A) $65.77

B) $69.23

C) $72.69

D) $76.33

E) $80.14

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A venture capital investment group received a proposal from Wireless Solutions to produce a new smart phone. The variable cost per unit is estimated at $250, the sales price would be set at twice the VC/unit, fixed costs are estimated at $750,000, and the investors will put up the funds if the project is likely to have an operating income of $500,000 or more. What sales volume would be required in order to meet this profit goal?

A) 4,513

B) 4,750

C) 5,000

D) 5,250

E) 5,513

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following events is likely to encourage a company to raise its target debt ratio, other things held constant?

A) An increase in the personal tax rate.

B) An increase in the company's operating leverage.

C) The Federal Reserve tightens interest rates in an effort to fight inflation.

D) The company's stock price hits a new high.

E) An increase in the corporate tax rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two operationally similar companies, HD and LD, have identical amounts of assets, operating income (EBIT) , tax rates, and business risk. Company HD, however, has a much higher debt ratio than LD. Company HD's return on invested capital (ROIC) exceeds its after-tax cost of debt, (1-T) rd. Which of the following statements is CORRECT?

A) Company HD has a higher times interest earned (TIE) ratio than Company LD.

B) Company HD has a higher return on equity (ROE) than Company LD, and its risk, as measured by the standard deviation of ROE, is also higher than LD's.

C) The two companies have the same ROE.

D) Company HD's ROE would be higher if it had no debt.

E) Company HD has a higher return on assets (ROA) than Company LD.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major contribution of the Miller model is that it demonstrates that

A) personal taxes decrease the value of using corporate debt.

B) financial distress and agency costs reduce the value of using corporate debt.

C) equity costs increase with financial leverage.

D) debt costs increase with financial leverage.

E) personal taxes increase the value of using corporate debt.

Correct Answer

verified

Correct Answer

verified

True/False

When a firm has risky debt, its equity can be viewed as an option on the total value of the firm with an exercise price equal to the face value of the debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

VanMannen Foundations, Inc. (VF)

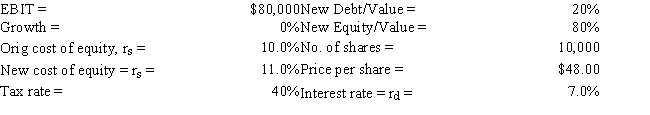

VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

-Refer to the data for VanMannen Foundations, Inc. (VF) . What would the stock price be if VF issued the new debt and immediately used the proceeds to repurchase stock?

-Refer to the data for VanMannen Foundations, Inc. (VF) . What would the stock price be if VF issued the new debt and immediately used the proceeds to repurchase stock?

A) $49.43

B) $50.70

C) $52.00

D) $53.33

E) $56.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since debt financing is cheaper than equity financing, raising a company's debt ratio will always reduce its WACC.

B) Increasing a company's debt ratio will typically reduce the marginal cost of both debt and equity financing. However, this action still may raise the company's WACC.

C) Increasing a company's debt ratio will typically increase the marginal cost of both debt and equity financing. However, this action still may lower the company's WACC.

D) Since a firm's beta coefficient it not affected by its use of financial leverage, leverage does not affect the cost of equity.

E) Since debt financing raises the firm's financial risk, increasing a company's debt ratio will always increase its WACC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eccles Inc. Eccles Inc., a zero growth firm, has an expected EBIT of $100,000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%. -Refer to the data for Eccles Inc.What is the firm's cost of equity according to MM with corporate taxes?

A) 21.0%

B) 23.3%

C) 25.9%

D) 28.8%

E) 32.0%

Correct Answer

verified

Correct Answer

verified

True/False

If a firm utilizes debt financing, an X% decline in earnings before interest and taxes (EBIT) will result in a decline in earnings per share that is larger than X.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Best Bagels, Inc. (BB) Best Bagels, Inc. (BB) currently has zero debt. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. BB's current cost of equity is 13%, and its tax rate is 40%. The firm has 20,000 shares of common stock outstanding selling at a price per share of $23.08. -Refer to the data for Best Bagels, Inc. (BB) . Now assume that BB is considering changing from its original capital structure to a new capital structure with 45% debt and 55% equity. This results in a weighted average cost of capital equal to 10.4% and a new value of operations of $576,923. Assume BB raises $259,615 in new debt and purchases T-bills to hold until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

A) $14.42

B) $19.36

C) $23.91

D) $28.85

E) $35.62

Correct Answer

verified

Correct Answer

verified

True/False

As the text indicates, a firm's financial risk has identifiable market risk and diversifiable risk components.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these items will not generally be affected by an increase in the debt ratio?

