Correct Answer

verified

Correct Answer

verified

True/False

The percentage analysis of increases and decreases in corresponding items in comparative financial statements is referred to as horizontal analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of an audit is to

A) determine whether or not a company is a good investment.

B) render an opinion on the fairness of the statements.

C) determine whether or not a company complies with income tax regulations.

D) determine whether or not a company is a good credit risk.

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that the quantities of inventory on hand during the current year were sufficient to meet all demands for sales,a decrease in the inventory turnover for the current year when compared with the turnover for the preceding year indicates an improvement in the management of inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The number of times interest charges are earned is computed as

A) net income plus interest charges,divided by interest charges.

B) income before income tax plus interest charges,divided by interest charges.

C) net income divided by interest charges.

D) income before income tax divided by interest charges.

Correct Answer

verified

Correct Answer

verified

True/False

Statements in which all items are expressed in relative terms are called common-size statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An acceleration in the collection of receivables will tend to cause the accounts receivable turnover to

A) decrease.

B) remain the same.

C) either increase or decrease.

D) increase.

Correct Answer

verified

Correct Answer

verified

True/False

The percentage analysis of increases and decreases in corresponding items in comparative financial statements is referred to as vertical analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An analysis in which all the components of an income statement are expressed as a percentage of net sales is called

A) vertical analysis.

B) horizontal analysis.

C) liquidity analysis.

D) common-size analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability of a business to earn a reasonable amount of income is referred to as the factor of

A) leverage.

B) profitability.

C) wealth.

D) solvency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT an analysis used in assessing solvency?

A) Inventory analysis

B) Number of times interest charges are earned

C) Asset turnover

D) Accounts receivable analysis

Correct Answer

verified

Correct Answer

verified

Multiple Choice

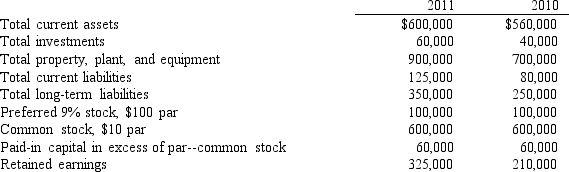

The balance sheets at the end of each of the first two years of operations indicate the following:

-If net income is $130,000 and interest expense is $40,000 for 2011,what is the rate earned on stockholders' equity for 2011 (rounded to one decimal place) ?

-If net income is $130,000 and interest expense is $40,000 for 2011,what is the rate earned on stockholders' equity for 2011 (rounded to one decimal place) ?

A) 12.0%

B) 12.7%

C) 13.2%

D) 16.5%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What type of analysis is indicated by the following? Increase (Decrease*) 2011 2010 Amount Percent Current assets $ 380,000 $ 500,000 $(120,000*) (24%) * Fixed assets 1,680,000 1,500,000 180,000 12%

A) Vertical analysis

B) Horizontal analysis

C) Liquidity analysis

D) Common-size analysis

Correct Answer

verified

Correct Answer

verified

Multiple Choice

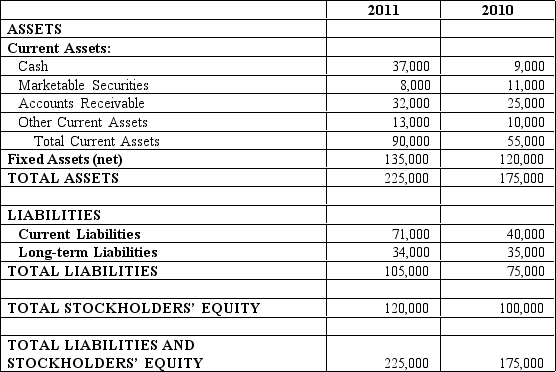

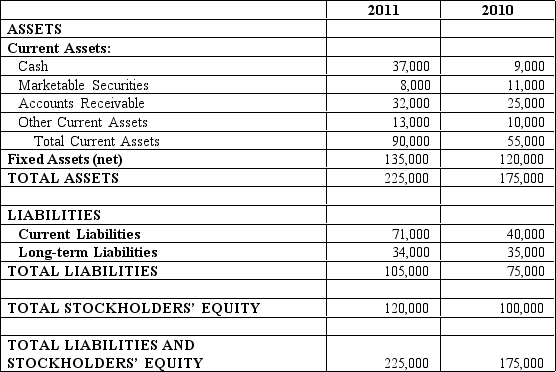

Washington Corporation has the following financial data for 2011 and 2010.

-What is Washington's current ratio for 2011?

-What is Washington's current ratio for 2011?

A) 1.08

B) .79

C) 1.27

D) 1.50

Correct Answer

verified

Correct Answer

verified

True/False

"Working capital" is another term for the current ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For most profitable companies,the rate earned on total assets will be less than

A) the rate earned on stockholders' equity.

B) the rate earned on total liabilities and stockholders' equity.

C) the rate earned on sales.

D) cannot be determined without more information.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the following data for the current year,what is the accounts receivable turnover?

A) 13.14

B) 11.7

C) 10.35

D) 8.3

Correct Answer

verified

Correct Answer

verified

True/False

If a company has current assets totaling $56,000 and current liabilities totaling $40,500,then the company's working capital totals $15,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Washington Corporation has the following financial data for 2011 and 2010.

-What is Washington's working capital for 2011?

-What is Washington's working capital for 2011?

A) $6,000

B) $19,000

C) $0

D) $120,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the computation of the quick ratio?

A) Prepaid rent

B) Accounts receivable

C) Inventory

D) Supplies

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 83

Related Exams