A) $1,650

B) $1,860

C) $2,310

D) $2,100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not required to apply the gross margin method?

A) Total sales for the current period

B) The amount of inventory on hand at the end of the current period

C) Amount of purchases during the current period

D) The beginning inventory for the current period

Correct Answer

verified

Correct Answer

verified

Multiple Choice

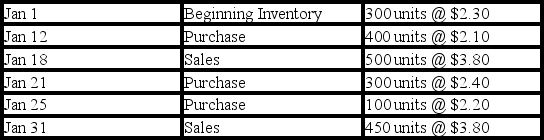

Chase Co.uses the perpetual inventory method.The inventory records for Chase reflected the following information:

-Assuming Chase uses a LIFO cost flow method,what is the amount of cost of goods sold for the sales transaction on January 18?

-Assuming Chase uses a LIFO cost flow method,what is the amount of cost of goods sold for the sales transaction on January 18?

A) $1,150

B) $1,050

C) $1,070

D) $1,130

Correct Answer

verified

Correct Answer

verified

True/False

One of the disadvantages of the specific identification inventory cost flow method is that it can allow managers of a business to manipulate the amount of income the business reports.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anton Co.uses the perpetual inventory system and FIFO cost flow method.During the year,Anton purchased 400 units of inventory that cost $12.00 each and then purchased an additional 600 units of inventory that cost $16.00 each.If Anton sells 700 units of inventory,what is the amount of cost of goods sold?

A) $11,200

B) $10,400

C) $8,400

D) $9,600

Correct Answer

verified

Correct Answer

verified

True/False

A company uses a cost flow method (such as LIFO or FIFO)to allocate product costs between cost of goods sold and beginning inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company is using the lower-of-cost-or-market rule and a write-down is required,how will that write-down affect the elements of the company's financial statements?

A) Net income will increase.

B) Gross margin will decrease.

C) Total assets will decrease.

D) Gross margin and total assets will both decrease.

Correct Answer

verified

Correct Answer

verified

True/False

If a company overstates its Inventory balance at the end of Year 1 due to an error,its Retained Earnings will also be overstated on the Year 1 balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carson Company has an inventory turnover of 12.75,and its inventory amounts to $2,400,000.What is the amount of cost of goods sold?

A) $30,600,000

B) $188,235

C) $26,666,667

D) $51,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 31,Year 1,Owings Corporation overstates the ending inventory by $5,000.How will this affect the amount of retained earnings shown on the balance sheet at December 31,Year 2?

A) Retained Earnings will be correctly stated.

B) Retained Earnings will be understated by $5,000.

C) Retained Earnings will be overstated by $5,000.

D) Cannot be determined with the above information.

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

When the perpetual inventory system is used,where can the best estimate of the amount of inventory on hand be found?

A) On the previous period's balance sheet

B) In the Inventory account in the general ledger

C) By applying the gross margin method

D) By subtracting sales for the period from the beginning Inventory account balance

Correct Answer

verified

Correct Answer

verified

True/False

The specific identification inventory method is not practical for companies that sell many low-priced,high turnover items.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Koontz Company uses the perpetual inventory method and the weighted-average method.On January 1,Year 1,the company's first day of operations,Koontz purchased 400 units of inventory that cost $7.50 each.On January 10,Year 1,the company purchased an additional 600 units of inventory that cost $9.00 each.If the company sells 550 units of inventory,what is the amount of inventory that would appear on the balance sheet immediately following the sale?

A) $3,780

B) $4,738

C) $3,080

D) $3,713

Correct Answer

verified

Correct Answer

verified

True/False

A company's gross margin reported on the income statement is not affected by the inventory cost flow method it uses.

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following circumstances would be a valid reason to estimate the amount of inventory that is on hand at the end of the period?

A) To complete the company's annual income tax return

B) To avoid taking a physical count of inventory

C) To test for financial statement manipulation

D) All of the answer choices are valid reasons for estimating the ending inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the cost of purchasing inventory is declining,which inventory cost flow method will produce the highest amount of cost of goods sold?

A) Weighted-average

B) LIFO

C) FIFO

D) LIFO,FIFO,and weighted-average will all produce the same amount of cost of goods sold.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

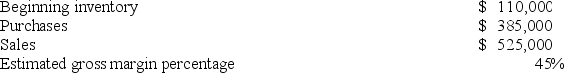

When preparing its quarterly financial statements,Pace Co.uses the gross margin method to estimate ending inventory.The following information is available for the quarter ending March 31,Year 2:

What is the estimated amount of inventory that is on hand on March 31,Year 2?

What is the estimated amount of inventory that is on hand on March 31,Year 2?

A) $236,250

B) $288,750

C) $206,250

D) $258,750

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles often allows companies to account for the same types of events in different ways.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

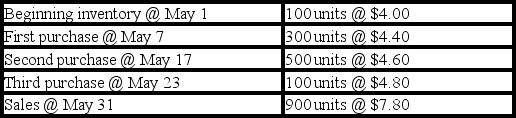

The inventory records for Radford Co.reflected the following:

-What is the amount of gross margin assuming the FIFO cost flow method?

-What is the amount of gross margin assuming the FIFO cost flow method?

A) $2,920

B) $3,420

C) $3,000

D) $4,020

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happens when prices are falling?

A) LIFO will result in lower net income and a lower inventory valuation than will FIFO.

B) LIFO will result in lower net income and a higher inventory valuation than will FIFO.

C) LIFO will result in higher net income and a higher inventory valuation than will FIFO.

D) LIFO will result in higher net income and a lower inventory valuation than will FIFO.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 86

Related Exams