A) $85,931

B) $88,695

C) $90,219

D) $90,407

E) $92,478

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are paying an effective annual rate of 18.974 percent on your credit card.The interest is compounded monthly.What is the annual percentage rate on this account?

A) 17.50 percent

B) 18.00 percent

C) 18.25 percent

D) 18.64 percent

E) 19.00 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

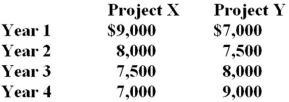

You are considering two projects with the following cash flows:  Which of the following statements are true concerning these two projects?

I.Both projects have the same future value at the end of year 4,given a positive rate of return.

II.Both projects have the same future value given a zero rate of return.

III.Project X has a higher present value than Project Y,given a positive discount rate.

IV.Project Y has a higher present value than Project X,given a positive discount rate.

Which of the following statements are true concerning these two projects?

I.Both projects have the same future value at the end of year 4,given a positive rate of return.

II.Both projects have the same future value given a zero rate of return.

III.Project X has a higher present value than Project Y,given a positive discount rate.

IV.Project Y has a higher present value than Project X,given a positive discount rate.

A) II only

B) I and III only

C) II and III only

D) II and IV only

E) I,II,and IV only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Your credit card company quotes you a rate of 17.9 percent.Interest is billed monthly.What is the actual rate of interest you are paying?

-Your credit card company quotes you a rate of 17.9 percent.Interest is billed monthly.What is the actual rate of interest you are paying?

A) 19.03 percent

B) 19.21 percent

C) 19.44 percent

D) 19.57 percent

E) 19.72 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements related to annuities and perpetuities is correct?

A) An ordinary annuity is worth more than an annuity due given equal annual cash flows for ten years at 7 percent interest,compounded annually.

B) A perpetuity comprised of $100 monthly payments is worth more than an annuity comprised of $100 monthly payments,given an interest rate of 12 percent,compounded monthly.

C) Most loans are a form of a perpetuity.

D) The present value of a perpetuity cannot be computed,but the future value can.

E) Perpetuities are finite but annuities are not.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An amortized loan:

A) requires the principal amount to be repaid in even increments over the life of the loan.

B) may have equal or increasing amounts applied to the principal from each loan payment.

C) requires that all interest be repaid on a monthly basis while the principal is repaid at the end of the loan term.

D) requires that all payments be equal in amount and include both principal and interest.

E) repays both the principal and the interest in one lump sum at the end of the loan term.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

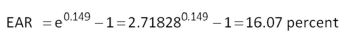

-What is the effective annual rate of 5.25 percent compounded continuously?

-What is the effective annual rate of 5.25 percent compounded continuously?

A) 5.27 percent

B) 5.39 percent

C) 5.43 percent

D) 5.46 percent

E) 5.49 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

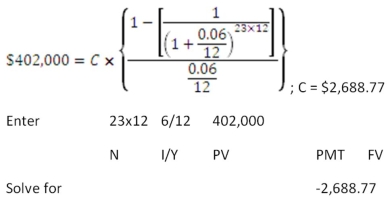

-Kingston Development Corp.purchased a piece of property for $2.79 million.The firm paid a down payment of 15 percent in cash and financed the balance.The loan terms require monthly payments for 15 years at an annual percentage rate of 7.75 percent,compounded monthly.What is the amount of each mortgage payment?

-Kingston Development Corp.purchased a piece of property for $2.79 million.The firm paid a down payment of 15 percent in cash and financed the balance.The loan terms require monthly payments for 15 years at an annual percentage rate of 7.75 percent,compounded monthly.What is the amount of each mortgage payment?

A) $22,322.35

B) $23,419.97

C) $23,607.11

D) $24,878.15

E) $25,301.16

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-You are considering a project which will provide annual cash inflows of $4,500,$5,700,and $8,000 at the end of each year for the next three years,respectively.What is the present value of these cash flows,given a 9 percent discount rate?

-You are considering a project which will provide annual cash inflows of $4,500,$5,700,and $8,000 at the end of each year for the next three years,respectively.What is the present value of these cash flows,given a 9 percent discount rate?

A) $14,877

B) $15,103

C) $15,429

D) $16,388

E) $16,847

Correct Answer

verified

Correct Answer

verified

Multiple Choice

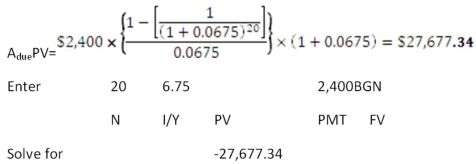

-You just won the grand prize in a national writing contest! As your prize,you will receive $2,000 a month for ten years.If you can earn 7 percent on your money,what is this prize worth to you today?

-You just won the grand prize in a national writing contest! As your prize,you will receive $2,000 a month for ten years.If you can earn 7 percent on your money,what is this prize worth to you today?

A) $172,252.71

B) $178,411.06

C) $181,338.40

D) $185,333.33

E) $190,450.25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

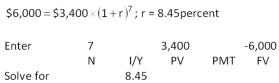

-Consider a firm with a contract to sell an asset 3 years from now for $90,000.The asset costs $71,000 to produce today.At what rate will the firm just break even on this contract?

