Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under variable costing, which of the following costs would be included in finished goods inventory?

A) advertising costs

B) salary of vice-president of finance

C) wages of carpenters in a furniture factory

D) straight-line depreciation on factory equipment

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis, the effect of a difference in the number of units sold, assuming no change in unit sales price or cost, is termed the unit price or unit cost factor.

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis, the effect of a difference in unit sales price or unit cost on the number of units sold is termed the quantity factor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What term is commonly used to describe the concept whereby the cost of manufactured products is composed of direct materials cost, direct labor cost, and variable factory overhead cost?

A) Absorption costing

B) Differential costing

C) Standard costing

D) Variable costing

Correct Answer

verified

Correct Answer

verified

True/False

Service firms can only have one activity base for analyzing changes in costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

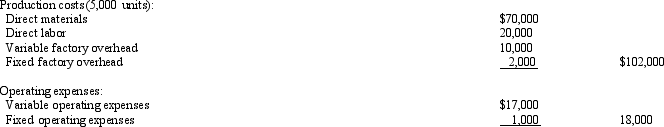

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what is the amount of the manufacturing margin that would be reported on the absorption costing income statement?

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, what is the amount of the manufacturing margin that would be reported on the absorption costing income statement?

A) $50,000

B) $54,000

C) not reported

D) $70,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If variable cost of goods sold totaled $80,000 for the year (16,000 units at $5.00 each) and the planned variable cost of goods sold totaled $86,250 (15,000 units at $5.75 each) , the effect of the unit cost factor on the change in variable cost of goods sold is:

A) $12,000 increase

B) $5,750 decrease

C) $12,000 decrease

D) $5,750 increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the variable costing income statement, the figure representing the difference between manufacturing margin and contribution margin is the:

A) fixed manufacturing costs

B) variable cost of goods sold

C) fixed selling and administrative expenses

D) variable selling and administrative expenses

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end was smaller than that at the beginning, income from operations reported under variable costing will be smaller than income from operations reported under absorption costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of income under absorption costing will be less than the amount of income under variable costing when units manufactured:

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

Correct Answer

verified

Correct Answer

verified

True/False

Fixed factory overhead costs are included as part of the cost of products manufactured under the absorption costing concept.

Correct Answer

verified

Correct Answer

verified

True/False

On the variable costing income statement, all of the fixed costs are deducted from the contribution margin.

Correct Answer

verified

Correct Answer

verified

True/False

The factory superintendent's salary would be included as part of the cost of products manufactured under the variable costing concept.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of income under absorption costing will be more than the amount of income under variable costing when units manufactured:

A) exceed units sold

B) equal units sold

C) are less than units sold

D) are equal to or greater than units sold

Correct Answer

verified

Correct Answer

verified

Essay

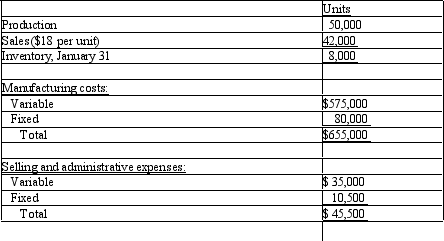

On January 1 of the current year, Townsend Co. commenced operations. It operated its plant at 100% of capacity during January. The following data summarized the results for January:

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis, the effect of a difference in the number of units sold, assuming no change in unit sales price or cost, is termed the quantity factor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The systematic examination of the differences between planned and actual contribution margin is termed the:

A) gross profit analysis

B) contribution margin analysis

C) sales mix analysis

D) volume variance analysis

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In contribution margin analysis, the quantity factor is computed as:

A) the increase or decrease in the number of units sold multiplied by the planned unit sales price or unit cost

B) the increase or decrease in unit sales price or unit cost multiplied by the planned number of units to be sold

C) the increase or decrease in the number of units sold multiplied by the actual unit sales price or unit cost

D) the increase or decrease in the unit sales price or unit cost multiplied by the actual number of units sold

Correct Answer

verified

Correct Answer

verified

Multiple Choice

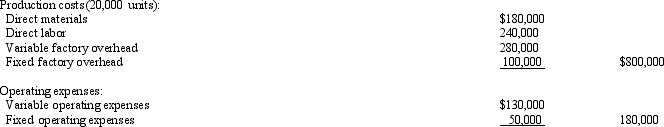

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,600 units remain unsold at the end of the month, what is the amount of inventory that would be reported on the variable costing balance sheet?

A) $64,000

B) $56,000

C) $66,400

D) $78,400

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 154

Related Exams