A) Estimated overhead divided by estimated units produced

B) Estimated overhead divided by actual direct labor hours

C) Actual units produced divided by estimated overhead

D) Estimated direct labor dollars divided by estimated overhead

Correct Answer

verified

Correct Answer

verified

True/False

The amount computed for cost of goods manufactured should be the same as the amount transferred from the materials inventory, direct labor, and overhead accounts into the Work in Process Inventory account.

Correct Answer

verified

Correct Answer

verified

True/False

Both product costs and period costs could appear on the income statement.

Correct Answer

verified

Correct Answer

verified

Essay

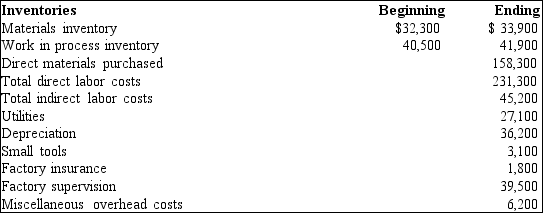

Use the information below for the year ended December 31, 20xx, to prepare the statement of cost of goods manufactured.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a product cost?

A) Indirect materials costs

B) Packaging costs

C) Direct labor costs

D) Overhead costs

Correct Answer

verified

Correct Answer

verified

Essay

Use the information below for the year ended December 31, 20xx, to prepare the statement of cost of goods manufactured.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of indirect materials?

A) Wood in a desk

B) Nails in a desk

C) Screws in a desk

D) Lubricants for machinery

Correct Answer

verified

Correct Answer

verified

True/False

Some period costs can be found in inventory accounts on the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of goods manufactured decreases which of the following accounts?

A) Work in Process Inventory

B) Finished Goods Inventory

C) Overhead

D) Cost of Goods Sold

Correct Answer

verified

Correct Answer

verified

True/False

The job order cost card reflects the product cost per unit.

Correct Answer

verified

Correct Answer

verified

True/False

A single predetermined overhead rate is most appropriately used to assign overhead costs when a company produces a diverse set of products.

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation on factory equipment is a value-adding cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following documents initiates the purchasing of materials?

A) Job order cost sheet

B) Receiving report

C) Purchase requisition

D) Purchase order

Correct Answer

verified

Correct Answer

verified

True/False

Product costs for a manufacturing company consist of direct materials, direct labor, and overhead.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a manufacturing environment, costs of materials initially flow

A) into the Work in Process Inventory account.

B) into the Materials Inventory account.

C) directly to Cost of Goods Sold.

D) into the Finished Goods Inventory account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information was taken from the cost records of the Krameer Company: If overhead is applied based on direct labor hours, the company's overapplied or underapplied overhead was

A) $2,000 overapplied.

B) $2,000 underapplied.

C) $9,500 overapplied.

D) $9,500 underapplied.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All manufacturing costs that are assigned to completed (but unsold) products should be classified as

A) materials inventory costs.

B) overhead costs.

C) work in process inventory costs.

D) finished goods inventory costs.

Correct Answer

verified

Correct Answer

verified

Essay

As the management accountant for Bynami Enterprises, Inc., you have been asked to prepare a statement of cost of goods manufactured at the end of the first quarter. Account balances at that time were as follows: March 31 inventories were as follows: materials, $540,200; work in process, $795,400; and finished goods, $604,100. Prepare the statement of cost of goods manufactured for the first quarter of 20xx.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company calculates its product unit cost using estimated costs, it is using which cost measurement method?

A) Standard costing

B) Actual costing

C) Full costing

D) Normal costing

Correct Answer

verified

Correct Answer

verified

True/False

Sugar is an indirect cost in the manufacture of candy.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 188

Related Exams