-Consider a firm with a contract to sell an asset 3 years from now for $90,000.The asset costs $71,000 to produce today.At what rate will the firm just break even on this contract?

A) 7.87 percent

B) 8.01 percent

C) 8.23 percent

D) 8.57 percent

E) 8.90 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

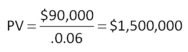

-A preferred stock pays an annual dividend of $3.20.What is one share of this stock worth today if the rate of return is 11.75 percent?

-A preferred stock pays an annual dividend of $3.20.What is one share of this stock worth today if the rate of return is 11.75 percent?

A) $23.48

B) $25.00

C) $27.23

D) $33.80

E) $35.55

Correct Answer

verified

Correct Answer

verified

Multiple Choice

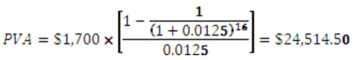

Beginning three months from now,you want to be able to withdraw $1,700 each quarter from your bank account to cover college expenses over the next 4 years.The account pays 1.25 percent interest per quarter.How much do you need to have in your account today to meet your expense needs over the next 4 years?

A) $24,514.50

B) $24,847.15

C) $25,068.00

D) $25,454.09

E) $25,711.18

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-You are preparing to make monthly payments of $72,beginning at the end of this month,into an account that pays 6 percent interest compounded monthly.How many payments will you have made when your account balance reaches $9,312?

-You are preparing to make monthly payments of $72,beginning at the end of this month,into an account that pays 6 percent interest compounded monthly.How many payments will you have made when your account balance reaches $9,312?

A) 97

B) 100

C) 119

D) 124

E) 131

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following terms is used to describe a loan wherein each payment is equal in amount and includes both interest and principal?

A) amortized loan

B) modified loan

C) balloon loan

D) pure discount loan

E) interest-only loan

Correct Answer

verified

Correct Answer

verified

Multiple Choice

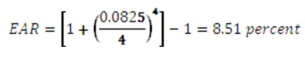

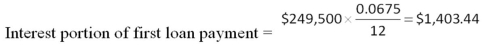

-On June 1,you borrowed $220,000 to buy a house.The mortgage rate is 8.25 percent.The loan is to be repaid in equal monthly payments over 15 years.The first payment is due on July 1.How much of the second payment applies to the principal balance? (Assume that each month is equal to 1/12 of a year. )

-On June 1,you borrowed $220,000 to buy a house.The mortgage rate is 8.25 percent.The loan is to be repaid in equal monthly payments over 15 years.The first payment is due on July 1.How much of the second payment applies to the principal balance? (Assume that each month is equal to 1/12 of a year. )

A) $626.08

B) $721.14

C) $1,358.56

D) $1,453.38

E) $2,056.70

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-You are planning to save for retirement over the next 15 years.To do this,you will invest $1,100 a month in a stock account and $500 a month in a bond account.The return on the stock account is expected to be 7 percent,and the bond account will pay 4 percent.When you retire,you will combine your money into an account with a 5 percent return.How much can you withdraw each month during retirement assuming a 20-year withdrawal period?

-You are planning to save for retirement over the next 15 years.To do this,you will invest $1,100 a month in a stock account and $500 a month in a bond account.The return on the stock account is expected to be 7 percent,and the bond account will pay 4 percent.When you retire,you will combine your money into an account with a 5 percent return.How much can you withdraw each month during retirement assuming a 20-year withdrawal period?

A) $2,636.19

B) $2,904.11

C) $3,008.21

D) $3,113.04

E) $3,406.97

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-John's Auto Repair just took out a $52,000,10-year,8 percent,interest-only loan from the bank.Payments are made annually.What is the amount of the loan payment in year 10?

-John's Auto Repair just took out a $52,000,10-year,8 percent,interest-only loan from the bank.Payments are made annually.What is the amount of the loan payment in year 10?

A) $7,120

B) $8,850

C) $13,264

D) $49,000

E) $56,160

Correct Answer

verified

Correct Answer

verified

Multiple Choice

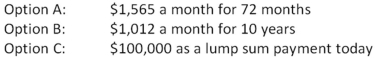

-You just received an insurance settlement offer related to an accident you had six years ago.The offer gives you a choice of one of the following three offers:

-You just received an insurance settlement offer related to an accident you had six years ago.The offer gives you a choice of one of the following three offers:  You can earn 7.5 percent on your investments.You do not care if you personally receive the funds or if they are paid to your heirs should you die within the settlement period.Which one of the following statements is correct given this information?

You can earn 7.5 percent on your investments.You do not care if you personally receive the funds or if they are paid to your heirs should you die within the settlement period.Which one of the following statements is correct given this information?

A) Option A is the best choice as it provides the largest monthly payment.

B) Option B is the best choice because it pays the largest total amount.

C) Option C is the best choice because it is has the largest current value.

D) Option B is the best choice because you will receive the most payments.

E) You are indifferent to the three options as they are all equal in value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements correctly states a relationship?

A) Time and future values are inversely related,all else held constant.

B) Interest rates and time are positively related,all else held constant.

C) An increase in the discount rate increases the present value,given positive rates.

D) An increase in time increases the future value given a zero rate of interest.

E) Time and present value are inversely related,all else held constant.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 129

Related Exams