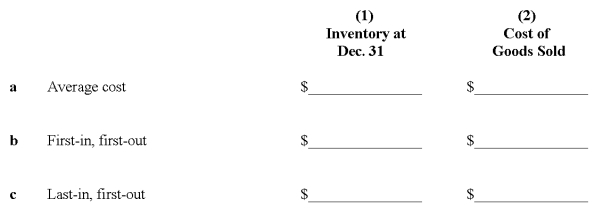

Sherman Electric uses a periodic inventory system. The beginning inventory of a particular product, and the purchases during the current year, were as follows:

At December 31, the ending inventory of this product consisted of 65 units.

Using periodic costing procedures, determine (1) cost of the year-end inventory and, (2) cost of goods sold relating to this product under each of the following flow assumptions:

At December 31, the ending inventory of this product consisted of 65 units.

Using periodic costing procedures, determine (1) cost of the year-end inventory and, (2) cost of goods sold relating to this product under each of the following flow assumptions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total amount debited to the Inventory account during January was:

A) $0.

B) $84,000.

C) $102,000.

D) $140,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Salerno Co. has an inventory turnover rate of 7 and an accounts receivable turnover rate of 5. Assuming 365 days in a year, the period of time required for Salerno to convert its inventory into cash through normal business operations is approximately:

A) 21 days.

B) 52 days.

C) 4 months.

D) 2.5 months.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carl Equipment's inventory turnover rate is:

A) 6.7 times.

B) 10 times.

C) 12 times.

D) 1.2 times.

Correct Answer

verified

Correct Answer

verified

True/False

Because of the consistency principle, inventory should never be written down below cost.

Correct Answer

verified

Correct Answer

verified

True/False

In a periodic inventory system, overstating the amount of ending inventory will cause an understatement of gross profit in the following year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the replacement cost of this monitor at year-end is $210 per unit. Using LIFO flow assumption and the lower-of-cost-or-market rule, the ending inventory amounts to:

A) $46,000.

B) $42,000.

C) $37,000.

D) $83,000.

Correct Answer

verified

Correct Answer

verified

True/False

In a perpetual inventory system, the flow of inventory cost is first through the balance sheet then through the income statement.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 169

Related Exams