Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aa2 bond is rated lower than a _____ bond.

A) Aa1

B) Aa3

C) A1

D) A2

Correct Answer

verified

Correct Answer

verified

True/False

Debentures are commonly issued by small companies.

Correct Answer

verified

Correct Answer

verified

True/False

As interest rates decline, bond refunding should become more common.

Correct Answer

verified

Correct Answer

verified

True/False

Senior debentures usually provide lower interest rates than junior secured debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the June 2009 bankruptcy of General Motors is false?

A) The government provided more than $50 billion in bailout.

B) The common stockholders received nothing.

C) The U.S. government owns 85% of the common stock of GM.

D) The preferred stockholders received nothing.

Correct Answer

verified

Correct Answer

verified

True/False

Bonds may be recalled only if there is a specific call provision in the bond.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The disadvantages of debt to the corporation include all but which of the following?

A) Debt may have to be paid back with "cheaper" dollars.

B) Interest and principal payments must be met.

C) Indenture agreements may place burdensome restrictions on the firm.

D) Too much debt may depress the firm's stock price.

Correct Answer

verified

Correct Answer

verified

True/False

The call premium tends to increase with the passage of time.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond with a coupon rate of 6.5%, maturing in 10 years at a value of $1,000 and a current market price of $950, will have a yield to maturity (using the approximation formula) of

A) between 6% and 6.5%

B) between 6.5% and 7%

C) between 7% and 7.5%

D) between 7.5% and 8%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A conversion feature allows:

A) the bondholder to redeem the bond before the maturity date.

B) the corporation to redeem the bond before the maturity date.

C) the bondholder to convert the bond to common stock.

D) the bondholder to demand increased collateral.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buchanan Corp. is refunding $10 million worth of 10% debt. The new bonds will be issued for 8%. The corporation's tax rate is 35%. The call premium is 9%. What is the net cost of the call premium?

A) $390,000

B) $1,080,000

C) $585,000

D) $702,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The benefits of debt to the corporation include all of the following except:

A) tax-deductible interest payments

B) increases stock value when used heavily

C) fixed obligation

D) generally a lower overall cost than equity

Correct Answer

verified

Correct Answer

verified

True/False

A capital lease is the same as an operating lease.

Correct Answer

verified

Correct Answer

verified

True/False

If you expect interest rates to go up, you should buy a long-term bond now.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The main cause for the increase in corporate debt in America is:

A) rapid business expansion.

B) inflationary impacts.

C) inadequate internally-raised funds.

D) All of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The document that outlines the covenants and duties existing between bondholders and the issuing corporation is called

A) an indenture.

B) a debenture.

C) secured debt.

D) protective covenants.

Correct Answer

verified

Correct Answer

verified

True/False

A Eurobond is a bond payable in the borrower's currency but sold outside the borrower's country.

Correct Answer

verified

Correct Answer

verified

True/False

In an inflationary economy, debt must be paid back with "more expensive dollars."

Correct Answer

verified

Correct Answer

verified

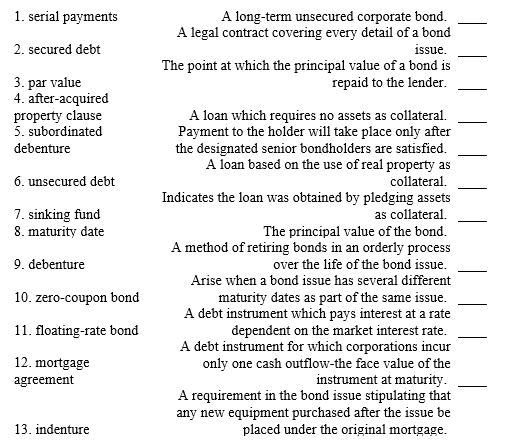

Essay

Match the following with the items below:

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 123

Related Exams