A) 11.7 days

B) 13.0 days

C) 14.4 days

D) 15.2 days

E) 16.7 days

Correct Answer

verified

Correct Answer

verified

True/False

The aging schedule is a commonly used method for monitoring receivables.

Correct Answer

verified

Correct Answer

verified

True/False

If a firm takes actions that reduce its days sales outstanding (DSO), then, other things held constant, this will lengthen its cash conversion cycle (CCC).

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Howes Inc. purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15, net 50. If the firm chooses to pay on time but does not take the discount, what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year.)

A) 20.11%

B) 21.17%

C) 22.28%

D) 23.45%

E) 24.63%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitson Co. is looking for ways to shorten its cash conversion cycle. It has annual sales of $36,500,000, or $100,000 a day on a 365-day basis. The firm's cost of goods sold is 75% of sales. On average, the company has $9,000,000 in inventory and $8,000,000 in accounts receivable. Its CFO has proposed new policies that would result in a 20% reduction in both average inventories and accounts receivable. She also anticipates that these policies would reduce sales by 10%, while the payables deferral period would remain unchanged at 35 days. What effect would these policies have on the company's cash conversion cycle? Round to the nearest whole day.

A) −26 days

B) −22 days

C) −18 days

D) −14 days

E) −11 days

Correct Answer

verified

Correct Answer

verified

True/False

If a firm switched from taking trade credit discounts to paying on the net due date, this might cost the firm some money, but such a policy would probably have only a negligible effect on the income statement and no effect whatever on the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the cash budget is CORRECT?

A) Cash budgets do not include financial items such as interest and dividend payments.

B) Cash budgets do not include cash inflows from long-term sources such as the issuance of bonds.

C) Changes that affect the DSO do not affect the cash budget.

D) Capital budgeting decisions have no effect on the cash budget until projects go into operation and start producing revenues.

E) Depreciation expense is not explicitly included, but depreciation's effects are reflected in the estimated tax payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newsome Inc. buys on terms of 3/15, net 45. It does not take the discount, and it generally pays after 60 days. What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year?

A) 25.09%

B) 27.59%

C) 30.35%

D) 33.39%

E) 36.73%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

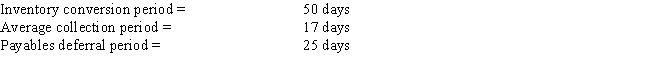

Brothers Breads has the following data. What is the firm's cash conversion cycle?

A) 31 days

B) 34 days

C) 38 days

D) 42 days

E) 46 days

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Data on Mertz Co. for the most recent year are shown below, along with the payables deferral period (PDP) for the firms against which it benchmarks. The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average. If this were done, by how much would payables increase? Use a 365-day year.

A) $764

B) $849

C) $943

D) $1,048

E) $1,164

Correct Answer

verified

Correct Answer

verified

True/False

Shorter-term cash budgets⎯say a daily cash budget for the next month⎯are generally used for actual cash control while longer-term cash budgets⎯say monthly cash budgets for the next year⎯are generally used for planning purposes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carter & Carter is considering setting up a regional lockbox system to speed up collections. The company sells to customers all over the U.S., and all receipts come in to its headquarters in San Francisco. The firm's average accounts receivable balance is $2.5 million, and they are financed by a bank loan at an 11% annual interest rate. The firm believes this new lockbox system would reduce receivables by 20%. If the annual cost of the system is $15,000, what pre-tax net annual savings would be realized?

A) $29,160

B) $32,400

C) $36,000

D) $40,000

E) $44,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Commercial paper is a form of short-term financing that is primarily used by large, strong, financially stable companies.

B) Short-term debt is favored by firms because, while it is generally more expensive than long-term debt, it exposes the borrowing firm to less risk than long-term debt.

C) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

D) Commercial paper is typically offered at a long-term maturity of at least five years.

E) Trade credit is provided only to relatively large, strong firms.

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "free" capital in the sense that no explicit interest must normally be paid on accrued liabilities.

Correct Answer

verified

Correct Answer

verified

True/False

If the yield curve is upward sloping, then short-term debt will be cheaper than long-term debt. Thus, if a firm's CFO expects the yield curve to continue to have an upward slope, this would tend to cause the current ratio to be relatively low, other things held constant.

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a firm changes its credit policy from 2/10 net 30 to 3/10 net 30. The change is meant to meet competition, so no increase in sales is expected. The average accounts receivable balance will probably decline as a result of this change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm that sells on terms of net 30 changes its policy to 2/10 net 30, and if no change in sales volume occurs, then the firm's DSO will probably increase.

B) If a firm sells on terms of 2/10 net 30, and its DSO is 30 days, then the firm probably has some past-due accounts.

C) If a firm sells on terms of net 60, and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July.

D) If a firm changed the credit terms offered to its customers from 2/10 net 30 to 2/10 net 60, then its sales should increase, and this should lead to an increase in sales per day, and that should lead to a decrease in the DSO.

E) Other things held constant, the higher a firm's days sales outstanding (DSO) , the better its credit department.

Correct Answer

verified

Correct Answer

verified

True/False

A firm's collection policy, i.e., the procedures it follows to collect accounts receivable, plays an important role in keeping its average collection period short, although too strict a collection policy can reduce profits due to lost sales.

Correct Answer

verified

Correct Answer

verified

True/False

Net working capital is defined as current assets divided by current liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Conservative firms generally use no short-term debt and thus have zero current liabilities.

B) A short-term loan can usually be obtained more quickly than a long-term loan, but the cost of short-term debt is normally higher than that of long-term debt.

C) If a firm that can borrow from its bank at a 6% interest rate buys materials on terms of 2/10 net 30, and if it must pay by Day 30 or else be cut off, then we would expect to see zero accounts payable on its balance sheet.

D) If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it will not have an adverse financial impact on your firm if the customer periodically pays off its entire balance.

E) Under normal conditions, a firm's expected ROE would probably be higher if it financed with short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 138

Related Exams