A) Net margin.

B) Return on equity.

C) Return on debt.

D) Return on assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current financial reporting standards assume that users of accounting information:

A) Have an expert's understanding of economic and financial events and conditions.

B) Have a reasonably informed knowledge of business.

C) Have widely differing levels of knowledge about business,and that financial reporting must meet these differing needs.

D) Have only minimal knowledge of business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

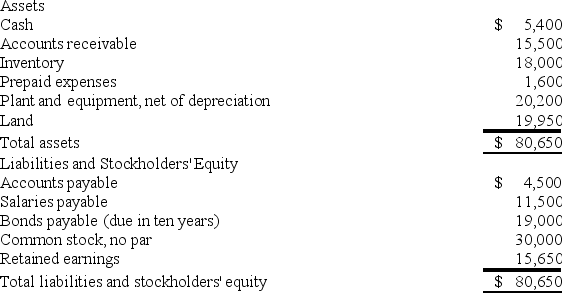

The following balance sheet information is provided for Duke Company for Year 2:

What is the company's current ratio? (Round your answer to 2 decimal places. )

What is the company's current ratio? (Round your answer to 2 decimal places. )

A) 2.53

B) 1.16

C) 1.31

D) 3.79

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Investors need to understand that the value of a company's earnings per share is affected by its choices of accounting principles and assumptions.

B) Earnings per share is calculated for a company's preferred stock.

C) The most widely quoted measure of a company's earnings performance is return on equity.

D) The book value per share measures the market value of a corporation's stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In vertical analysis,each item is expressed as a percentage of:

A) Total assets on the balance sheet.

B) Total cash on the balance sheet.

C) Total current assets on the balance sheet.

D) None of these answers is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grove Corporation had sales of $3,000,000,cost of sales of $2,250,000,and average inventory of $500,000.What was Grove's inventory turnover ratio for the period?

A) 1.6 times

B) 6 times

C) 4.5 times

D) 23 times

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is generally not true from an investor's perspective?

A) A 1:1 current ratio is generally preferred over a 1.5:1 current ratio.

B) A 20-day average collection period for accounts receivable is generally preferred over a 30-day average collection period.

C) A 5% dividend yield is generally preferred over a 3% dividend yield.

D) A 10% net margin is generally preferred over an 8% net margin.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold divided by average inventory is the formula for which of these analytical measures?

A) Number of day's sales in inventory

B) Return on investment

C) Inventory turnover

D) Debt to assets ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is (are) objective(s) of ratio analysis?

A) Assessing past performance.

B) Assessing the prospects for future performance.

C) Analyzing how a company finances its operations.

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

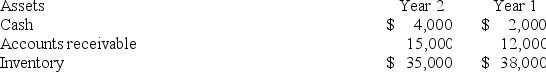

The following balance sheet information is provided for Patton Company:

Assuming Year 2 cost of goods sold is $730,000,what is the company's average days to sell inventory? (Use 365 days in a year.Do not round your intermediate calculations. )

Assuming Year 2 cost of goods sold is $730,000,what is the company's average days to sell inventory? (Use 365 days in a year.Do not round your intermediate calculations. )

A) 17.5 days

B) 18.25 days

C) 19 days

D) 20.86 days

Correct Answer

verified

Correct Answer

verified

Multiple Choice

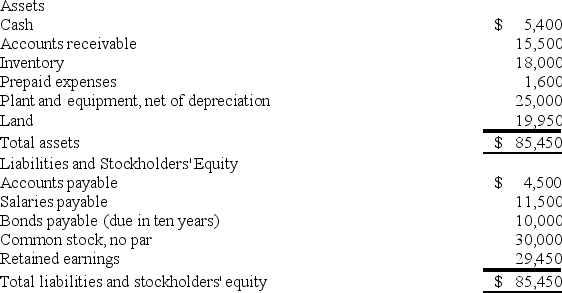

Alpha Company provided the following balance sheet for Year 2:

What is the company's plant assets to long-term liabilities ratio?

What is the company's plant assets to long-term liabilities ratio?

A) 2.5

B) 4.5

C) 1.7

D) None of these answers is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding ratio analysis is not true?

A) Ratio analysis is a specific form of horizontal analysis.

B) There are many different ratios available for evaluating a firm's performance.

C) Some ratios involve an account from the balance sheet and one from the income statement.

D) Ratio analysis involves making comparisons between different accounts in the same set of financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income divided by net sales is the formula for which of these analytical measures?

A) Return on assets

B) Return on equity

C) Earnings per share

D) Net margin

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Working capital is defined as:

A) Current assets divided by current liabilities.

B) Total assets minus total liabilities.

C) Current assets less current liabilities.

D) Current liabilities divided by total liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the correct statement regarding vertical analysis.

A) Vertical analysis of the income statement involves showing each item as a percentage of sales.

B) Vertical analysis of the balance sheet involves showing each asset as a percentage of total assets.

C) Vertical analysis examines two or more items from the financial statements of one accounting period.

D) All of these answers are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about financial statement analysis is not true?

A) In horizontal percentage analysis,an item from the financial statements is expressed as a percentage of the same item from a previous year's financial statements.

B) Vertical analysis compares two or more financial statement items within the same time period.

C) Horizontal analysis for several years can be done by choosing one year as a base year and calculating increases or decreases in relation to that year.

D) The reason behind a financial statement ratio or percentage analysis result is usually self-evident and does not require further study or analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solvency ratios are used to assess a company's:

A) Long-term debt paying ability.

B) Profitability.

C) Short-term debt paying ability.

D) Efficiency in use of its assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

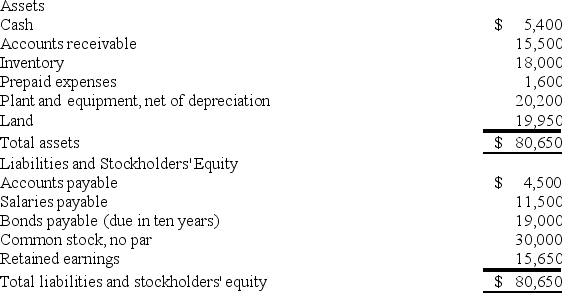

The following balance sheet information is provided for Santana Company for Year 2:

What is the company's debt to equity ratio? (Rounded to nearest whole percent. )

What is the company's debt to equity ratio? (Rounded to nearest whole percent. )

A) 42%

B) 130%

C) 43%

D) 77%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering an investment in IBM stock and wish to assess the firm's long-term debt-paying ability and its use of debt financing.All of the following ratios can be used to assess solvency except:

A) Number of times interest is earned.

B) Debt to assets ratio.

C) Debt to equity ratio.

D) Net margin.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company purchased a $60,000 piece of equipment by paying $30,000 and having the rest financed with a short-term note from the bank,then immediately after this transaction what is the expected impact on the components of the current ratio?

A) Current assets decrease and current liabilities increase by the same amount.

B) Current liabilities decrease.

C) Current assets and current liabilities decrease by the same amount.

D) Current assets increase.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 108

Related Exams