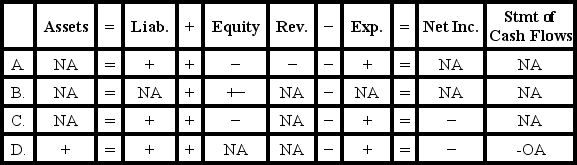

A) Issued common stock

B) Paid a cash dividend to stockholders

C) Collected cash from customers in settlement of accounts receivable

D) Accrued salary expense

Correct Answer

verified

Correct Answer

verified

True/False

Revenues and expenses are temporary accounts.

Correct Answer

verified

Correct Answer

verified

True/False

The cash payment of interest is classified as a financing activity on the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events would not require a year-end adjusting entry?

A) Purchasing supplies for cash during the year.

B) Paying for one year's rent during the year.

C) Providing services on account during the year.

D) Each of these events would require a year-end adjusting entry.

Correct Answer

verified

C

Correct Answer

verified

True/False

Sometimes the recognition of revenue is accompanied by an increase in liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following choices accurately reflects how the recording of accrued salary expense affects the financial statements of a business?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

True/False

The governance of a corporation includes the roles and responsibilities of the board of directors,managers,shareholders,and auditor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the purpose of the accrual basis of accounting?

A) Recognize revenue when it is collected from customers.

B) Match assets with liabilities during the proper accounting period.

C) Recognize expenses when cash disbursements are made.

D) Recognizing revenue when it is earned and expenses when they are incurred,regardless of when cash changes hands.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of accounts is not closed at the end of an accounting cycle?

A) Revenues

B) Retained earnings

C) Dividends

D) Expenses

Correct Answer

verified

Correct Answer

verified

True/False

Recognition of depreciation expense is an asset use transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding accrual accounting?

A) Revenue is recorded only when cash is collected.

B) Expenses are recorded when they are incurred.

C) Revenue is recorded in the period when it is earned.

D) Revenue is recorded in the period when it is earned and expenses are recorded when they are incurred.

Correct Answer

verified

Correct Answer

verified

True/False

The term "accrual" describes an earnings event that is recognized before cash is received or paid.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the balance in a revenue account at the beginning of an accounting period?

A) Zero

B) Last period's ending balance

C) Higher than the previous period's beginning balance

D) Equal to the amount of retained earnings for the previous period

Correct Answer

verified

Correct Answer

verified

Multiple Choice

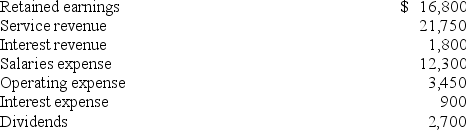

Prior to closing,Syracuse Company's accounting records showed the following balances:

After closing,what is the balance of the Retained Earnings account?

After closing,what is the balance of the Retained Earnings account?

A) $16,800

B) $23,700

C) $21,000

D) $26,400

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

On January 1,Year 2,the Supplies account of Sheldon Company had a balance of $1,200.During the year,the company purchased $3,400 of supplies on account and made partial payments totaling $3,000 on those accounts.On December 31,Year 2,Sheldon determined that there were $1,400 of supplies on hand.Which of the following would be reported on Sheldon's Year 2 financial statements?

A) $1,600 of supplies;$200 of supplies expense

B) $1,400 of supplies;$2,000 of supplies expense

C) $1,400 of supplies;$3,200 of supplies expense

D) $1,600 of supplies;$3,400 of supplies expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

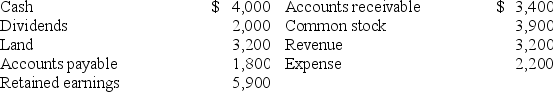

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31,Year 1:

-What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

-What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

A) $12,600

B) $13,800

C) $7,200

D) $10,600

Correct Answer

verified

Correct Answer

verified

True/False

Adjusting entries never affect a business's cash account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Nelson Company experienced the following transactions during Year 1, its first year in operation. Acquired $12,000 cash by issuing common stock Provided $4,600 of services on account Paid $3,200 cash for operating expenses Collected $3,800 of cash from customers in partial settlement of its accounts receivable Paid a $200 cash dividend to stockholders -What is the amount of net income that will be reported on the Year 1 income statement?

A) $1,400

B) $800

C) $1,000

D) $1,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1,Year 1,Gomez Company collected $9,000 in advance from a customer for services to be provided over a one-year period beginning on that date.How much revenue would Gomez Company report related to this contract on its income statement for the year ended December 31,Year 1? How much would the company report as net cash flows from operating activities for Year 1?

A) $3,000;$3,000

B) $9,000;$9,000

C) $3,000;$9,000

D) $0;$9,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How would a payment for rent paid in advance be classified?

A) Asset source transaction

B) Asset use transaction

C) Asset exchange transaction

D) Claims exchange transaction

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 92

Related Exams