Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price/earnings (P/E) ratio is measured in terms of

A) dollars.

B) a percentage.

C) times.

D) days.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sale of treasury stock cannot result in

A) an increase in Retained Earnings.

B) the crediting of Paid-in Capital, Treasury Stock.

C) the debiting of Paid-in Capital, Treasury Stock.

D) an increase in total stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

When common stock with a par value is sold for a price that exceeds par value,the Common Stock account is credited only for the par value of the shares sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the question below. When Calvert Corporation was formed on January 1,2010,the corporate charter provided for 50,000 shares of $20 par value common stock.The following transactions were among those engaged in by the corporation during its first month of operation: 1) The corporation issued 200 shares of stock to its lawyer in full payment of the $5,000 bill for assisting the company in drawing up its articles of incorporation and filing the proper papers with the state agency. 2) The company issued 8,000 shares of stock at a price of $25 per share. 3) The company issued 8,000 shares of stock in exchange for equipment that had a fair market value of $160,000. The entry to record transaction 3 would be:

A)

B)

C)

D)

Correct Answer

verified

Correct Answer

verified

Essay

Indicate on the blanks below the net effect (I = increase,D = decrease,NE = no effect)of each of the following entries on working capital. _____ 1.To record the declaration of a cash dividend _____ 2.To record the payment of a previously declared and recorded cash dividend _____ 3.To close the Dividends account at the end of the accounting period

Correct Answer

verified

Correct Answer

verified

True/False

When no-par common stock has a stated value,the stated value of the shares issued normally is considered the legal capital of the corporation.

Correct Answer

verified

Correct Answer

verified

True/False

Return on equity equals average stockholders' equity divided by net income.

Correct Answer

verified

Correct Answer

verified

Essay

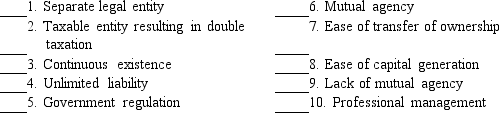

Identify (by code letter)each of the following characteristics as being an advantage of (A),a disadvantage of (D),or not applicable to (N)the corporate form of business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 5,000 shares of 8 percent noncumulative preferred stock and 10,000 shares of common stock outstanding.Par value for each is $100.No dividends were paid last year,but this year a $93,000 dividend is paid.How much of this $93,000 goes to the holders of common stock?

A) $53,000

B) $63,000

C) $73,000

D) $83,000

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock is reported as an asset on the balance sheet because treasury shares may be sold later.

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a cash dividend causes an increase in a corporation's liabilities at the date of record.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following classifications represents the fewest shares of common stock?

A) Outstanding shares

B) Issued shares

C) Treasury shares

D) Impossible to determine

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An advantage of the corporate form of business is

A) possible lack of control by owners.

B) tax treatment.

C) lack of mutual agency.

D) government regulation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The par value of the common stock represents the

A) amount entered into the corporation's Common Stock account when a share is issued.

B) liquidation value of the stock.

C) market value of a share of stock.

D) amount the corporation received when the stock was issued.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following phrases is not descriptive of the corporate form of business?

A) Professional management

B) Continuous existence

C) Double taxation

D) Unlimited liability

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are stockholders' equity accounts except

A) Treasury Stock.

B) Preferred Stock.

C) Retained Earnings.

D) Dividends Payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the declaration of a cash dividend will

A) not affect working capital.

B) reduce working capital.

C) not affect total stockholders' equity.

D) increase total stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

To form a corporation,most states require persons called incorporators to sign and file it with proper state official.This application contains the articles of incorporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the question below. On January 1,2010,Falcon Corporation had 40,000 shares of $10 par value common stock issued and outstanding.All 40,000 shares had been issued in a prior period at $17 per share.On February 1,2010,Falcon purchased 6,100 shares of treasury stock for $19 per share and later sold the treasury shares for $26 per share on March 2,2010. What amount of gain due to these treasury stock transactions should be reported on the income statement for the year ended December 31,2010?

A) $0

B) $42,700

C) $6,100

D) $4,270

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 191

Related Exams