A) Total risk.

B) Financial risk.

C) Market risk.

D) The firm's beta.

E) Business risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two operationally similar companies, HD and LD, have the same total assets, operating income (EBIT) , tax rate, and business risk. Company HD, however, has a much higher debt ratio than LD. Also HD's return on invested capital (ROIC) exceeds its after-tax cost of debt, (1-T) rd. Which of the following statements is CORRECT?

A) HD should have a higher times interest earned (TIE) ratio than LD.

B) HD should have a higher return on equity (ROE) than LD, but its risk, as measured by the standard deviation of ROE, should also be higher than LD's.

C) Given that ROIC > (1-T) rd, HD's stock price must exceed that of LD.

D) Given that ROIC > (1-T) rd, LD's stock price must exceed that of HD.

E) HD should have a higher return on assets (ROA) than LD.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barette Consulting currently has no debt in its capital structure, has $500 million of total assets, and its basic earning power is 15%. The CFO is contemplating a recapitalization where it will issue debt at a cost of 10% and use the proceeds to buy back shares of the company's common stock, paying book value. If the company proceeds with the recapitalization, its operating income, total assets, and tax rate will remain unchanged. Which of the following is most likely to occur as a result of the recapitalization?

A) The ROA would remain unchanged.

B) The basic earning power ratio would decline.

C) The basic earning power ratio would increase.

D) The ROE would increase.

E) The ROA would increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anson Jackson Court Company (AJC) The Anson Jackson Court Company (AJC) currently has $200,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 6%. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. AJC's current cost of equity is 8.8%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $60.00. -Refer to the data for the Anson Jackson Court Company (AJC) . Now assume that AJC is considering changing from its original capital structure to a new capital structure with 50% debt and 50% equity. If it makes this change, its resulting market value would be $820,000. What would be its new stock price per share?

A) $58

B) $59

C) $60

D) $61

E) $62

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would increase the likelihood that a company would increase its debt ratio, other things held constant?

A) An increase in the corporate tax rate.

B) An increase in the personal tax rate.

C) The Federal Reserve tightens interest rates in an effort to fight inflation.

D) The company's stock price hits a new low.

E) An increase in costs incurred when filing for bankruptcy.

Correct Answer

verified

Correct Answer

verified

True/False

Financial risk refers to the extra risk stockholders bear as a result of using debt as compared with the risk they would bear if no debt were used.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anson Jackson Court Company (AJC) The Anson Jackson Court Company (AJC) currently has $200,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 6%. Its earnings before interest and taxes (EBIT) are $100,000, and it is a zero growth company. AJC's current cost of equity is 8.8%, and its tax rate is 40%. The firm has 10,000 shares of common stock outstanding selling at a price per share of $60.00. -Refer to the data for the Anson Jackson Court Company (AJC) . Now assume that AJC is considering changing from its original capital structure to a new capital structure that results in a stock price of $64 per share. The resulting capital structure would have a $336,000 total market value of equity and a $504,000 market value of debt. How many shares would AJC repurchase in the recapitalization?

A) 4,250

B) 4,500

C) 4,750

D) 5,000

E) 5,250

Correct Answer

verified

Correct Answer

verified

Multiple Choice

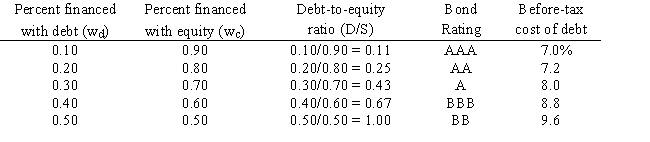

LeCompte Learning Solutions is considering making a change to its capital structure in hopes of increasing its value. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: The company uses the CAPM to estimate its cost of common equity, rs. The risk-free rate is 5% and the market risk premium is 6%. LeCompte estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is LeCompte's optimal capital structure, and what is the firm's cost of capital at this optimal capital structure?

A) wc = 0.9; wd = 0.1; WACC = 14.96%

B) wc = 0.8; wd = 0.2; WACC = 10.96%

C) wc = 0.7; wd = 0.3; WACC = 7.83%

D) wc = 0.6; wd = 0.4; WACC = 10.15%

E) wc = 0.5; wd = 0.5; WACC = 10.18%

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 87

Related Exams