Correct Answer

verified

Correct Answer

verified

True/False

The management certification indicates management's primary responsibility for financial statement information and the steps to ensure the accuracy of the company's records.

Correct Answer

verified

Correct Answer

verified

True/False

Independent CAs in the public practice of accounting are viewed as employees of their clients.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

External decision makers want answers to all of the following questions except

A) Will the company be able to pay its debts as they come due?

B) Will the company be able to afford employee pay raises this year?

C) How does the company compare in profitability with competitors?

D) Is the company earning satisfactory income?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is accounting information developed primarily for external decision makers called?

A) Financial accounting.

B) Cost accounting.

C) Auditing.

D) Management accounting.

Correct Answer

verified

Correct Answer

verified

True/False

The financial statement that shows an entity's economic resources and its liabilities is the statement of retained earnings.

Correct Answer

verified

Correct Answer

verified

True/False

The accounting period in which service revenue is recognized (i.e.,revenue for services rendered)is generally the period in which the cash is collected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When would a company report a net loss?

A) When retained earnings decreased due to paying dividends to shareholders.

B) When its assets decreased during an accounting period.

C) When its liabilities increased during an accounting period.

D) When its expenses exceeded its revenues for an accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How do most businesses earn revenues?

A) When they collect trade receivables.

B) Through sales of goods or services to customers.

C) By borrowing money from a bank.

D) By selling shares to shareholders.

Correct Answer

verified

Correct Answer

verified

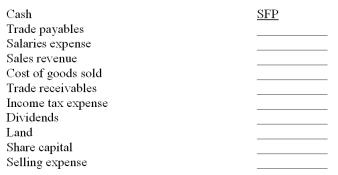

Essay

Indicate on which financial statement you would expect to find each of the following.The first is done for you.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the purpose of an audit?

A) to prove the accuracy of an entity's financial statements.

B) to lend credibility to an entity's financial statements.

C) to endorse the quality of leadership that managers provide for a corporation.

D) to establish that a corporation's shares are a sound investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are business liabilities?

A) Amounts it expects to collect in the future from customers.

B) Debts or obligations resulting from past business events.

C) The amounts that owners have invested in the business.

D) The increases in assets that result from profitable operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 20A,Burton Company delivered products to customers for which customers paid or promised to pay $3,820,000.The company collected $3,670,000 in cash from customers during the year.Indicate which of these amounts will appear on the income statement and which on the statement of cash flows.

A) $3,670,000 appears on both the income statement and the statement of cash flows.

B) $3,670,000 appears on the statement of cash flows,and $3,820,000 appears on the income statement.

C) $3,820,000 appears on both the income statement and the statement of cash flows.

D) $3,820,000 appears on the statement of cash flows,and $3,670,000 appears on the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The BAT Corporation had 20B revenues of $110,000,expenses of $85,000,and an income tax rate of 20 percent.What would profit after taxes be?

A) $5,000.

B) $15,000.

C) $20,000.

D) $25,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 20B,its second year in operation,Banner Company delivered goods to customers for which customers paid or promised to pay $5,850,000.The amount of cash collected from customers was $5,960,000.The amount of trade receivables at the beginning of 20B was $1,200,000.What is the amount of sales revenue that Banner should report on its income statement for 20B?

A) $4,650,000.

B) $4,760,000.

C) $5,850,000.

D) $5,960,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In what order are assets are listed on a statement of financial position?

A) dollar amount (largest first) .

B) date of acquisition (earliest first) .

C) ease of conversion to cash.

D) importance to the operation of the business.

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities are the entity's legal obligations that result from past business events.

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation does not pay its obligations when they are due,its creditors may be able to force the sale of the business's assets to pay their claims.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carrington Company owes you $500 on account due within 15 days.Which of the following amounts on its statement of financial position would help you to determine the likelihood that you will be paid in full and on time?

A) cash and trade receivables.

B) cash and property and equipment.

C) cash and inventory.

D) share capital and retained earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true about a sole proprietorship?

A) The owner and the business are separate legal entities but not separate accounting entities.

B) The owner and the business are separate accounting entities but not separate legal entities.

C) The owner and the business are separate legal entities and separate accounting entities.

D) Most large businesses in this country are organized as sole proprietorships.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 119

Related Exams