Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total consumer surplus enjoyed by all consumers in a market

A) exceeds the market price

B) is measured by the area under the market demand curve

C) is measured by the area beneath the market price

D) is a Pareto improvement

E) is called market consumer surplus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The more elastic the demand for a good,

A) the more of an excise tax is that is collected by sellers

B) the more of an excise tax that is paid by buyers

C) the more an excise that is paid by sellers

D) the more elastic the supply of that good

E) the smaller the burden of a tax on that good

Correct Answer

verified

Correct Answer

verified

Multiple Choice

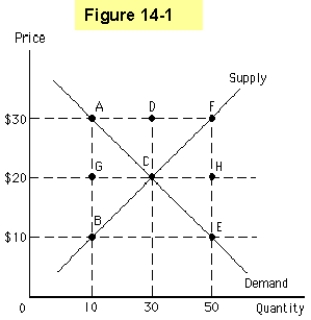

-In Figure 14-1 which area represents producer surplus?

-In Figure 14-1 which area represents producer surplus?

A) A

B) B

C) C

D) D

E) E

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If 10 units of a good are sold at a market price of $40 each,then

A) the value to some individual of the tenth unit of output is $40

B) the economy is efficient

C) selling an 11th unit would be a Pareto improvement

D) a side payment of $40 is needed to ensure that the good is produced

E) the market must be perfectly competitive

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tom carries on loud cellphone conversations in public places.He values such conversations at $1 per minute.Steve prefers piece and quiet.He would pay $2 per minute to avoid overhearing Tom's conversations.In this situation

A) Tom should quit using his cellphone because that would be a Pareto improvement

B) Tom should quit using his cellphone because that would be efficient

C) If Steve made a side payment of $3 to Tom,that would be a Pareto improvement

D) If Steve paid Tom 50 cents per minute to quit talking,that would be a Pareto improvement

E) If Steve paid Tom $1.50 per minute to quit talking,that would be a Pareto improvement

Correct Answer

verified

Correct Answer

verified

True/False

Of the four major market structures,perfect competition is the best at achieving economic efficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market supply curve is perfectly elastic and an excise tax is imposed,

A) all of the tax is paid by buyers

B) all of the tax is paid by sellers

C) the tax burden is divided equally between buyers and sellers

D) the market price will not change

E) the market price will fall by the amount of the tax

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the output level corresponding to the efficient quantity of a good,

A) the value of the last unit can be negative for some consumer

B) the value of the last unit to some consumer equals the minimum price some seller must receive for producing it

C) the distribution of the good is fair

D) the minimum price some consumer must pay for the last unit equals the value of the unit to some producer

E) the price is the lowest that a typical firm would ever be willing to accept

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic efficiency

A) should be society's main goal

B) means that no Pareto improvements are possible

C) cannot coexist with Pareto efficiency

D) requires that income be distributed fairly

E) implies that goods can be reallocated in a way that benefits someone

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An efficient economy

A) is a fair economy

B) can only be a capitalist economy

C) is not necessarily a fair economy

D) would never experience air or water pollution

E) would not have a government sector

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm changed its fringe benefit program so that no employee suffered a loss in benefits and some employees enjoyed an increase in benefits,then

A) this could not be a Pareto improvement

B) the firm's policies are economically efficient

C) this could be a Pareto improvement

D) the firm's policies are fair

E) the firm is losing money

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic efficiency

A) is guaranteed in perfectly competitive and monopolistically competitive markets

B) is achieved in any market where firms are free to maximize profits

C) leads to a fair distribution of income

D) leads to a fair distribution of goods

E) is most likely to be achieved in perfectly competitive markets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a perfectly competitive market is in equilibrium,and then market supply decreases.Which of the following would happen?

A) both producer and consumer surplus would increase

B) both producer and consumer surplus would decrease

C) producer surplus would decrease and consumer surplus would increase

D) producer surplus would increase and consumer surplus would decrease

E) producer and consumer surplus would remain unchanged

Correct Answer

verified

Correct Answer

verified

True/False

Pareto improvements that require the use of side payments typically are easy to coordinate and tend to enhance economic efficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Pareto improvement

A) cannot take place unless a side payment is made

B) cannot take place unless a market is perfectly competitive

C) cannot occur unless both parties to a transaction enjoy positive net benefits

D) will increase the total net benefits available in a perfectly competitive market

E) occurs whenever the sum of market consumer surplus and market producer surplus is positive

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A price ceiling in a perfectly competitive market

A) leads to the same result as if the market were monopolized

B) results in a welfare loss

C) is effective only if it is set above the equilibrium price

D) may result from collusion among the firms selling in that market

E) may result from collusion among the consumers buying in that market

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a market with a price ceiling.If the price ceiling is raised which of the following would happen?

A) The consumer surplus would increase,the producer surplus would decrease and the dead weight loss would decrease

B) The consumer surplus would increase,the producer surplus would decrease and the dead weight loss would increase

C) The consumer surplus,the producer surplus and the dead weight loss would all decrease

D) The consumer surplus,the producer surplus and the dead weight loss would all increase

E) The consumer surplus would decrease,the producer surplus would increase and the dead weight loss would decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply curve is perfectly inelastic and an excise tax is imposed

A) all of the tax is paid by buyers

B) all of the tax is paid by sellers

C) the market price will rise by the amount of the tax

D) the market price will fall by the amount of the tax

E) the tax is divided equally between buyers and sellers

Correct Answer

verified

Correct Answer

verified

True/False

Instead of throwing away a worn-out pair of jeans,a cowboy trades them in for $12.The jeans are resold for $45 to someone who likes to project a rugged image.These transactions are Pareto improvements.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 80

Related Exams