A) currency in circulation only.

B) money market funds only.

C) traveler's checks only.

D) currency in circulation, money market funds, and traveler's checks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

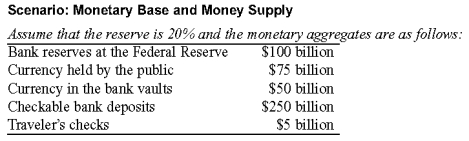

Use the following to answer questions :  -(Scenario: Monetary Base and Money Supply) Look at the scenario Monetary Base and Money Supply. How much is M1?

-(Scenario: Monetary Base and Money Supply) Look at the scenario Monetary Base and Money Supply. How much is M1?

A) $325 billion

B) $330 billion

C) $380 billion

D) $480 billion

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A vicious cycle of deleveraging occurs when:

A) asset sales to cover losses produce negative balance sheet effects and force creditors to call in loans, forcing more sales of assets at decreasing prices.

B) bank regulators take over a bank.

C) deposit insurance is paid out.

D) top executives at failing companies are forced to return bonuses.

Correct Answer

verified

Correct Answer

verified

True/False

To make it easier for S&Ls to compete with banks in the late 1970s, Congress allowed the thrifts to undertake riskier investments in addition to home mortgages.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed increases the reserve requirement, banks lend _____ of their deposits, which leads to a(n) _____ in the money supply.

A) less; decrease

B) less; increase

C) more; decrease

D) more; increase

Correct Answer

verified

Correct Answer

verified

True/False

Commodity-backed money is more efficient than commodity money because commodity-backed money ties up fewer resources than commodity money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you transfer $500 from your savings account to your checking account. With this transaction, M1 _____ and M2 _____.

A) increases; decreases

B) increases; stays the same

C) decreases; decreases

D) stays the same; decreases

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If banks decide to hold some of their excess reserves instead of lending them all out:

A) the money multiplier will be less than 1 divided by the required reserve ratio.

B) a loan of $1 will lead to a change in the money supply by a multiple amount equal to 1 divided by the required reserve ratio.

C) the money multiplier becomes 1 divided by the excess reserves.

D) depositors will have to borrow more to increase the money supply.

Correct Answer

verified

Correct Answer

verified

True/False

Included in the M2 definition of money are checkable bank deposits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve reports on two main monetary aggregates:

A) M2 and total debt.

B) M1 and currency held by banks.

C) M1 and M2.

D) M1 and total stock purchases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. dollar is defined as:

A) fiat money, because it was established as money by an act of law.

B) faith money, because we trust the government to defend its value.

C) commodity-backed money, because it is convertible to gold.

D) commodity money, because it is widely used to buy commodities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_____ occurs when financial institutions assemble pools of loans and sell shares in the income from these pools.

A) Loan origination

B) Securitization

C) Risk aversion

D) Adverse selection

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is part of M1?

A) gold

B) shares of corporate stock

C) currency in a bank's vault

D) traveler's checks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is near-money?

A) a traveler's check

B) a credit card

C) a debit card

D) a savings account

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are responsibilities of the Federal Reserve EXCEPT to:

A) control the monetary base.

B) mint bills and coins.

C) oversee and regulate the banking system.

D) set the discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money is:

A) any form of wealth.

B) an asset that can be easily used to purchase goods and services.

C) only currency designated by law.

D) only currency in circulation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

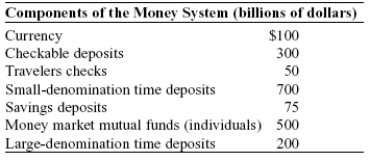

Use the following to answer questions:

Table: Components of the Money System  -(Table: Components of the Money Supply) Look at the table Money Supply. The money supply measured by M2 is:

-(Table: Components of the Money Supply) Look at the table Money Supply. The money supply measured by M2 is:

A) $450 billion.

B) $1,425 billion.

C) $1,725 billion.

D) $2,075 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Panic of 1907, the savings and loan crisis, and the financial crisis of 2008 were similar in that they all:

A) were caused by restrictive monetary policy.

B) involved financial institutions that were not as strictly regulated as deposit-taking banks.

C) were caused by large budget deficits.

D) were caused by excessive regulation by the Federal Reserve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a bank has deposits of $100,000, cash in its vault of $10,000, and $15,000 on deposit at the Federal Reserve and if the required reserve ratio is 20%, then the bank:

A) has no excess reserves.

B) has excess reserves of $5,000.

C) has insufficient reserves to meet requirements.

D) has an insufficient deposit to loan ratio.

Correct Answer

verified

Correct Answer

verified

True/False

Subprime lending takes place at below-prime interest rates.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 468

Related Exams